There are some tax deductions that all employees can claim on their personal tax returns: Set up a system to track all your expenses and use them as deductions when you file your income tax return.

A plethora of work opportunities, and the favorable tax rules, ensure that freelancing is now more fruitful than before, for those who wish to make a living out of it, or who do it part time.

Tax deductions for freelance journalists. The irs gives a little back, however. Journalism related tax deductions occupations. A plethora of work opportunities, and the favorable tax rules, ensure that freelancing is now more fruitful than before, for those who wish to make a living out of it, or who do it part time.

Deduct office equipment for freelance writers most technology and other tangible things that last more than a year are considered capital expenditures. There is good news about taxes for independent journalists: On top of figuring out how to get freelance writing clients, taxes is one of the biggest challenges new independent writers face as they establish their business.knowing what is or is not available as a deduction, how to calculate tax brackets, and what percentage of your income should be saved for tax purposes are all critical to maintaining a healthy productive.

As a general rule of thumb, freelancers can write off expenses for: In most cases you can claim the cost of these as a deduction. Most freelancers have to pay taxes four times a year.

You can deduct costs for any continuing education classes, conferences (like the american society of journalists and authors conference), or publishing events (like bookexpo) that help you learn new techniques and improve your business. Income tax filing for the freelancers. It�s a good practice to keep all receipts and documents regarding the expenses.

You can deduct all of your office materials like pens, paper, books, and printer cartridges in line. Website design & build laptop web hosting licences, software and subscriptions We are small business owners, solopreneurs, entrepreneurs, and in these roles we are (usually) our own bookkeeper, office supply administrator, decorator, and more.

Ebooks, freelance photography, freelance writing tips, freelancer, tax, tax deduction, writing, writing for magazines freelancers have many tax deductions to enjoy. Claim depreciation over a number of years on tools. Quarterly estimated tax filings are required for anyone who expects to owe $1,000 or more at the end of the year in taxes on.

How do i file taxes as a freelance journalist? Use this list to help organize your writer tax preparation. The cost of income protection or sickness and accident.

If you freelance, you are considered self. The amount of any donations to registered charities (as long as you haven’t received anything in return for your donation, such as raffle tickets or novelty items) the cost of bank fees charged on any investment accounts. Insurance & registration car insurance, roadside assistance, registration costs, etc.

Make tax time easy with an online platform such as bonsai’s accounting and taxes tool. 25 tax deductions you can claim as a freelancers 1. There are some tax deductions that all employees can claim on their personal tax returns:

If you are a big enough business, you may have to depreciate these kinds of expenses over a period of several years. * meals you can deduct 50% of the cost of any meals that you have out at a restaurant, etc. Journalists have an important job in reporting the current events and other newsworthy stories to the public.

And don’t forget to take deductions for any writers’ conferences you attend, also. This is a basic list of typical expenses incurred by writers. Agent commissions (if included in income) book, magazines, reference material business insurance business meals cabs, subways, buses copying cultural events

If you talk about your writing before, during, or after the meal and make it a “business meeting.” how cool is that? This is probably the biggest deduction that you’ll claim as a freelancer and do you most of your work. There is also bad news:

Claim tools and equipment up to $1000 in your annual tax return. There is no age limit for freelancing. When it comes time for taxes, it’s important for those who work as a journalist or media professional to know what to expect.

They can (and should) still be deducted. Tax deductible expenses for writers writers: There are a couple of ways you can ensure you take advantage of all the appropriate journalist tax deductions:

When and how to claim back your freelance equipment costs: Set up a system to track all your expenses and use them as deductions when you file your income tax return. A number of other expenses are also deductible, including those incurred for investments, rentals, certain insurance policies, and donations to charities.

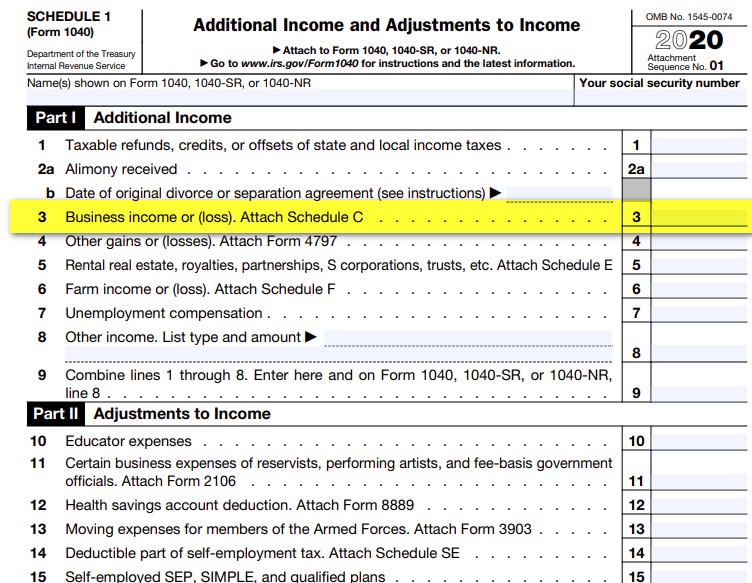

The irs guideline for freelancer tax deductions is that expenses must be ordinary and necessary. You can even deduct travel and lodging expenses if you travel to a convention or conference. The amount you owe—15.3% as of the 2021 tax year—is based on the net amount of income you arrived at when you completed your schedule c.