Y’s liability to deposit the deducted withholding tax with the central government. Doctors were working in the hospital named ruby hall clinic and were giving services in the hospital.hospital has hired them and were paid on monthly basis for the services they render.

The business expenses deduction allow for doctors to deduct for all of their “ordinary and necessary” practice expenses (no, this does not include buying that red sports car for your business trip).

Tax deductions for doctors in india. Inr 112,500 + 30% of the income exceeding inr 10,00,000. What follows are the top ten tax deductions for doctors you should be aware of: So now while paying the bill to the doctor (mr.

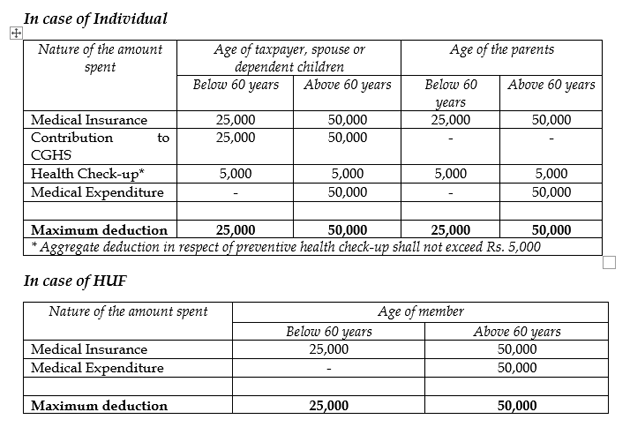

However, it�s just as important to make sure you�re not falling victim to potentially risky schemes. Y) has credited rs 45000 to the doctor (mr. 25,000 shall be allowed (rs.

Indian companies can claim deduction for payments on account of royalties, and for interest and fees for technical or management service provided by foreign affiliates, as long as they are not capital in nature. Brief facts of the case: A) for self, spouse and dependent children:

50,000 if specified person is a senior citizen) b) for parents: Thus, pharmaceutical companies’ gifting freebies to doctors is clearly ‘prohibited by law’, and not allowed to be claimed as a deduction under section 37(1) of the income tax act (as. You can find further details on using the advanced calculator features by reviewing the instructions below the calculator and supporting finance guides.

The business expenses deduction allow for doctors to deduct for all of their “ordinary and necessary” practice expenses (no, this does not include buying that red sports car for your business trip). Nobody wants to pay more in income taxes than they absolutely have to. Y’s liability to deposit the deducted withholding tax with the central government.

Deduction for medical treatment of a dependant who is a person with a disability assess being individual or huf incurred any expenditure for medical treatment including nursing along with maintenance expenditure if incurred any during the previous year, the person will be allowed to claim a deduction of rs. X) and deducted rs 5000 as withholding tax. For senior citizens and very senior citizens, the tax slabs are different.

If your annual receipts exceed rs 50lakhs, you must report them and deduct actual business expenses to compute profit (or loss). B) setting up and operating a warehousing facility for storage of agricultural produce. Y has deducted the withholding tax.

Charitable donations of cash or used items can save taxes but most physicians forget that they can. While making payment to doctors hospital deducts tds @10 % u/s 194j as they consider that they are rendering services because they were having freedom to. Employee’s total contribution in epf/vpf qualifies for section 80c deduction.

Further, an additional deduction of inr 25,000 is available for insuring one’s parents (inr 50,000 where either of the parents is a senior citizen). Unlike epf, ppf can be invested in even by doctors having their own practice. Deduction in respect of expenditure on specified businesses, as under:

It is open to every individual, including doctors. Those who opt for presumptive taxes do not have to compute or report actual profits. There are no provisions in india for carrying losses back to earlier years.

