Previously, employee meals for employer convenience had to be deductible at 100 percent. Reimbursements using per diem rates are always only 50 percent deductible.

Beginning january 1, 2021, through december 31, 2022, businesses can claim 100% of their food or beverage expenses paid to restaurants as long as.

Tax deductions for employee meals. The amount of the deduction was limited to 50% of such expenses. Meals with value you include in an employee�s wages meals as part of social events, like a holiday party or annual picnic Are employer provided meals taxable to employee?

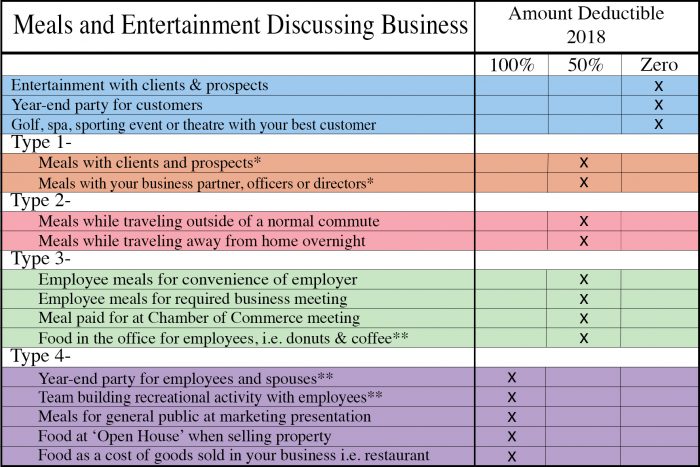

Below we review several situations in which meal expenses are now 100% deductible. So, what’s the big change? Now, they are deductible at 50 percent.

Meals that were previously only 50% deductible under the tax cuts and jobs act of 2017 are now 100% deductible. The act added a temporary exception to the 50% limit on the amount that businesses may deduct for food or beverages. For the irs, bank and credit card statements are good enough.

The 2017 tcja generally eliminated the deduction. The temporary exception allows a 100% deduction for food or beverages from restaurants. Before, business meal deductions were capped at 50%.

The meal cannot be extravagant under the circumstances, and in the past, you could only deduct 50% of the meal’s actual cost if you keep your receipts, or 50% of the standard meal allowance if you. The rate for this calculation is 47%, irrespective of the personal income tax rate of the employee receiving the benefit. They’re also 50% deductible if they’re provided on the premises of the employer and are offered for the convenience of the employer.

The expense is an ordinary and necessary business expense the meal isn’t lavish or extravagant under the circumstances the business owner or an employee is present the food and beverages must be provided to a current or potential business customer, client, consultant, or similar business contact, and Your business can deduct the cost of meals for employees while traveling and for meals with clients or customers at 50%, but you can take a 100% deduction for some meals provided to employees, including: No longer can employees deduct expenses for business meals from their personal income taxes that are not reimbursed by the employer.

That’s right, entertainment, even when prospecting clients were no longer. Contrary to popular belief, you don’t have to hoard receipts for your restaurant visits in order to claim the business meal tax deduction. Beginning january 1, 2021, through december 31, 2022, businesses can claim 100% of their food or beverage expenses paid to restaurants as long as.

For example, let’s say that lunch costs you $100 for the employee. 50 percent deductible meals (no change): If your employer reimburses you for your travel expenses, you can only claim up to 50 percent of any cost that was not reimbursed.

274(n)(1), a deduction for any expense for food or beverages is generally limited to 50% of the amount that would otherwise be deductible. Office meetings and partner meetings fall into this category. The meal is 50% deductible if:

Irs issues final regulations on the deduction for meals and entertainment. 1, 2023, for food or. Meal expenses for a business meeting of employees, stockholders, agents, and directors.

However, there are detailed rules about what meal expenses qualify for this favored tax treatment. How much can i claim for meal allowance? Reimbursements using per diem rates are always only 50 percent deductible.

Hr 133 that was signed into law on december 29, 2020 changed the deduction for most business meals from 50% to 100% as long as it is provided by a restaurant. Employers and employees can both reap substantial tax benefits when the employer provides or pays for employee meals. Take a client out to lunch, treat your employees to a meal, or take a prospective customer to dinner.

Generally, any meals during business travel. A meal with a client where work is discussed (that isn’t lavish) 31, 2020, and before jan.

A deduction was permitted only if 1) the expense wasn’t lavish or extravagant under the circumstances, and 2) the taxpayer (or an employee of the taxpayer) was present when the food or beverages were furnished. However, the consolidated appropriations act, 2021, p.l. {write_off_block} keeping records for your business meals.

The 100 percent deduction is allowed as long as the expense isn’t “lavish or extravagant,” the business owner or their employee is present at the meal, and the meal is provided to the business owner or their client. If there is no business function to the meal, it is completely nondeductible for tax purposes. Previously, employee meals for employer convenience had to be deductible at 100 percent.

There are certain circumstances where the temporary 100 percent deduction does not apply. September 2020 final treasury regulations allow either a restaurant or a catering business to deduct 100% of the costs of food or beverage items purchased for its operations, some of which may be consumed by employees at the. Washington — the internal revenue service issued final regulations on the business expense deduction for meals and entertainment following changes made by the tax cuts and jobs act (tcja).

Meal expenses by an employee during a business trip, and reimbursed to that employee, are still only deductible at 50 percent, even though the employee was reimbursed 100 percent for the cost of the meals.