You can deduct common expenses such as tools and materials, and even certain other items that come in handy in your business or on the job. Salaries and wages paid to employees;

![Common Tax Deductions For Construction Contractors [16 Most Common]](https://www.stackct.com/wp-content/uploads/2020/01/construction-contractors-taxes-768x512.jpg)

If a contractor rents an office or works from home, the rent paid for the office is deductible while deductions on home spaces are calculated based on the fraction of the home used as an office.

Tax deductions for general contractors. As a result, it may be wise to work with a tax professional who understands your unique needs and expenses. This is probably the most confusing and improperly calculated tax for 1099 workers. Independent contractors have to pay the full 15.3% social security and medicare taxes that are taken out of a regular w2 paycheck.

Regardless of your trade in the construction industry, allowable tax deductions can lower your tax liability and possibly lead to getting a tax refund. For example, maybe you use your home as an office, a yoga. Insurance & registration car insurance, roadside assistance, registration costs, etc.

This can include contractor general liability insurance, property insurance and others. But this cost is a total of so many things like an initial advertisement, product and market research, etc. Salaries and wages paid to employees;

Depreciation of property and equipment. If you are working out of a home office, you are entitled to many tax deductions that will help you as you prepare your taxes for the next year.your home office must be exclusive to your business and should. You can deduct common expenses such as tools and materials, and even certain other items that come in handy in your business or on the job.

Top 6 tax deductions for construction businesses. For instance, if you started a company this tax year, you can write $5,000 as a cost you need for creating a new business. This includes not only the flyers and branded promotional items.

Tax deductions for independent contractors as an independent contractor, you can deduct reasonable and necessary expenses related to running your business. This doesn’t, however, include your personal health, auto or. 1099 employees don’t have that luxury, so you have to set aside 15.3% at a minimum for taxes.

25 tax deductions for tradesmen general business deductions: Try your best to fill this out. W2 employees have 7.65% of their net pay withdrawn to cover this tax, while their employer pays the other half.

As an independent contractor, you’re focused on making money. Income from partnerships, s corporations and limited liability companies is also included. That’s where tax deductions come in.

Under the tax cuts and jobs act, there is a new 20 percent deduction on business income for small business owners who report their operations on form 1040, such as sole proprietors who use schedule c. If you’re not sure where something goes don’t worry, every expense on here, except. Ad uncover business expenses you may not know about and keep more of the money you earn.

If you�re an employee for a construction company, rather than an. The 9% deduction allowed on net income for construction activities in. Top 25 1099 deductions for independent contractors.

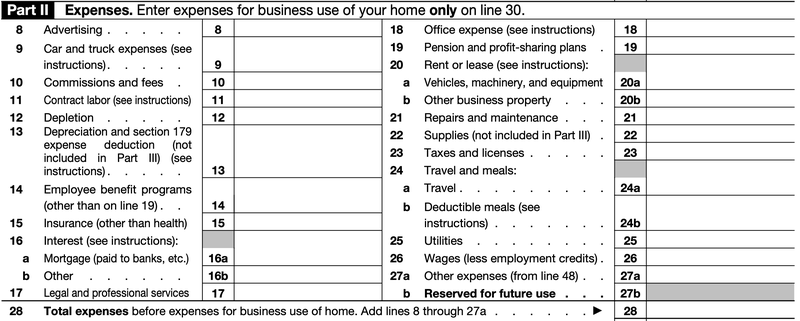

Here are 19 tax deductions available for independent contractors: Home office tax deductions for service contractors. Contract labor (line 11) legal and professional services (line 17) wages (line 26) meals for travel and entertainment (lines 24a and.

If a contractor rents an office or works from home, the rent paid for the office is deductible while deductions on home spaces are calculated based on the fraction of the home used as an office. The first thing you can write in the list of tax deductions is the startup cost of the business. Advertising (line 8) you can deduct any materials you use to market your business.

The 21 best 1099 tax deductions for self employed contractors if you can take a careful record of all of your business costs throughout the year then you will save yourself a lot of money when you file your tax return and a lot of hassle when tax season rolls around. You have two options when it comes to this. List of common expenses and tax deductions for construction workers and contractors.

16 amazing tax deductions for independent contractors. Simply put, if 20% of one’s home space is used as an office, then 20% of the house’s annual rent is deductible on the business taxes. Entrepreneurs often use their vehicle as a second office, as they spend a large portion of their time traveling for their business.

When it comes to doing taxes as a contractor, you want every opportunity to get the most deductions as possible. Business phone (landline or mobile) internet fees; Depending on your profession, you may have significant home office expenses.

Tax reform highlights for construction contractors if you’re a developer, home builder, or construction contracting company under a c corporation, your tax rate decreased from 35% to 21%. Tax deductions lower your taxable income, which translates into keeping more of your earnings at tax time. Tax deductions reduce net income,.

Use the six items below as a starting point when compiling your records. Wages paid to independent contractors; Electronics and other office equipment;

One of the largest expenses available to independent contractors to deduct is mileage.