They may also exclude any payment provided by a state or political subdivision on account of services performed as volunteer firefighters or ems personnel, up to a maximum of $600 per year (i.e., a qualified payment). However, dues paid for memberships in clubs organized for business, pleasure, recreation or other social purpose are.

If you earn your income as an employee fire fighter, this information will help you to work out what:

Tax deductions for firefighter. And (2) the clothes are not adaptable to ordinary street wear. You can claim a deduction for the decline in value when you purchase and use a computer or mobile phone (if the device cost more than $300) for your employment. Records you need to keep.

A necessary expense is one that is appropriate but not necessarily essential in your business. Tax deduction list for firefighters uniform and protective clothing. How do i make sure i get this deduction?

The tax relief appears to qualify for the federal exclusion, but a volunteer�s ability to claim the exclusion. (1) the uniforms are required by your employer (if you’re an employee); This $3,000 pso deduction comes right off the top, it directly reduces your adjusted gross income, even if you don’t exceed 7.5% of your income in expenses.

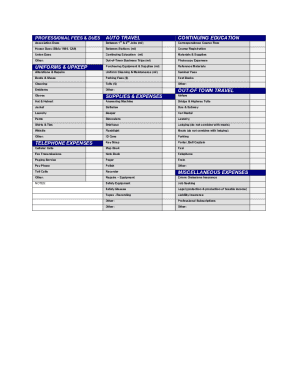

If you are enrolled in professional groups or societies that have some relationship with your job as. Communication expenses cellular phone purchase monthly cellular expenses used for business long distance/toll calls answering machine voice mail internet connection expenses 2. Protective clothing you wear to protect yourself from specific risks of injury or illness at work.

A firefighters professional fees & dues dues paid to professional societies related to your occupation as a firefighter are deductible. However, dues paid for memberships in clubs organized for business, pleasure, recreation or other social purpose are. Irs rules specify that work clothing costs and the cost of maintenance are deductible if:

According to irs rules, the costs you incur to buy your work uniform and the costs of. If you earn your income as an employee fire fighter, this information will help you to work out what: Tax tip as a volunteer firefighter or search and rescue volunteer, you may be eligible to claim a $1,000 exemption for each eligible employer instead of the vfa or the srva.

I can�t believe they actually pay me to do this!!! However, the cost of initial admission fees paid for membership in certain organizations or social clubs are considered capital expenses. They may also exclude any payment provided by a state or political subdivision on account of services performed as volunteer firefighters or ems personnel, up to a maximum of $600 per year (i.e., a qualified payment).

As a result, tax benefits and up to $600 per year of other incentives that volunteer. Job supplies/safety equipment $ strike bag/gear bag $ flashlight & batteries $ knife/utility tool $ camelback $ binoculars $ webbing/repelling gear $ helmet $ turnouts For more information, see emergency services volunteers.

Firefighters and specified ems personnel in the form of an abatement or an exemption. You can claim a deduction for costs you incur to buy, hire, repair or replace clothing, uniforms and footwear you wear at work if it’s: For information about payments you receive as a volunteer fire fighter.

What tax deductions can firefighters claim? Each government service has different requirements for how to apply for this deduction. Tax deductions for firefighters professional fees & dues:.

Generally, the costs of your firefighter uniforms are fully deductible if they aren’t provided to you without charge by your employer. First, i recommend you call us to confirm that you may qualify, and then we’ll give. This discussion addresses some of the common questions we receive from firefighters and their employing organizations.

Since the incentive is nontaxable (up to $600) on the federal return, do not include the first $600 on your tax return. Generally, the costs of your firefighter uniforms are fully deductible if they aren’t. This information is for employee fire fighters, it doesn�t apply to volunteer fire fighters.

Tax deductions for firefighters in order to deduct expenses in your trade or business, you must show that the expenses are “ordinary and necessary.” an ordinary expense is one that is customary in your particular line of work. Communication expenses $ cellular phone purchase $ monthly cellular expenses % used for business $ monthly internet expenses 2. Dues paid to professional societies related to your profession are deductible.

These could include professional organizations, business leagues, trade associations, chambers of commerce, boards of trade and civic organizations. @bryanj include the entire amount on the 1099s issued and let the individual firefighters make the necessary adjustments on their tax returns. The expenses incurred by volunteer firefighters can add up throughout the year and those performing such a public service can deduct all viable expenses on.

Dues paid to professional societies related to your profession are deductible. Tax deductions for firefighters/paramedics name: In south carolina, volunteer firefighters who earn enough points for participation earn a $3,000 state tax deduction.