Authorized by a collective agreement, such as union dues, and; A tax credit for the disabled.

Under paragraph 110 (1) (d) of the income tax act, employees of a ccpc may deduct one half of the employee stock option benefit when computing their taxable income if the employee:

Tax deductions for employees canada. Commission employees are often able to benefit from certain tax deductions that salaried employees do not have access to. In addition, taxable income above $49,020 is subject to a tax of 5%, if the value exceeds $48,040, up to $98,040. An employee’s gross salary is the amount earned without tax or other contributions being deducted.

This includes payroll tax, real estate tax for business property, sales tax, excise tax, fuel tax, state income tax etc. How much tax is deducted from a paycheck canada? Below is a list of tax deductions with information on how to maximize each tax deduction:

He can also apply for tax deductions for business licenses. The monthly paystub given to employees is also tax deductions for an employer. A registered retirement savings plan allows canadians to save for retirement and lower the amount of tax they owe.

Required by federal or provincial law, such as: General deductions include both mandatory deductions such as: He can subtract various forms of state taxes that are related to his business.

As an employee, your employer can make certain deductions from your pay, including those: The reason for this is commission employees are often required to pay additional expenses that salaried employees are not. How much should be deducted from my paycheck canada?

(1) gross remuneration for the pay period (weekly) $1,200.00. Students attending training in canada can get credit. Learn more on the canada revenue agency’s employed artists webpage.

Authorized by a court order, such as garnished child support payments; Authorized by a collective agreement, such as union dues, and; For example, the employer�s maximum annual employment insurance premium was $1,245.36 in 2021, except in quebec, where the maximum was $930.08.

(2) deals with the ccpc at an arm’s length, and (3) the employee stock option price (including. Form t2200s or form t2200 is kept by you and is not included with your tax return. Say an employer pays an employee $1,000, but after the employer deducted canada pension plan (cpp) contributions, employment insurance (ei) premiums, and income tax, the employee’s cheque is $850.

(2) minus the other amounts authorized by a tax services office. An increase of 5% would be sufficient to generate $3,750. 26% and above is taxable as $151,978.

There are federal and provincial/territorial td1 forms. Enter the amount from line 9368 on form t777s or form t777 on line 22900 other employment expenses on your tax return. Form t777s or form t777 must be filed with your tax return.

We will also see your monthly wages at $3,381, if you earn $40,568 per year. Below are examples of payroll deduction rates that applied for 2021. Do not include your supporting documents.

Intended to collect any overpaid wages Those who make $52,000 a year in the region of ontario, canada, will pay $10,432 in taxes each year. 2 hours agoaccording to the canada revenue agency (cra), the federal tax rates will be 15% and 20% for the first $49,020 of taxable income in 2022.

Employed artists may also qualify for additional expenses. The frequency of payments to the governments varies. Normally, employees pay a tax of 7.65% on their income (fica taxes) and their employers also pay that amount for a combined tax of 15.3%.

One example of such an allowable deduction is the motor vehicle travel expense in a limited number of situations. It is also necessary to pay to subscribe to digital news. The department of homeland security deducts the amounts of employees’ claiming ation, credits, and expenseshome office expenses for employees.

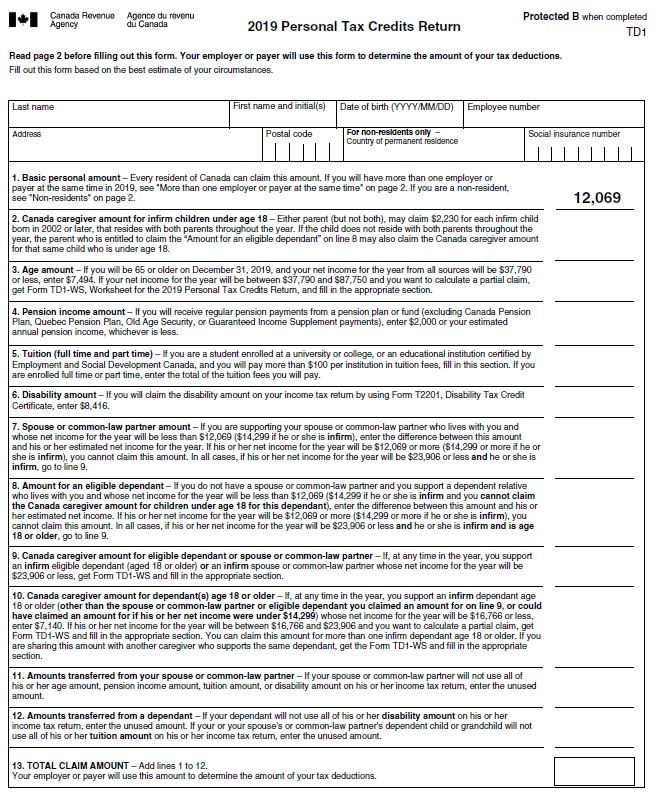

Td1, personal tax credits return, is a form used to determine the amount of tax to be deducted from an individual�s employment income or other income, such as pension income. Some benefits and allowances are subject to canada pension plan (cpp) contributions, employment insurance (ei) premiums, the new bc health tax, and income tax deductions. Claim the deduction on your tax return.

And voluntary deductions such as: A marginal tax rate of 35 applies to you and 0% to you. How often are deductions remitted to the governments?

The amount you contribute to your rrsp will be deducted from your taxable income, which. Subparagraph 110(1)(f)(iii) of canada’s income tax act subparagraph 110(1)(f)(iii) of canada’s income tax act allows a taxpayer to deduct “any amount that is income from employment with. An employee may also request that additional tax be withheld.

1 day agothe agi calculation method lets you calculate the medical expenses deduction at a factor of 7 and assume you did not need to make your deductions. You may deduct only a total of $50,000 of your agi if your medical expenses cost over $3,750, multiplied by $50,000 x 7. Under paragraph 110 (1) (d) of the income tax act, employees of a ccpc may deduct one half of the employee stock option benefit when computing their taxable income if the employee:

The average tax rate that you pay is 22 percent. Amount subject to 15% of gross income above $85,287 increased to $20,368. A taxable income of $45,142 will result in a tax rate of 05%.

October 20, 2020 | 3 min read. (1) received common shares upon exercising the employee stock option; Staying on top of the rules around taxable benefits in canada can be daunting.

Taxpayers with incomes of $92,287 up to $150,000 may face a 16% tax on their portion of their taxable income. A tax credit for the disabled.