Standard tax deduction for seniors. If you are age 65 or older, your standard deduction increases by $1,700 if you file as single or head of household.

Next, calculate the amount spent on home care that exceeds 7.5% of the amount of your agi.

Tax deductions for elderly. This tax credit ranges from $3,750 to $7,500, depending on your income and filing status. Standard tax deduction for seniors. For single filers, the 2021 standard deduction is $14,250.

As an example, if your agi is $50,000, you’ll need more than $3,750 in itemized medical expenses to qualify for a deduction. If you are legally blind, your standard deduction increases by $1,700 as well. If you are legally blind, your standard deduction increases by $1,700 as well.

If you are age 65 or older, your standard deduction increases by $1,700 if you file as single or head of household. For 2020, the standard deduction is $12,400 for single filers and $24,800 for married couples filing jointly. In general, you can deduct qualified medical expenses that are more than 7.5% of your adjusted gross income.

As per the latest changes in the income tax act, the standard deduction for senior citizens is ₹50,000. If you are married filing jointly and you or your spouse is 65 or older, your standard deduction increases by $1,350. If you don’t itemize your deductions, you can get a higher standard deduction amount if you and/or your spouse are 65 years old or older.

So, for example, if your. If your filing status is single, the standard deduction in 2018 is $12,000. For 2021, it is $12,550 for singles and $25,100 for married couples.

What is the tax rates for 2022? If you are age 65 or older, your standard deduction increases by $1,700 if you file as single or head of household. If you fit the requirements, the credit for the elderly or the disabled could really brighten your tax day.

The extra amount can range from $1,300 to $1,600. Seniors over the age of 65 may be able to qualify for a higher amount of their standard deduction if they don’t itemize. If you are legally blind, your standard deduction increases by $1,700 as well.

Medical and dental expenses are often one of. Your medical expense deduction is limited to the amount of medical expenses that exceeds 7.5% of your adjusted gross income. From simple to complex taxes, filing with turbotax® is easy.

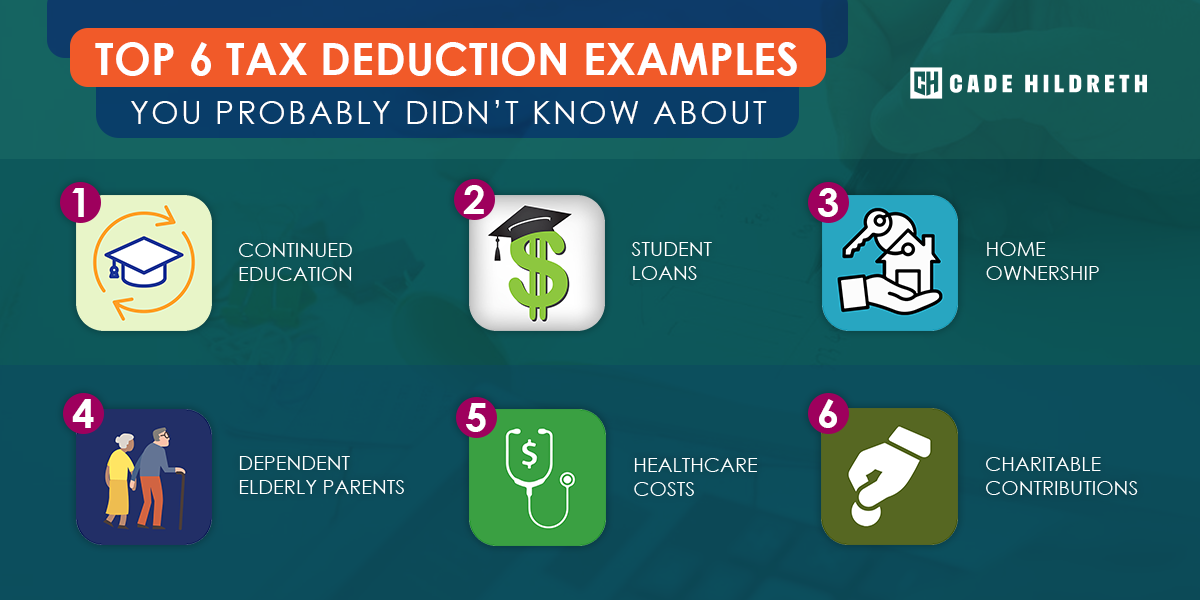

Is there a tax credit for caring for an elderly parent? Every taxpayer can either take the standard deduction or itemize his or her personal deductions. If you make less than $200,000 a year ($400,000 for married filing joint filers), you may be able to get a credit of $500 per dependent parent.

In the 2021 tax year (filed in 2022), the standard deduction is $12,550 for single filers and married filing separately, $25,100 for married filing jointly and surviving spouses, and $18,800 for the head of household. If you owe $4,000 in taxes before the credit and you get a $3,750 credit, your tax bill will be just $250. If you are legally blind, your standard deduction increases by $1,700 as well.

Ad answer simple questions about your life and we do the rest. If you are married filing jointly and you or your spouse is 65 or older, your standard deduction increases by $1,350. You can include medical expenses you paid for an individual that would have been your dependent except if:

Sometimes, taking the standard deduction makes more sense than itemizing. If you are age 65 or older, your standard deduction increases by $1,700 if you file as single or head of household. Next, calculate the amount spent on home care that exceeds 7.5% of the amount of your agi.

The benefit phases out as your income increases. For those 65 years of age or legally blind, the standard deduction was increased in 2021 to $1,700 for single filers or head of household, and $1,350 (per person) for married filing jointly, married filing separately, and surviving spouses. He or she received gross income of $4,300 or more in 2021, he or she filed a joint return for the year, or

(see form 1040 and form 1040a instructions.) If you are age 65 or older, your standard deduction increases by $1,700 if you file as single or head of household. And with an adjusted gross income or the total of nontaxable social security, pensions annuities or disability income under specific limits the credit ranges between $3,750 and $7,500.

Here�s a list of the top tax deductions for those over 50. 2021 senior citizen standard income tax deduction. If you are married filing jointly and you or your spouse is 65 or older, your standard deduction increases by $1,350.

You can get an even higher standard deduction amount if either you or your spouse is blind. (it’s only $12,550 for single filers under 65 years old.) Determine whether itemizing is better for you than claiming the standard deduction.

If you are married filing jointly and you or your spouse is 65 or older, your standard deduction increases by $1,350. If you are married filing a joint return, the standard deduction is $24,000. Aged 65 or older or retired on permanent and total disability and received taxable disability income for the tax year;

2021 standard tax deduction for seniors over 65 years of age with the standard deduction increase*: For those 65 years of age or legally blind, the standard deduction was. What is the personal exemption for 2021?