C) building and operating, anywhere in india, a hospital with at least 100 beds for patients This profit may be less or more than 50% of receipts. After all, you�ve worked hard all year for your income;

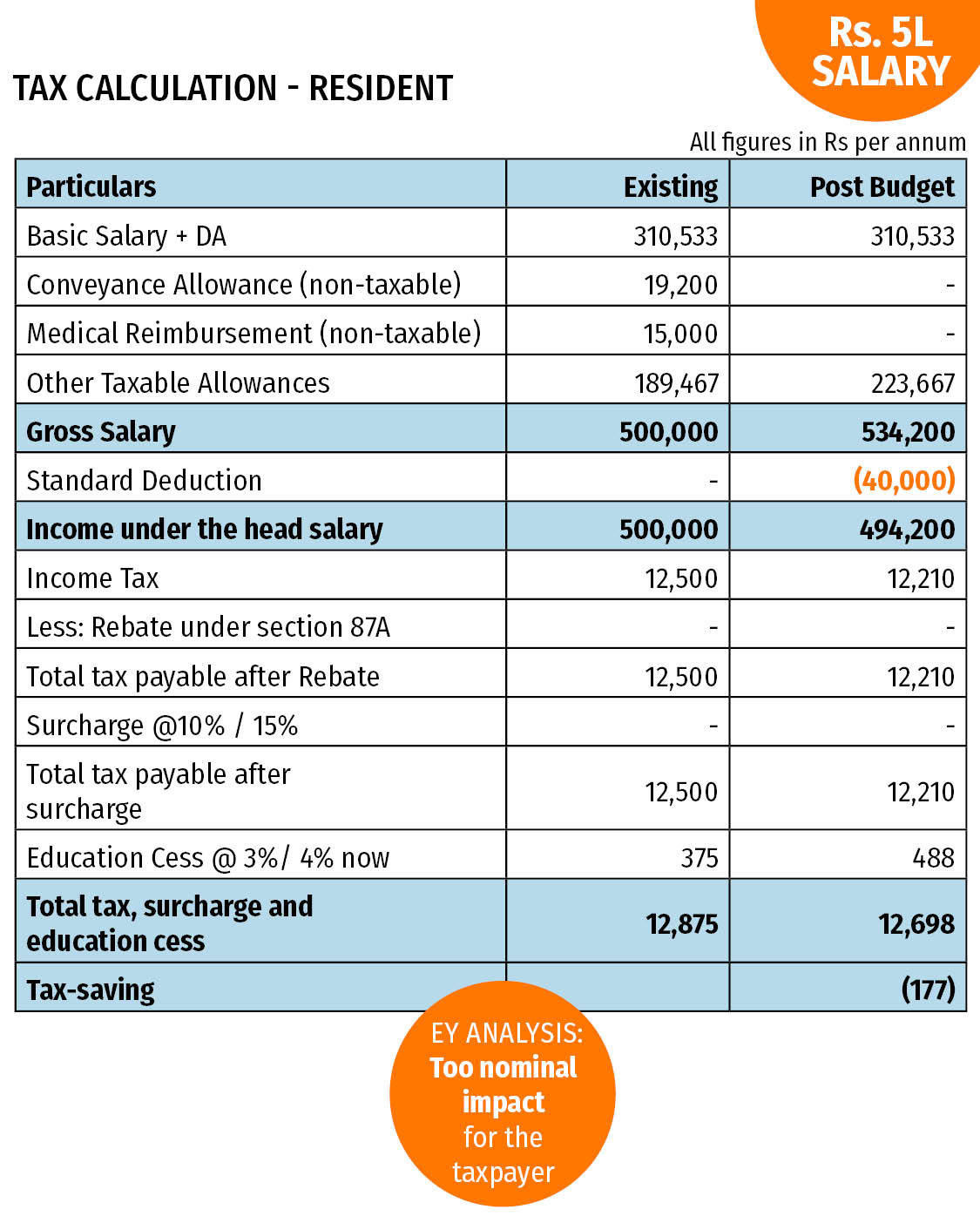

The deduction available is up to inr 25,000 (inr 50,000 where any of the insured persons is a senior citizen). Being india’s top 10s income earners, they have need to give more attention to their financial planning and taxation. Inr 12,500 + 20% of the income exceeding inr 500,000.

A) setting up and operating a cold chain facility. Doctors were working in the hospital named ruby hall clinic and were giving services in the hospital.hospital has hired them and were paid on monthly basis for the services they render. 50,000 if parent is a senior citizen) in case of huf, up to rs.

Here we are providing some necessary documentation and legal requirements for doctors in india as necessary to follow to avoid unnecessary payment of tax, interest & penalty. India monthly tax calculator with 2022 income tax slabs use the monthly tax calculator to calculate your salary and tax for 2022/23 assessment year. 16(ii) entertainment allowance [actual or at the rate of 1/5th of salary, whichever is less] [limited to rs.