If it is entertainment and an exception applies, it is tax deductible. If the entertainer’s home is his place of business, transportation to and from his home for business purposes is deductible.

This is a preview of one of the articles in the new krost quarterly sports & entertainment issue, titled “qualified business income deduction and the entertainment industry” by ronique davis, cpa.

Tax deductions for entertainment industry professionals. Pay less to the irs a tax deduction guide just for professionals. Tax deductions for entertainment professionals use this form to summarize and organize your taxdeductible business expenses. If it is entertainment and an exception applies, it is tax deductible.

Gst gst just follows all this. Internal revenue code section 199 provides entertainment and media companies, whether print, film, music or other audio, an opportunity to claim a domestic production activities deduction. Special deduction rules apply if the recipient is an officer, director, or other special types of business owners.

Entertainment industry tax deductions are therefore. If there is a demonstrable business purpose for a dinner out or another form of entertainment, you may claim a deduction, but only for 50%. This is the place it can get sticky so it becomes you to procure a decent bookkeeper.

If the entertainer’s home is his place of business, transportation to and from his home for business purposes is deductible. Ad tax advisory services with dedicated tax consultants and a flexible suite of services. Whatever is tax deductible as a business expense, gives rise to an input tax credit.

Qpa allows certain performing artists the option to take an “above the line” deduction for unreimbursed expenses. Tax deductions for entertainment industry expenses $ continuing education (mi) $ $ $ other: The regulations confirm that most entertainment expenses are nondeductible, but they clarify that some meal expenses remain 100% deductible, including certain food and beverage costs associated with employee shift meals.

Tax deductions for actors, musicians, and other performers. Learn about the �savers credit� by clicking here! To do this, you must calculate the part occupied for commercial purposes against the total area.

So now you know whether a specific entertainment expense is tax deductible for income tax purposes. This is a preview of one of the articles in the new krost quarterly sports & entertainment issue, titled “qualified business income deduction and the entertainment industry” by ronique davis, cpa. In the event that the occasion is blended with family and companions, you are permitted to deduct 100% of the expense credited to the representatives.

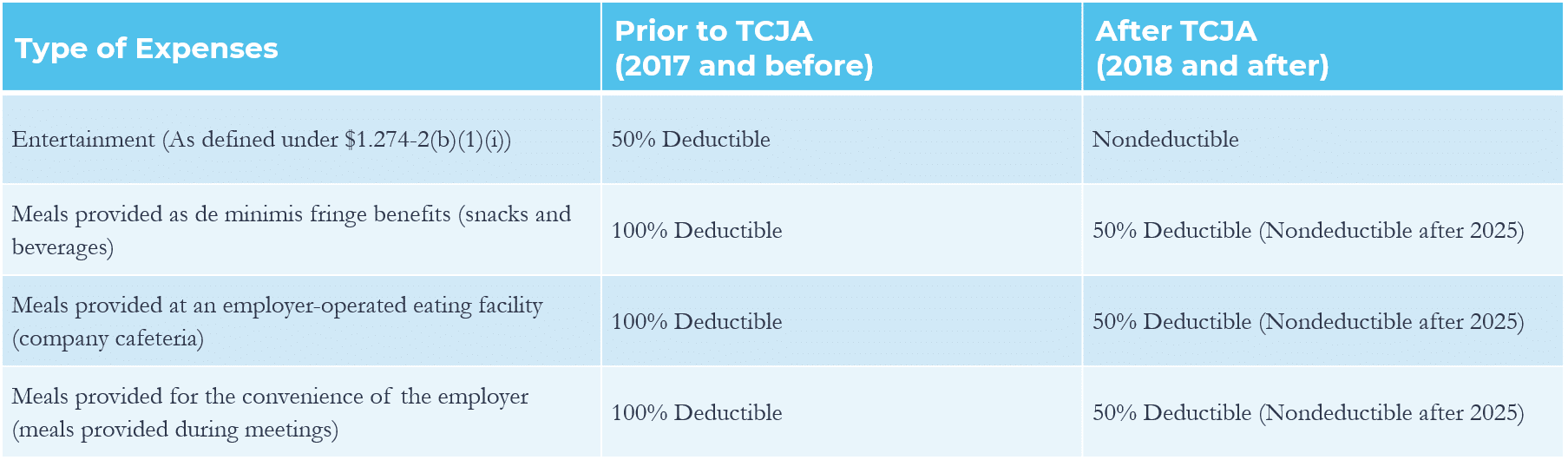

You can include 10% of your expenses in your tax return. Generally, only 50% entertainment costs are deductible. The tax cuts and jobs act (tcja) has had an impact on many industries since it was enacted in december 2017, and the entertainment industry is no different.

The 2017 tcja eliminated the. Washington — the internal revenue service issued proposed regulations on the business expense deduction for meals and entertainment following changes made by the tax cuts and jobs act (tcja). _____ $ musical instrument supplies postage seminars & workshops printing/reproduction/copies rent on business property repairs to equipment subcontracts $ supplies, office & general union meetings & expenses utilities wardrobe

Most, if not all, professional actors, actresses, and television personalities incur certain expenses to maintain their appearances. Generally, one of the best ways to make it easier to handle your tax payments as a boxer is by having a professional athlete tax planning strategy you can follow. Irs updates guidance on business expense deductions for meals and entertainment.

In order to deduct expenses in your trade or business, you must show that. Meals & entertainment business entertainment tax deduction. Entertainment industry tax deductions versus expenses.

The deduction applies to the portion of your profits derived from qualifying domestic production, and it increases as your profits increase. Learn about the unique deductions you qualify for as a licensed professional. In order to deduct expenses in your trade or business, you must show that the expenses are “ordinary and necessary.” an ordinary expense is one which is customary in your particular line of work.

If it is entertainment and no exception applies, it is not. Build an effective tax and finance function with a range of transformative services. Further, the expenses of going from one job location to another (e.g., auto mileage, taxi, subway) are also deductible, as is searching for employment, promoting oneself or even auditioning.

Here are 17 tax deductions for actors, musicians, and other performers you should be keeping track of throughout the year. Recently, the irs issued final regulations regarding limits on the deductibility of meal and entertainment expenses. If, for example, the room where your office is located is 100 pcs and your entire home is 1000 pcs.

Currently the adjusted gross income threshold for the qpa deduction is $16,000, a. You can deduct a part of the rent, electricity, heating. Boxing is traditionally considered a part of the entertainment industry, so creating a tax planning strategy begins by making sure your entertainment industry bookkeeping ledger is detailed and accurate.

Fully deductible meals and entertainment here are some common examples of 100% deductible meals and entertainment expenses: