A total combined credit limit of $500 for all tax years after 2005. The covid relief act retroactively extended the residential energy efficiency tax credits until december 31,2021 and the renewable energy credit (with updates) until december 31,2023.

10% of the amount paid or incurred for qualified energy efficiency improvements installed during 2020, and any residential energy property costs paid or incurred in 2020.

Tax deductions for energy improvements. If the improvement is done solely for the home office space, then 100% of the cost can be deducted. Tenants may be eligible if they make construction expenditures. This credit is worth a maximum of $500 for all years combined, from 2006 to its expiration.

The covid relief act retroactively extended the residential energy efficiency tax credits until december 31,2021 and the renewable energy credit (with updates) until december 31,2023. A total combined credit limit of $500 for all tax years after 2005. Available tax credits for improvements made by december 31, 2010, the credit is 30% of the purchase price and the overall cap on the available credit is $1,500 over both 2009 and 2010.

If you�re building a new patio in your backyard or revamping the kitchen in your home, don�t expect to get a tax break. Of that combined $500 limit, turbotax will search over 350 deductions to get your maximum refund, guaranteed. Thereof what homeowner expenses is not deductible?

The renewable energy tax credit is for solar, geothermal, and wind energy installments and improvements. This includes the solar energy tax credit. With this credit, homeowners can claim 10% of eligible home improvements (excludes labor/installation fees).

(although fuel cells only count on primary residences.) A limit for residential energy property costs in 2021 of $50 for an air circulating fan; You can claim a tax credit for 10% of the cost of qualified energy efficiency improvements and 100% of residential energy property costs.

Like that other credit, the amount you can get back is still 30%, with a decline until the tax credit expires after 2021. The tax credits for residential renewable energy products are. There is a total combined credit limit of $500 for all tax years after 2005—you can�t claim $500 per year.

When it comes to the renewable energy tax credit, the irs says energy saving improvements made to a personal residence before january 1, 2022 qualify for the credit, which is equal to 26% of the. You may have answered a question incorrectly, or you may have claimed energy credits on a past tax return, and have no more credit available. For windows specifically, there is a combined credit limit of $200 for all tax years after 2005.

Tax deductions for energy efficient commercial buildings allowed under section 179d of the internal revenue code were made permanent under the consolidated appropriations act of 2021. You will add up your various energy credits on irs form 5965. $150 for any qualified natural gas, propane, or oil furnace, or a hot water boiler;

So, if you use 10% of your home for office use, then 10% of the cost of the improvement would be deductible. Home improvements on a personal residence are generally not tax deductible for federal income taxes. For example, energy tax credits can be worth up to 30% of the cost of installation.

Both existing homes and new construction qualify for the credit — primary residences as well as second homes. When to claim home improvement deductions on your taxes. The tax credits for residential renewable energy products are still effective, as written on this site, through december 31, 2023.

This credit is worth 10% of the cost and a maximum of $200 and $500 for windows/skylights and doors, respectively. If so, you may qualify for energy credit tax savings for home improvements on your 2021 tax return. Turbotax notes that you “can claim a tax credit for 10% of the cost of qualified energy efficiency improvements.” you can also claim “100% of residential energy property costs.” unfortunately, a number of restrictions and limitations apply to.

As long as the upgrades meet energy star standards, you will qualify to claim the energy tax credit. 10% of the amount paid or incurred for qualified energy efficiency improvements installed during 2020, and any residential energy property costs paid or incurred in 2020. Are energy efficient home improvements tax deductible?

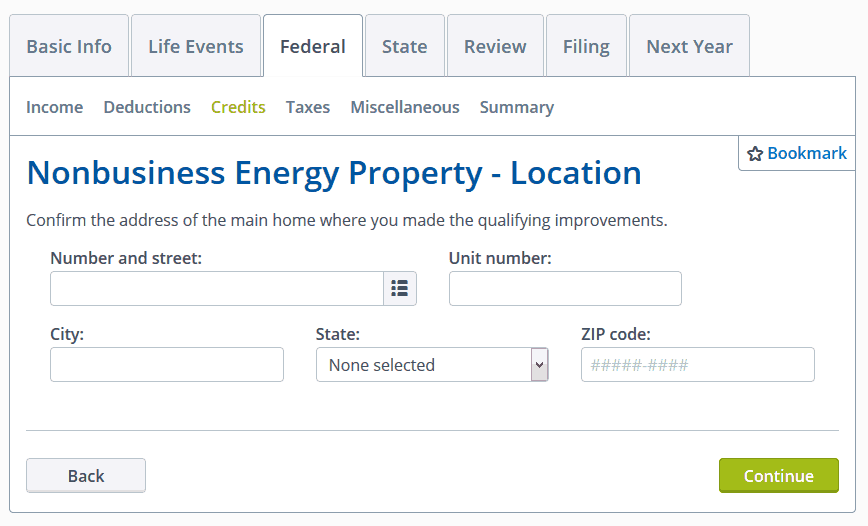

Make sure that you indicate that you are the sole owner of your home, and that your home is in the united states, and that this is your main home, and that the improvements weren�t. Examples are solar electric equipment, solar water heaters, geothermal heat pumps, small. Systems installed between 12/31/2022 and 12/31/2023 these credits are for home improvements, including fuel cells, wind turbines, and geothermal heat pumps.

However, this credit is limited as follows. In 2018, 2019, 2020, and 2021, an individual may claim a credit for (1) 10% of the cost of qualified energy efficiency improvements and (2) the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year (subject to the overall credit limit of $500). You can — and should — claim tax deductions in the year your home improvements were done.

Are you cutting back on your carbon footprint with this new improvement? The 179d commercial buildings energy efficiency tax deduction primarily enables building owners to claim a tax deduction for installing qualifying systems and buildings. However, some improvements must be claimed over a few years’ time.

Some can only be claimed if you sell the property.