To find out what guides are available. You’ll be able to claim expenses on fuel, maintenance, cleaning and parking.

Whether you’re making or receiving calls, or using your phone for security purposes at work, you can claim a portion of your mobile phone bill back on your tax return.

Tax deductions for engineers australia. To find out what guides are available. Travel expenses when you�re driving to and from work, but only if you�re required to transport heavy, bulky tools or. A deduction would only be made if you had a bachelor’s degree in the same field as march 31, 2008, and 4 years of relevant work experience.

“the message from today’s joint meeting is clear: Overnight and overseas travel for work purposes including airfares, meals and accommodation. Contact online tax australia for all your online tax return needs.

Travel between various building sites and places of work. The complete guide to fifo tax deductions. Engineers design, construct, and maintain products, machines, and structures.

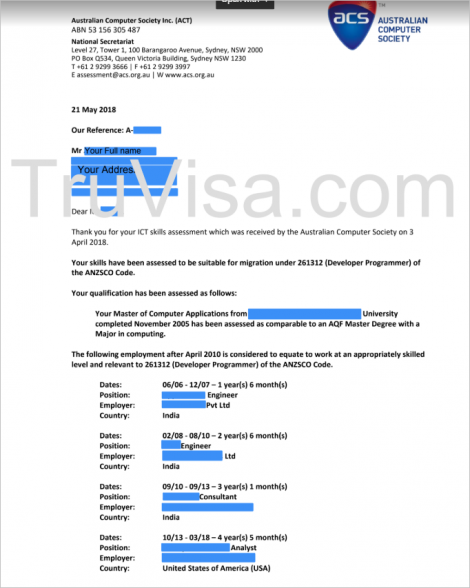

Any transport expenses including parking fees and tolls, if you are driving between multiple jobs (for. Make sure you hold on to any invoices or statements you received associated with these costs so you can provide evidence if. Acs examines your qualifications to ensure that your degrees align with australia’s instructional system and provides authentication to ensure ict major or minor status and your job comprehension.

Example of work experience deduction for your convenience, i’ve included an example below. You’ll be able to claim expenses on fuel, maintenance, cleaning and parking. A constructive acs assessment is expected to ensure that all training, practice is dedicated to australia pr.

Other taxes, including property, payroll, prrt, and fbt, as well as other business taxes (excluding income tax and the diverted profits tax [dpt]) are deductible to the extent they are incurred in producing assessable income or necessarily incurred in carrying on a business for this purpose, and are not of a capital or private nature. In contrast, someone earning $110,000 would receive a $1470 refund after deducting $3,500 in taxes. Actuaries, mathematicians & statisticians (1) actors, dancers & entertainers (1) advertising and marketing professionals (1) aged and disabled carers (1) agricultural & forestry scientists (1)

You can also deduct running costs for any electricals. In other words, your tax deductions get you an extra $1260 in your tax refund when you lodge your tax return. However, additional tax may apply to the extent that the total of all superannuation contributions made in a year for the individual (including contributions made by.

Tax deductions for engineers car. Whether you’re making or receiving calls, or using your phone for security purposes at work, you can claim a portion of your mobile phone bill back on your tax return. There is a wide range of deductions you can claim as an engineer, such as:

Contact us to know about tax deductions for engineers. Car expenses for work travel; As an employee engineer, there are certain circumstances where you may be able to claim deductions.

Can you explain a deduction? Depending on your income, it may be higher or lower. The amount of additional tax refund your deductions get you is not a fixed amount.

Before applying for a visa, you must first have a satisfactory skill assessment result if you wish to move to australia as a skilled worker. If you subscribe to other trade magazines or pay dues to an association not related to engineering you can claim up to $42 per income year for these. When completing your tax return, you�re able to claim deductions for some expenses.

As a general rule you can claim home office equipment such as computers up to $300 or a decline in value for items costing $300 or more. 2 days agohow do tax deductions work example? The proposal to cap tax deductions at $2,000 is a.

As an example, if a person earns $35,000, their tax deductions of $3,500 increase their refund by $735. E.g for someone earning $35,000, their $3,500 of tax deductions increases their refund. Travel to and from work, and client’s premises, while transporting bulky equipment (normally 20 or more kilos).

You can also claim your phone bill if it is used in part for work related expenses. Engineers australia is the official evaluating authority for all engineering professions, and they will consider your academic qualifications, professional experience, and english level, among other factors. You must have record to prove it you must have spent the money yourself

You may be able to claim: How do tax deductions work in australia? From engineers australia media release 8 july 2013.

If, for example, you earn $50,000 a year and give $1,000 to charity, reducing your taxable income by $49,000, you can use that donation as an income deduction. Another common tax deduction for engineers and science workers is mobile phone use. These are costs you incur to earn your employment income.

To be able to claim work related deductions you must meet the following criteria: The logbook method provides a way. Reimbursement of income is an allowable deduction by the internal revenue service.

It changes as your income increases or decreases. Your deductions increase your tax refund in a variable manner. Deductions will be made per skill level, and the deduction date will be june 31, 2010.