Medical expenses that exceed seven are not deductible, and payments for the year must be deductible. $2,397 3% of your dependant�s net income (line 23600 of their tax return) note the maximum provincial or territorial amount you can claim for medical expenses may differ depending on where you live.

:format(jpeg)/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/VT7FAQE4VRBYRGVAVU74SITHDU)

Depending on your tax bracket, this could save you up to 50% of that amount — or $2,250 — in taxes.

Tax deductions for doctors canada. Your ability to pay less tax starts with setting up a corporation through which you provide your professional medical services. However, if your corporation is a canadian controlled private corporation throughout the year, (i.e. It is not clear if this is an isolated judgment or whether this is an effort by revenue canada to disallow expenses that are a vital part of the business of practice of physicians.

Generally speaking, employment at a work location is temporary if it is realistically expected to last for no more than a. 1 day agothe medical expense deduction is a deduction for medical expenses. Approximately 5% of the company’s 2021 adjusted.

Tax deductions for canadian doctors, physicians, and surgeons 1. Tax doctors canada was built from the ground up to be a customer service oriented company. Prior to 2018, it was at least possible to deduct unreimbursed work expenses on schedule a, but it was subject to a 2% of income floor, which for most doctors was far more than they spent.

If your corporation qualifies for the small business tax deduction, the first $500,000 of its income is taxed at a preferential tax rate of 15.5%. Nobody wants to pay more in income taxes than they absolutely have to. There are over 400 deductions and credits that the cra outlines.

In 2020, you’ll earn 5% of your adjusted gross income (agi). The biggest source of deductions for many physicians would be their automobile expenses, as well as membership fees, professional fees, and potentially some overhead costs you might pay to the clinic that you work out of. Your work outfit has to be specific to the work you do as a healthcare professional, pharmacist, or nurse.

To determine how you can write off. Tax doctors canada was created on the premise of providing highly personalized professional tax preparation and accounting services at extremely competitive rates. So, it�s best to get your employer to pay for them.

An example of a refundable tax credit is the (gst/hst) credit. Your annual expenses for utilities, internet, rent, and so forth are $30,000. Insurance premiums doctors can deduct overhead, malpractice and property insurance premiums.

I wish to hear from any other member of the bcma with a similar. Since your home office is 15% of the total space, you can deduct 15% of the expenses — or $4,500 — from your employment income. For example, scrubs, lab coats, or medical shoes are items you can write off when doing your taxes.

The goods and services tax/harmonized sales tax credit (gst/hst credit) is a refundable tax. The money you save for retirement with an ira or a 401 (k) is money you can deduct from your income. These deductions include federal and provincial income tax, employment insurance premiums, and canada pension plan contributions.

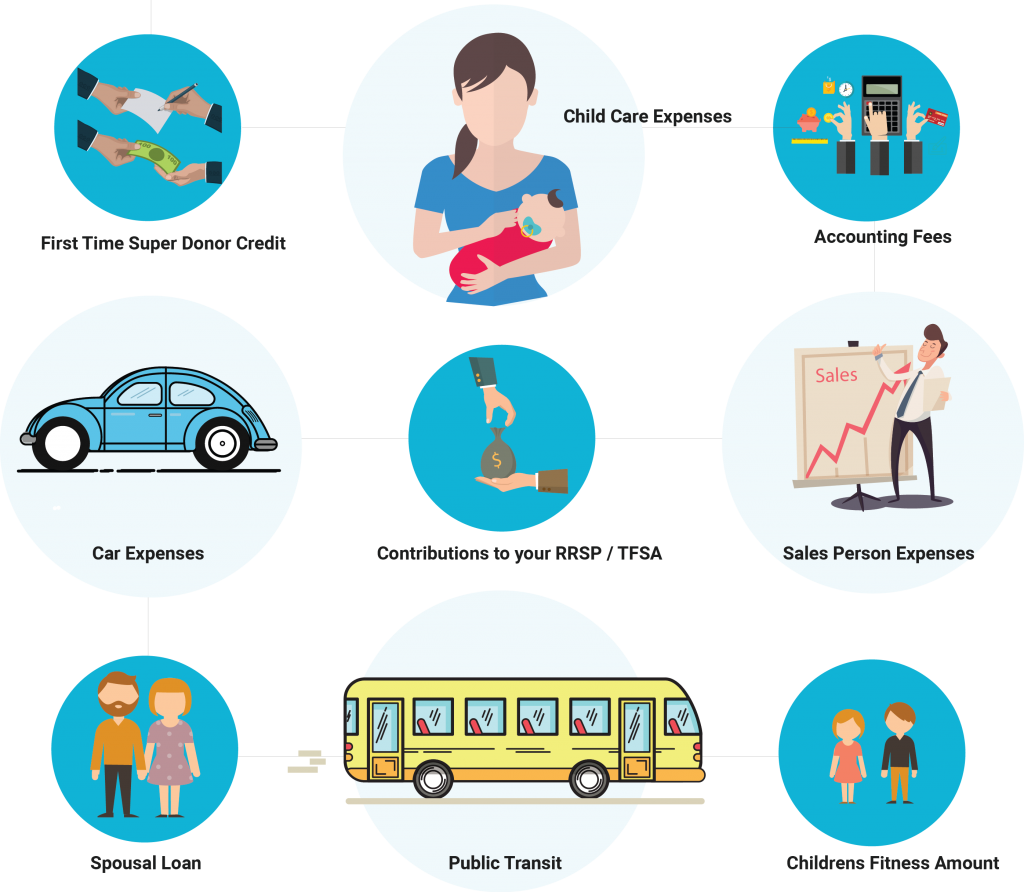

We’ve rounded up the most popular 20 to help you make the most out of your taxes and get the best refund. Top tax deductions for doctors retirement savings. What medical expenses are tax deductible for 2020?

Air filter, cleaner, or purifier used by a person to cope with or overcome a severe. In order for your professional corporation to qualify, you must be a canadian resident and you must control. The business expenses deduction allow for doctors to deduct for all of their “ordinary and necessary” practice expenses (no, this does not include buying that red sports car for your business trip).

Your licensing and membership fees for belonging to provincial and other professional medical groups are fully deductible. Automobile expenses to kick things off let’s take a look at automobile expenses. Another large business expense that you can write off would be all those membership fees.

What follows are the top ten tax deductions for doctors you should be aware of: It’s controlled by canadian residents and not by a public. $2,397 3% of your dependant�s net income (line 23600 of their tax return) note the maximum provincial or territorial amount you can claim for medical expenses may differ depending on where you live.

Business income earned in a corporation may be considered active business income and subject to a federal corporate tax rate of 15%, plus the applicable provincial rate. Medical expenses that exceed seven are not deductible, and payments for the year must be deductible. Taxpayers whose medical expenses exceed seven percent qualify for the deduction for tax returns filed in 2022.

As a rule, most expenses incurred are deductible if they are incurred to earn business income, are reasonable, and are allowed by the income tax act (ita). Depending on your tax bracket, this could save you up to 50% of that amount — or $2,250 — in taxes. However, it�s just as important to make sure you�re not falling victim to potentially risky schemes.

After all, you�ve worked hard all year for your income; Eligible expenses may include transportation costs, meals, and accommodation for both the patient and an attendant if required. Employee benefit premiums, such as health and dental, can be deducted as well.

The following are some common business expenses for physicians: To kick things off let’s look at automobile expenses. Now, you can�t deduct unreimbursed work expenses at all.

Staff wages and professional services You can claim the deduction for any amount of medical expenses over $3,750 that you earn through your agi less $52,000 per year.