Book, magazines, reference material business gifts business insurance business meals cabs, subways, buses cultural events distribution costs @ david and ny photographers… photography services are not taxable in nys.

Know exactly how much money can be saved with tax deductions for a photographer.

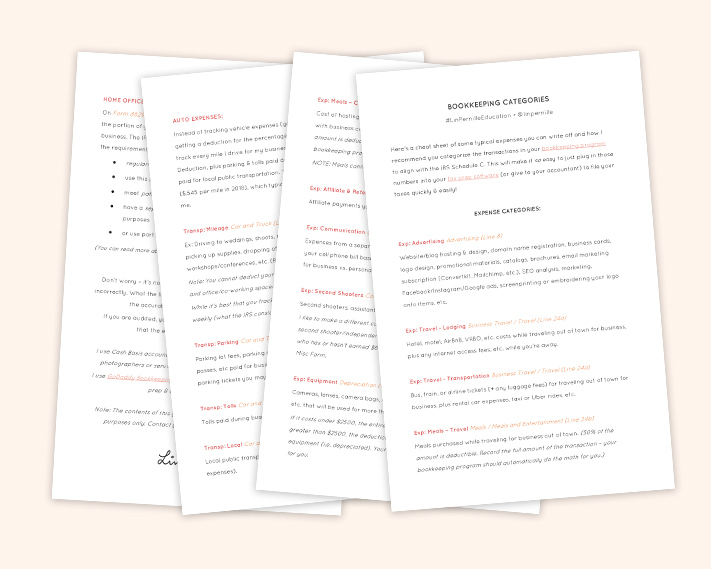

Tax deductions for freelance photographers. Welcome to the labyrinthine world of deductions! Or you can calculate what it costs to operate your vehicle for the year and apply the percentage that you use it for photography to determine your auto expense. You have two options here:

Today’s infographic highlights tax deductions for freelance photographers. Know exactly how much money can be saved with tax deductions for a photographer. Vehicle, machinery, or leasing equipment

Any meals you consumed while out for a photoshoot are deductible. Use a software system like the bonsai accounting and taxes tool. Finding clients takes hustle, and keeping them takes grit.

Here, we go over the tax deductions every freelancer needs to know. Photographers can save money with the help of expert cpas. As a freelancer, your taxes can get pretty complicated.

@ david and ny photographers… photography services are not taxable in nys. The irs guideline for freelancer tax deductions is that expenses must be ordinary and necessary. The irs lets you subtract the cost of business expenses from your overall income before they tax you on it.

Use this list to help organize your film tax, video tax, and animation tax preparation. Some common eligible expenses include: Yes, freelance photographers do pay taxes like any other freelancer if they earn $400 or more.

Tax deductible expenses for photographers | freelance tax tax deductible expenses for photographers photographers: There are a lot more like business meals, telephone, insurance costs, legal expenses, and marketing expenses that we are yet to cover. Other expenses will be unique to your business.

Canvas, paints, makeup products, and costumes are common freelance artist tax deductions. 26 tax write offs for freelance photographers 📸. Here�s a list of every purchase you should be claiming as a write off on taxes.

Even if you have an accountant prepare your taxes, it’s still a good idea to know what’s possible so you can make sure you’re keeping track of the right expenses. This allows some business owners and s corporations to get a 20 percent deduction on qualified business. A freelancer’s guide to tax deductions.

Tax deductions for photographers if you work in still or video photography, , some of the tax deductions you may be able to claim on your personal tax return are: How can i use these photography tax deductions? Use this list to help organize your photographer tax preparation.

Website hosting and domain fees transaction fees for credit card processing licenses subscriptions to. Book, magazines, reference material business insurance business meals Book, magazines, reference material business gifts business insurance business meals cabs, subways, buses cultural events distribution costs

Photographer invoices should separately state the photography service fees (labor), production expenses (camera, lights, eqpt rental, etc), and the cost for the actual photos. As a photographer, you’ve likely invested in a significant amount of equipment to operate your normal business activities. This is a basic list of typical expenses incurred by photographers.

Flimmakers, video makers and animators: Keep that in mind as you continue reading because we’ll be discussing where to include that deduction on your form. You either can track the mileage you travel for photography purposes and deduct the government rate per mile ( currently $0.565 );

As a photography enthusiasts and a tax accountant, i feel the need to put in my 2 cents in here. Taxes, deductions & freelancers fitzgerald considers the “tax cuts and jobs act” of 2018 to be a good thing for many small businesses, including freelance photographers, because of its new 20 percent qualified business income deduction. This is a basic list of typical expenses incurred by film and video makers and animators.

It�s not easy making a living taking photos. As a general rule of thumb, freelancers can write off expenses for: This can be deducted by filling out line 30 of form 1040, schedule c.

For example, software like photoshop and image costs are common tax deductions for freelance graphic designers. This rate consists of 12.4% for. Track these deductions on your own and file your own income tax return.

Hire an accountant (in which case you’ll still have to keep your own records).