Federal law enforcement officers and related personnel currently, the definition of a federal law enforcement officer (leo) for retirement purposes is limited to an employee who performs certain duties defined in statute under either the civil service retirement system (csrs), which covers federal employees hired before 1984, or the For box 2a, select �click here for options�.

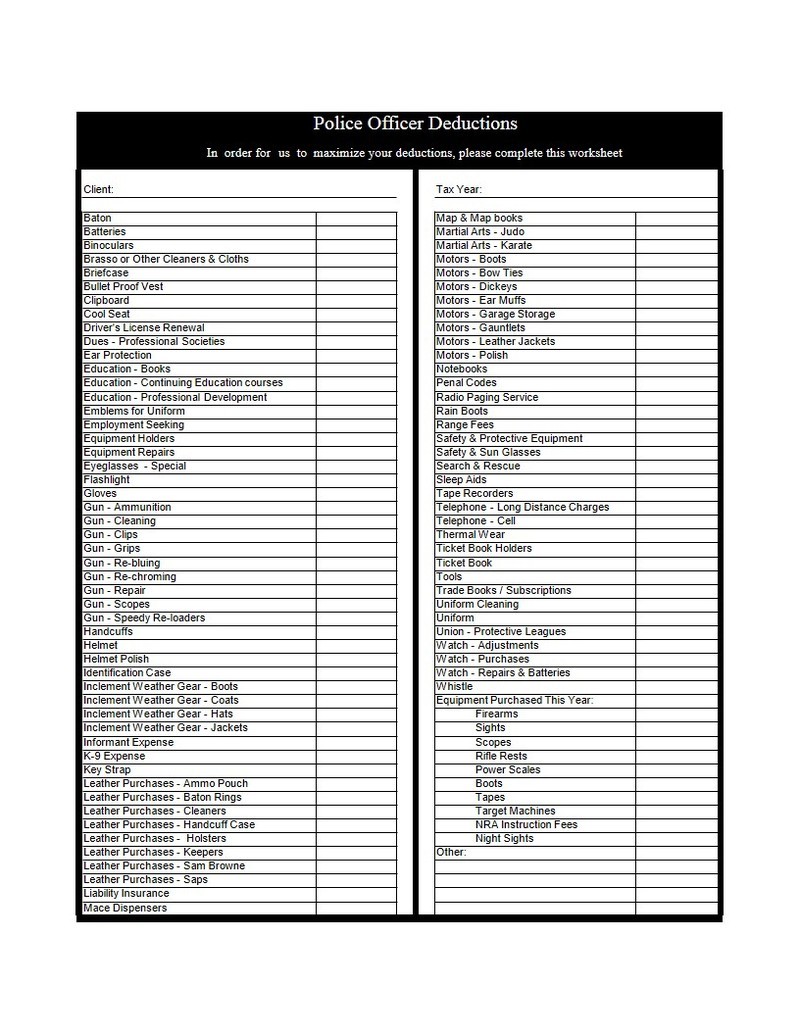

A police officer can use schedule a for work related deductions such as uniforms and equipment.

Tax deductions for federal law enforcement officers. Federal law enforcement officers and related personnel currently, the definition of a federal law enforcement officer (leo) for retirement purposes is limited to an employee who performs certain duties defined in statute under either the civil service retirement system (csrs), which covers federal employees hired before 1984, or the San dimas, long beach, valencia, palmdale, irvine tel: The tax cuts and jobs act of 2017 have changed the way police officers, and every other taxpayer is able to claim deductions.

A law enforcement officer can deduct the cost of his uniforms if his employer requires them in the performance. A single person is allowed $5,700 as a standard deduction. (only the vehicle license fee)

Your standard deduction nearly doubles to $12,400 for a single filer, $18,650 for head of household, and $24,800 for married couples filing jointly, if you don’t file an itemized federal tax return. This $3,000 pso deduction comes right off the top, it directly reduces your adjusted gross income, even if you don’t exceed 7.5% of your income in expenses. If needed, turbotax will reduce the deduction to.

Kevin@policetax.com law enforcement deductions dues. Unreimbursed job expenses such as uniforms, travel, union dues, required weapons, and itemized deductions are no longer available. Barron noted that the uniform and equipment deductions are permitted if the dollar value is above the amount of the given allowance and/or expenditure of the items.

First, i recommend you call us to confirm that you may qualify, and then. Total property taxes paid (do not include rentals) deductible dmv fees. A police officer can use schedule a for work related deductions such as uniforms and equipment.

Tax deductions for law enforcement uniforms. Beginning in 2023, officers would be allowed to deduct 25% of their salary, with the adjustment increasing an additional 25% each year until 2026, when 100% of a police officer’s wages would be exempt from state taxes. Answer yes to the question, if you were employed as a public safety officer (law enforcement officer, firefighter, chaplain, or member of a rescue squad or ambulance crew).

The mythology among law enforcement officers about taxes is extensive. For box 2a, select �click here for options�. Each government service has different requirements for how to apply for this deduction.

Enter the total amount paid for the health insurance payment amount. Leos must sometimes purchase a second landline or cell phone to respond to emergency. Officers who have completed at least 10 years but less than 20 years of service could deduct 75 percent, and officers who have completed at least 20 years of service could deduct 100 percent.

Choose public safety officers distribution and enter the smaller of the amount of premiums or $3,000. Insurance premiums for retired public safety officers if you are an eligible retired public safety officer (law enforcement officer, firefighter, chaplain, or member of a rescue squad or ambulance crew), you can elect to exclude from income distributions made from your eligible retirement plan that are used to pay the premiums for accident or. Enter the information for your distribution.

What law enforcement expenses are tax deductible? Tax deduction, tuition waiver for law enforcement officers advanced march 3, 2022 admin sen. Law enforcement officers, like all taxpayers, are responsible for paying the correct amount of tax on all income they receive unless that income is specifically excluded by the internal revenue.

Eliot bostar , lb1273 lb1272 a bill that would provide a state income tax deduction to retired law enforcement officers advanced to the second round of debate march 3 after lawmakers amended it to include a tuition waiver for eligible officers. When the taxpayer is an eligible retired public safety officer, defined by the irs as a law enforcement officer, firefighter, chaplain, or member of a rescue squad or ambulance crew, they can elect to exclude up to $3,000 of the distributions they receive from an eligible retirement plan from their taxable income. How do i make sure i get this deduction?

Along with a higher standard deduction, itemized deductions such as unreimbursed employee expenses were eliminated. Law enforcement deductions uniforms uniforms belts boots, shoes gloves hat, helmet jacket pants shirts ties emblems, insignia dry cleaning laundry rain gear other total telephone long distance faxes pay phone cellular 2nd line beeper/pager answering service other other total vehicle & travel In general, less people are itemizing because of the standard deduction nearly doubling.

Answer yes, if the pension administrator paid for health insurance. Examples of prevalent, but innocent myths include the deduction of haircuts, meals, wristwatches, suits and gym fees.