(1) the uniforms are required by your employer (if you’re an employee); (1) the uniforms are required by your employer (if you’re an employee);

Volunteer firefighters are required to pay annual dues to the fire company to be considered full and active members of the station.

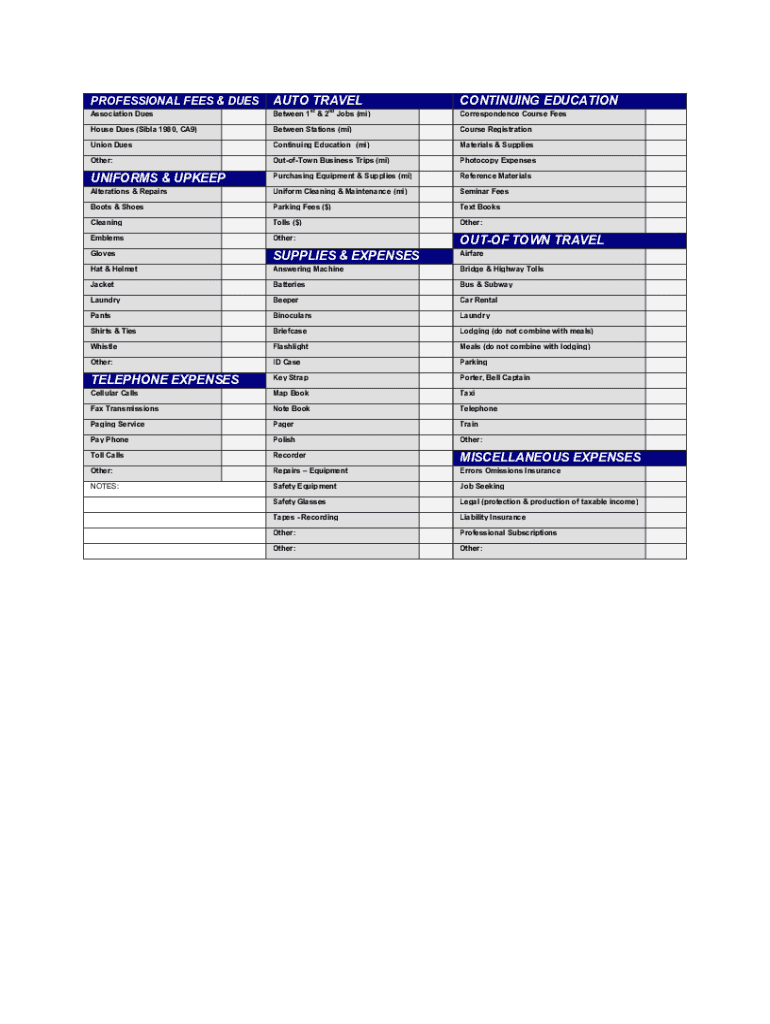

Tax deductions for firefighters worksheet. However, dues paid for memberships in clubs organized for business, pleasure,. Communication expenses cellular phone purchase monthly cellular expenses used for business long distance/toll calls answering machine voice mail internet connection expenses 2. Fire & wind (list live weight) less for house.

$810 • age 51 to 60: Some senior residences (nursing homes) have an amount in the monthly cost which is a medical expense. As long as you dont get health insurance via a spouse or employer you can deduct.

Information for firefighters the downloadable, fillable form is at the bottom of the page: Ad turbotax® makes it easy to get your taxes done right. Firefighters may receive amounts that are designated as expenses for transportation, equipment, clothing, etc.

Inventory at beginning of year. Information, dependent information, important tax questions, itemized deduction information, engagement letter, firm disclosure. Updated worksheets have been posted.

Download our 12 month expense worksheet excel worksheet. $430 • age 41 to 50: An ordinary expense is one that is customary in your particular line of work.

Hair stylist tax deductions worksheet. Job supplies/safety equipment $ strike bag/gear bag $ flashlight & batteries $ knife/utility tool $ camelback $ binoculars $ webbing/repelling gear $ helmet $ turnouts A necessary expense is one that is appropriate but not necessarily essential in your business.

In general, these are treated as taxable wages. $4,350 • age 71 and over: $5,430 the limit on premiums is for each person.

(1) the uniforms are required by your employer (if you’re an employee); Keep payroll records of hours Security) $church (name:) prescriptions $ church (name:) $ long term care.

You can claim a deduction for the decline in value when you purchase and use a computer or mobile phone (if the device cost more than $300) for your employment. Insurance premiums $ cash contributions: Give the date and business purpose of each trip;

Self employed tax deductions worksheet. This deduction includes meals, lodging and transportation expenses, and is based on the rates applied to federal employees. Download our 12 month expense worksheet excel worksheet.

According to irs rules, the costs you incur to buy your work uniform and the costs of. Volunteer firefighters are required to pay annual dues to the fire company to be considered full and active members of the station. To begin the form, use the fill & sign online button or tick the preview image of the form.

And (2) the clothes are not adaptable to ordinary street wear. Complete firefighter tax deductions 2019 worksheet within several minutes by following the recommendations below: Select the document template you require from our library of legal form samples.

Select the get form key to open the document and. That means if you go out for a 500 meal the deductible portion is only 250. Note the place to which you traveled, (3) record the number of business miles;

Medical and dental floor percentage is 7.5%. Download our expense checklist pdf. This covers persons traveling to drills, meetings, training exercises, and summer camps.

*if over $600 to an individual, use our form 1099 worksheet to provide information necessary for preparing 1099s. Communication expenses $ cellular phone purchase $ monthly cellular expenses % used for business $ monthly internet expenses 2. Tax deduction list for firefighters uniform and protective clothing.

Tax deductions for firefighters/paramedics name: In south carolina, volunteer firefighters who earn enough points for participation earn a $3,000 state tax deduction. If you are enrolled in professional groups or societies that have some relationship with your job as.

However, if the amounts are paid under an accountable plan, they may be excluded from wages and no tax reporting is required. Profession specific deduction checklist (to be used only by experienced tax preparers) actors, performers,. Amounts of 60000 or more paid to individuals not.

Generally, the costs of your firefighter uniforms are fully deductible if they aren’t provided to you without charge by your employer. In order to deduct expenses in your trade or business, you must show that the expenses are “ordinary and necessary.”. These could include professional organizations, business leagues, trade associations, chambers of commerce, boards of trade and civic organizations.

Free income tax organnizers and data worksheets to help you plan and preparer your federal and state income taxes. Answer simple questions about your life and we do the rest. Medicare premiums (withheld from soc.

$1,630 • age 61 to 70: These worksheets have been prepared to help you organize your information prior to your tax appointment. Dues paid to professional societies related to your profession are deductible.

• age 40 or under: Further, military personnel are no longer Filetax offers free tax forms and information.

(4) record your car�s odometer reading at both the beginning and end of. Irs rules specify that work clothing costs and the cost of maintenance are deductible if: