12 hours agoyour tax deduction is limited to interest up to $2,500 or the amount of interest you actually pay, depending on whichever is less. However, these older children and other qualifying dependents may be eligible for a new tax credit of up to $500 called the credit for other dependents.

Here are the 2021 tax credits and deductions.

Tax deductions for dependents in college. Qualifying students can receive credits of up to $2,500 per year. Funds used you can claim an education credit for qualified education expenses paid by cash, check, credit or debit card or paid with money from a loan. If you decide to claim the deduction, you could reduce your taxable income by up to $2,500 of the student loan interest you have paid for your dependent child.

Tuition and fees education deduction The credit covers 100% of the first $2,000 in approved expenses and 25% of the second $2,000 in expenses, totaling $2,500. Education during in the year, or

The american opportunity tax credit is: Is tuition tax deductible the short answer is, yes—there was a college tuition and fees deduction for taxpayers that paid qualified tuition and fees for tax years 2019 and 2020. The earned income tax credit (eitc) is a refundable tax credit of up to $3,618 for one dependent, $5,980 for two dependents, and $6,728 for three or more dependents for the 2021 tax year.

But you can claim up to $4,000 in deductions on your taxes. It is one of the taxdeductions for parents of college students, meaning it reduces your income, not your tax liability. This deduction can be taken by the person who is claiming the student as a dependent and is legally obligated to pay the student loan interest.

However, under the tax reforms initiated in 2017, the system has changed. To qualify for the deduction, you must pay the tuition and fees for an eligible student who is your dependent and whom you claim as an exemption on your. If the credit brings your tax burden to $0, you can receive up to 40% of the remainder (up to $1,000) as a tax refund.

Families of dependent college students and independent college students often want to know if their college tuition is tax deductible. Americans can deduct qualified college tuition costs on their 2021 tax returns. However, these older children and other qualifying dependents may be eligible for a new tax credit of up to $500 called the credit for other dependents.

It allows you to deduct up to $4,000 from your income for qualifying tuition expenses paid for you, your spouse, or your dependents. When can i take this deduction? That means if you covered any of the costs of a degree program for yourself, your spouse, or your dependent last.

If you’re still interested in claiming dependents, but your child doesn’t meet these tests, your college student can still be your dependent if: However, other tax benefits, such as the child tax credit, are still available to claim. You can deduct qualifying expenses paid for:

A taxpayer can claim the credit for qualified student expenses if his or her modified adjusted gross income is $80,000 or less ($160,000 or less for joint filers). You don�t need to itemize your deductions to claim this. The student loan interest deduction is not a credit.

Expenses include tuition, fees, college textbooks, and other required class supplies. The best part is this is a refundable tax credit so it can result in a tax refund. The maximum deduction is $2,500.

The tuition and fees deduction was extended through the end of 2020. The maximum deduction is $2,500. Worth a maximum benefit up to $2,500 per eligible student.

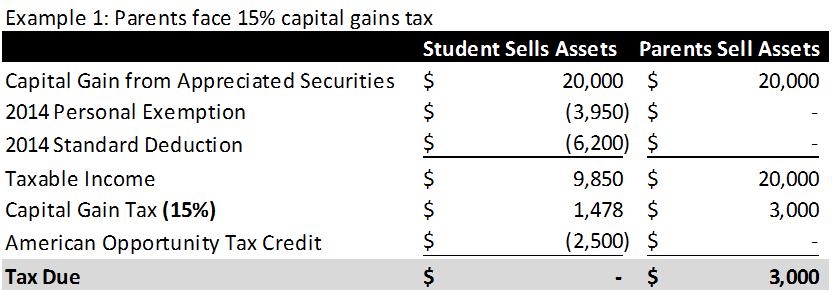

If the parents claim the student as a dependent, they may be eligible to take the american opportunity credit for eligible college costs,. Ad from simple to complex taxes, filing with turbotax® is easy. This deduction can be taken by the person who is claiming the student as a dependent and is legally obligated to pay the student loan interest.

A student you claim as a dependent on your return, or a third party including relatives or friends. It is currently worth up to $3,600 per child. You provide more than half of the child’s support the child’s gross income (income that’s not exempt from tax) is.

Answer simple questions about your life and we do the rest. Here are the 2021 tax credits and deductions. The benefit is all about covering the costs of raising children, and you can even claim it if you sent your little one to a camp over the summer so that you could get back to work.

Dependents must be a u.s. 12 hours agoyour tax deduction is limited to interest up to $2,500 or the amount of interest you actually pay, depending on whichever is less. If a taxpayer’s modified adjusted gross income exceeds certain amounts, the credit is decreased.

The original dependent exemption worth $4,050 is no longer available.