This chapter is intended to help operators of farms and ranches optimize deductions to reduce their tax liability. Specifically, a farmer may claim a maximum expensing.

Other deductions are available only to farmers and ranchers.

Tax deductions for farm. Who and what farm equipment qualifies for a section 179 deduction according to the irs, anyone buying, financing or leasing new or used equipment for the 2021 tax year will qualify for a section 179 deduction, provided the total amount is less than $3,670,000 (the deduction itself plus the price of eligible purchases). Firstly, farms can be dangerous environments. Up and down the income range, the income levels that apply to each tax band are growing.

There are a few different deductions to explore, depending on what you do with your cattle. Like any business, farmers are permitted to deduct their business expenses from their taxable income. The irs allows farmers to deduct normal operating costs for their farms, including such expenses as feed and fertilizer, as well as livestock, seed and other essential items.

Let us find the credits & deductions you deserve. Like other businesses, farmers can take advantage of enhanced writeoffs for property placed in service in 2017. When deductible losses from operating your farm exceed your other income from the year, or you experience a personal or business loss that was more than your income, you can see a net operating loss.

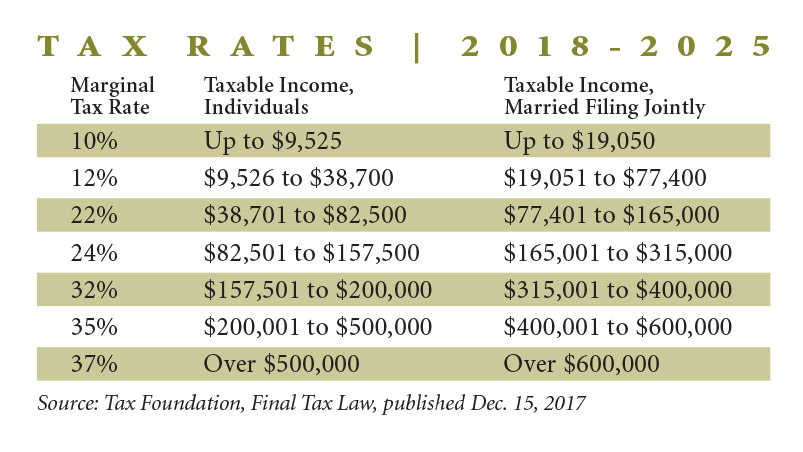

This chapter is intended to help operators of farms and ranches optimize deductions to reduce their tax liability. Individuals earning $523,600, or $628,300 for married couples filing jointly, will pay the highest 37 percent rate in 2021 returns. As with any farm business, you may deduct ordinary and necessary expenses from your taxable income, including beekeeping supplies, items purchased for resale, utilities, fuel, insurance, repairs, loan interest, and much more.

The purchase limit for this is $2,620,000—after that amount, deductions are reduced. Ad turbotax® has your back. To begin, an important deduction to consider is the section 179 deduction.

Specifically, a farmer may claim a maximum expensing. Reduce capital gains tax liabilities on sale by taking advantage of the small business cgt concessions. Some income tax deductions have special rules for farmers.

The deduction increases to $12,950 the next year, a $400 increase. It is also important to keep in mind that most farm assets are included in this, but not all. Depreciation is the loss of value over time due to such factors as aging and wear and tear.

If you earn some income from a hobby farm, you�re allowed to deduct farm expenses. According to this rule, up to $1,050,000 of farm purchases in a given year can be deducted. Noteducation (farm related) currently deductible (will add to cost of.

Taxpayers can�t deduct the full amount in the same year they bought the asset; We explain changes in your tax refund and provide tips to get your biggest refund. Business farms are allowed to deduct expenses in excess of revenues.

A cattle tax deduction is designed to help you save money when you file taxes, and was created by the internal revenue service (irs) to ensure farmers have incentives for their businesses. If your farm starts to become profitable, you may need to report it has a business instead of a hobby. Other deductions are available only to farmers and ranchers.

For full details on all tax breaks for farmers, check our tax guide for primary producers at www.hrblock.com.au or visit our nearest office. To claim deductions for a farm you have to be able to prove your intention to make a profit. The internal revenue service (irs) allows farmers to deduct the depreciated cost of farm equipment.

Instead they take the deduction over several years. When that happens, you may be able to carry the loss back up to two years and deduct it from income you had in those years. You might also qualify for an exemption on the part of the farm which is your home.

There are a range of farm hand tax deductions that apply to most people who work on a farm. You can only deduct hobby farm expenses to the extent you have hobby income. The cattle industry is critical to the united states, after all.

Farm hands are required to wear. Deductions are split into two categories: Current costs, which you deduct in the year they incurred capitalized costs, which you deduct over a number of future years