Usually involves travel to areas eligible for different standard meal allowance rates during any one trip.; Tax deductions for flight attendants.

What can flight attendants claim?

Tax deductions for flight attendants. Flight attendant professional deductions receipts are not required for travel expenses under $75 if entered into your logbook, including item, date & cost. Keep them for your records. He (past accountant) just didn’t understand the whole airline (tax detail) and international tax.

Tax deductions for flight attendants. Keep them for your records. Skill level certificate iii or iv.

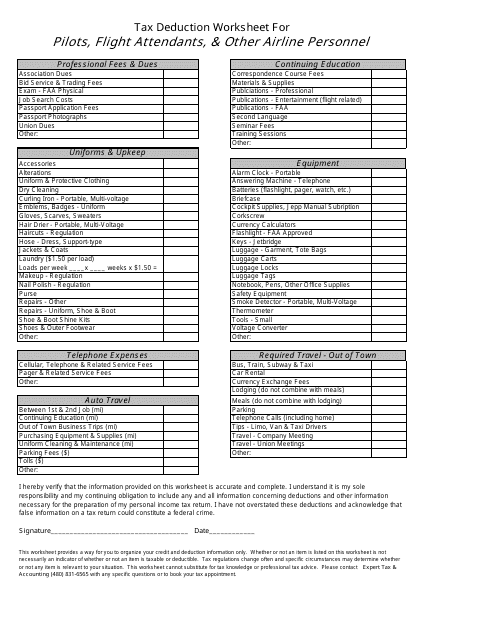

Flight attendant professional deductions proofs of expenses are required (receipts, credit or debit card statements, paystubs, etc.) do not provide these to diamond financial; Uniform items transportation expenses computer & related expenses travel/safety items communications temporary duty expenses/spa union expenses training job search commuter pad moving expense All expenses below must be specifically for.

None of these items can be deducted. The irs treats flight crew members special, and allows transportation workers to take 80% of the difference instead of the normal 50%. If you work as a flight attendant, some of the tax deductions you may be able to claim on your personal tax return are:

Some of this is moot, as fancy lawyers like to say, since the tax cuts and jobs act of 2017 basically killed most flight crew deductions. Obviously they all pass the ordinary and necessary tests, but they all fail the personal test. Please use this form to detail your flight attendant and pilot tax deductions.

You are in the transportation industry if your job:. Tax deductions for flight attendants. Motor vehicle travel between various places of work or training related travel.

Flight attendant, it pays to learn what you can claim at tax time you can claim a deduction for the cost of buying, hiring, mending or cleaning certain uniforms that are unique and distinctive to your job. Daniel datzer client for over 20 years, flight attendant, business owner, pilates instructor and cabaret singer. Examples that crewmembers often try to deduct, but fail the ordinary test are socks, underwear, haircuts, and wristwatches.

Answer simple questions about your life and we do the rest. First is out of pocket expenses such as uniforms, cell phone, union dues, etc. The cost of buying mealswhen you work overtime, provided you have been paid an allowance by your employer (you can claim for your meals without having to keep any receipts, provided you can show how you.

As a flight attendant, covered under transportation workers, what all can i deduct in 2018? Business related expenses for flight crew. We need both to prepare your tax returns.

You would incur the expense even if you weren�t employed. If you had to pay these expenses this year, you may be eligible to claim them on this year’s tax return. $8,420.46 x 80% = $6,736.37 this is essentially how your per diem calculation (pdc) is going to impact your taxes as far as deductions go (the irs does require you to subtract 2% of your gross income off of your work expenses).

Some costs of business travel, such as lodging, food and incidentals, can be deducted on form 2106 (unreimbursed employee business expenses) of the individual tax return. Ad turbotax® makes it easy to get your taxes done right. Here is a sampling of important us tax court cases involving pilot and flight attendant tax deductions.

There are two types of deductions for pilots and flight attendants. Directly involves moving people or goods by airplane, barge, bus, ship, train, or truck, and; Bookings typical tax deductions include:

The second is the per diem allowance and deduction. If you are new to flightax, below is a breakdown of the deductions we as flight attendants are allowed. You can’t claim a deduction for the cost of buying or cleaning plain clothing worn at work, even if your employer tells you to wear

Some of this is still pertinent and some of it is just fun reading. Rehydrating moisturiser and rehydrating hair conditioner. This applies even to transportation workers and is part of the tax reform changes that were signed into law in late.

What can flight attendants claim? Total blocks will be completed by tax preparer Flight personnel can achieve tax savings by maintaining proper records and claiming deductions in two key areas:

You can claim a deduction for the cost of buying, hiring, mending or cleaning certain uniforms that are unique and distinctive to your job. Regularly requires you to travel away from home, and; Usually involves travel to areas eligible for different standard meal allowance rates during any one trip.;