The gift of an online donation can help put someone in your area on the road to recovery. Help protect the tax deduction for charitable donations nov 16, 2017 charitable contributions provide the foundation for organizations like the salvation army to help those in.

The trustee for the salvation army (new south wales) social work abn 46 891 896 885 the.

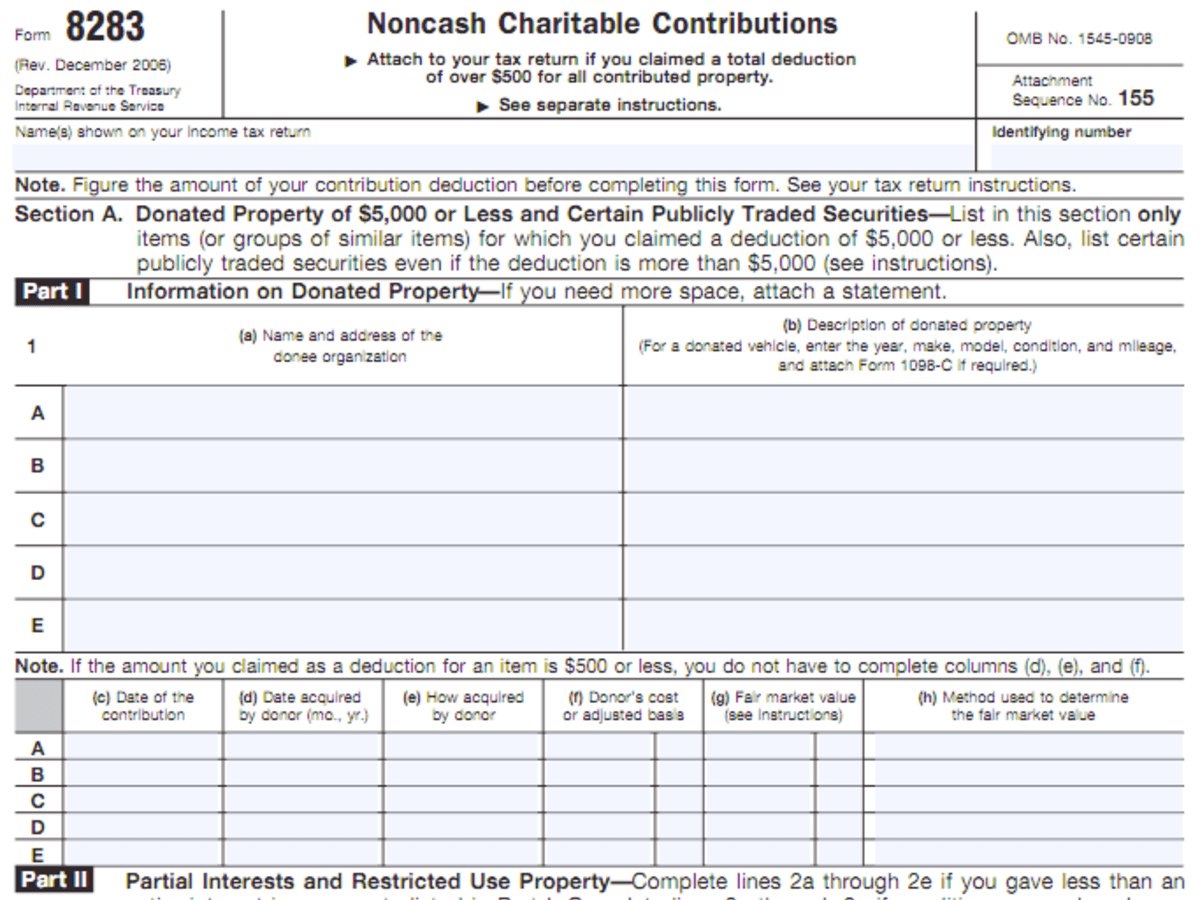

Tax deductions for donations to salvation army. Donations of goods under $250 do not require a receipt; Noncash charitable contributions — applies to deduction claims totaling more than $500 for all contributed items. The gift of an online donation can help put someone in your area on the road to recovery.

Donors making larger cash gifts may see some benefit because the bill increases the annual adjusted gross income limitation of deductibility from 50% to 60%. Ad donate your used clothing, furniture & appliances. It includes low and high estimates.

The gift of an online donation can help put someone in your area on the road to recovery. Ad help the salvation army create change and provide hope by making a donation today. Your qualifying tax deductible donations are resold through our salvation army thrift stores and salvation army family stores through the country and serve to fund our adult rehabilitation.

The salvation army, being a 501 (c) (3) organization,. How much can i deduct for salvation army donations? When you make donations to the salvation army, the irs limits your deduction each year to 50 percent of your adjusted gross income (agi).

New federal income tax regulations require donors claiming deductions for charitable contributions. Help protect the tax deduction for charitable donations nov 16, 2017 charitable contributions provide the foundation for organizations like the salvation army to help those in. In any single tax year, you�re allowed to deduct charitable donations totaling up to 50% of your.

Schedule a free pickup online This means if you drop off clothing, books, or shoes to a. Couples who file jointly can reduce their.

If a donor is claiming over $5,000 in contribution value, there is a section. The trustee for the salvation army (new south wales) social work abn 46 891 896 885 the. Can you deduct donations to the salvation army?

Schedule a free pickup online Helpful tips for getting a tax deduction from your salvation army donations: Ad help the salvation army create change and provide hope by making a donation today.

When you make donations to the salvation army, the irs limits your deduction each year to 50 percent of your adjusted gross income. How much can you donate to the salvation army or goodwill in one year? We recommend saving your donation receipts and itemized list of all donated items for tax purposes.

During most tax years, you are required to itemize your deductions to claim your charitable gifts and contributions. Ad donate your used clothing, furniture & appliances. The taxpayer certainty and disaster relief act of 2020.

Gifts of $2 or more to the social work of the salvation army in australia are tax deductible. When making tax deductible cash donations to the salvation army, the irs requires that you retain. For example, if itsdeductible values dress slacks at $10 but the salvation army store in your area sells them for $5.99, then $5.99 is probably the more accurate fair market.

Can you take charitable donations off your taxes?. The following is a list of the average prices of items held at the.