Federal tax deductions for charitable donations you may be able to claim a deduction on your federal taxes if you donated to a 5013 organization. Federal tax deductions for charitable donations you may be able to claim a deduction on your federal taxes if you donated to a 501 (c)3 organization.

Writing a check to charity is the easy way to give.

Tax deductions for giving to charity. That�s because individuals can write off up to $300 in cash donations, and up to $600 for married couples filing jointly, made to qualifying charities in 2021, regardless of if they take the standard deduction or itemize their taxes. That means individual taxpayers can take a deduction of up to $300 for cash donations made this year when they file their federal tax returns in 2022. With proper documentation, you can claim vehicle or cash donations.

Gifts to individuals are not deductible. With proper documentation, you can claim vehicle or cash donations. Federal tax deductions for charitable donations you may be able to claim a deduction on your federal taxes if you donated to a 5013 organization.

Married couples who file joint tax returns can. According to the internal revenue service (irs), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and. The maximum deduction is increased to $600 for married individuals filing joint returns.

Writing a check to charity is the easy way to give. Donations that exceed irs limits for the year may be carried forward for five years. Cash contributions are deductible in the year they are made, so if you mailed a check or charged a donation to your credit card in december, it counts.

Normally, only those taxpayers who itemize can take deductions for charitable giving. However, for 2021, individuals who do not itemize their deductions may deduct up to $300 ($600 for married individuals filing joint returns) from gross income for their qualified cash charitable contributions to public charities, private operating foundations, and federal, state, and local governments. The amount of your deduction may be limited if certain rules and limits explained in this publication apply to you.

How the charitable contributions deduction works. Donating to charity is a great way to give back and support organizations making a difference. Cash contributions to most charitable organizations qualify.

You may be eligible to deduct a cash contribution even if you don’t itemize deductions on schedule a (form 1040). These days, nearly 90% of taxpayers take the standard deduction. These donations allow companies to deduct up to a certain percentage in their taxes, helping them save money that would otherwise go to the government.

The taxpayer certainty and disaster relief act of 2020 waived this requirement in 2020 and the waiver still applies for tax year 2021. Because the standard deduction was doubled in. Claiming charitable donations as an itemized deduction.

This deduction was first offered last year as part of the cares act. Why your business should consider donating Deductible charity donations fall into two main categories:

This giving tuesday, don�t forget to keep track of your donation receipts. 21 hours agoif you made eligible charitable donations in 2021, you might qualify for a $300 deduction. However, for 2021 tax payers may be able to deduct up to.

14 hours agofor taxpayers claiming the standard deduction, the price of giving $1 is $1. To deduct donations, you must file a schedule a with your tax form. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations.

During most tax years, you are required to itemize your deductions to claim your charitable gifts and contributions. To deduct donations, you must file a schedule a with your tax form. A key change in the tax cuts and jobs act (tcja) of 2017 was an increase in the size of the standard deduction.

Donations made to a qualified charity are deductible for taxpayers who itemize their deductions, within certain limitations.typically for cash contributions made between 2018 and 2025, the amount that can be deducted is limited to no more than 60% of the taxpayer’s adjusted gross income (agi). You can deduct up to $300 if you�re single or married filing separately (or $600 if you�re married filing jointly) for cash contributions made to. Generally, to deduct a charitable contribution, you must itemize deductions on schedule a (form 1040).

Federal tax deductions for charitable donations you may be able to claim a deduction on your federal taxes if you donated to a 501 (c)3 organization. These individuals, including married individuals filing separate returns, can claim a deduction of up to $300 for cash contributions made to qualifying charities during 2021. This year’s special deduction for donations gives all those americans an extra tax break for their charitable giving.

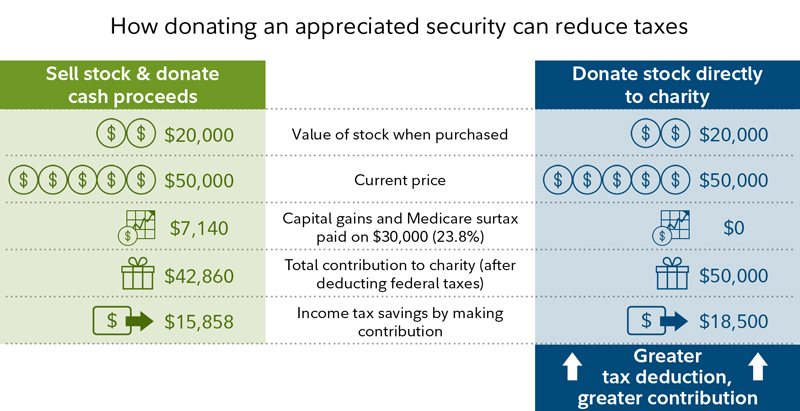

But other giving strategies can generate multiple benefits. This change allows individual taxpayers to claim a deduction of up to $300 for cash donations made to charity during 2020. Thankfully, it was extended into 2021.

If you are among the 9 out of 10 taxpayers who file for the standard deduction on your individual income tax return, you may qualify for extra tax savings on your 2021 return with the charitable giving deduction for 2021. It applies to cash donations of up to $300, or $600 if you’re married and filing jointly. These include donations you make by check, cash or card.