The irs requires an item to be in good condition or better to take a. Goodwill donations can only get you a deduction on your federal income taxes if you itemize them.

However, keep in mind that you can roll over additional deductions into the next tax year (restrictions apply, of course).

Tax deductions for goodwill donations. Vincent de paul, you may be eligible to receive a tax deduction for your donation. However, keep in mind that you can roll over additional deductions into the next tax year (restrictions apply, of course). How much can you deduct for the gently used goods you donate to goodwill.

Keep a list of everything you give to charity and do research to calculate the. Goodwill donations can only get you a deduction on your federal income taxes if you itemize them. 21 hours agoif you made cash donations to eligible charities in 2021, you might qualify for a tax deduction.

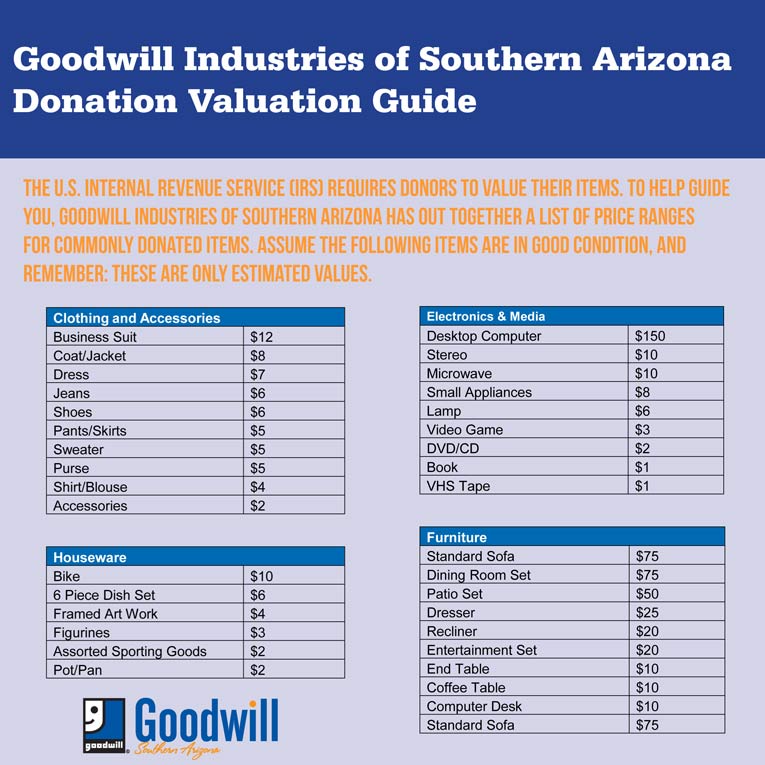

A tax deduction for a donated car is a simple step within the document in section a of the 8283. According to the internal revenue service (irs), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and so forth. You must fill out one or more forms 8283, noncash charitable contributions and attach them to your return, if your deduction for each noncash contribution is more than $500.

Eligible individuals can deduct up to $300, and eligible couples can deduct up. If you claim a deduction of more than $500, but not more than $5,000 per item (or a group of similar items), you must fill out form 8283, section a. For the 2021 tax year, you can deduct up to $300 per person rather than per tax return, meaning a married couple filing jointly could deduct up to $600 of donations without having to itemize.

According to the internal revenue service (irs), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and so forth. How to claim tax deductible donations on your tax return Calculate your goodwill tax deduction now!

You can�t both itemize and use the standard deduction as well, so you should base the choice on which will reduce your taxable income the most. In general, you can deduct up to 60% of your adjusted gross income via charitable donations (100% if the gifts are in cash), but you may be limited to 20%, 30% or 50% depending on the type of contribution and the organization (contributions to certain private foundations, veterans organizations, fraternal societies, related guide for how much can i deduct for goodwill. There are many sources to locate reasonable values for your donations.

The quality of the item when new and its age must be considered. A common question we receive is about goodwill tax deductions or tax write off for donations to goodwill. Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income.

Contributions that exceed that amount can carry over to the next tax year. Ad search for goodwill car donation tax deduction. What is the maximum goodwill deduction for 2019?

The cares act eliminated the 60% limit for cash donations to public charities. The $300 deduction is for donations made in cash, which includes currency, checks, credit or debit cards, and electronic funds transfers. Deductions for charitable donations generally cannot exceed 60% of your adjusted gross income, though in some cases limits of 20%, 30% or 50% may apply.

It’s also important to understand that you can only claim deductions on up to 50% of your income. The donation values you�ll generate comply with irs fair market value guidelines. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations.

Qualifying for a tax deduction for goodwill transactions does not include giving goodwill to other individuals such as friends and family members unless they are also doing so as part of their job responsibilities. Charitable donations of goods and money to qualified organizations can be deducted on your income taxes, lowering your taxable income. To qualify, the contribution must be:

A donor is responsible for valuing the donated items and it’s important not to abuse or overvalue such items in the event of a tax audit. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. A goodwill donation receipt is used to claim a tax deduction for clothing and household property that are itemized on an individual’s taxes.

Additional forms you may need you must get a written acknowledgment or receipt from the organization for any gift you make for which you’re claiming a deduction of $250 or more. How much can you deduct for the gently used goods you donate to goodwill? The irs requires an item to be in good condition or better to take a.

As such, individuals can deduct up to 100% of their adjusted gross income and corporations can deduct up to 25% of their taxable income. Cash donations to qualified charities. When you file your taxes, you can choose to either take a standard deduction, which is based on your age, marital status, and income, or an itemized deduction, which takes all of your deductible activity into account.

A corporation may deduct qualified contributions of up to 25 percent of its taxable income. So, if you made $40,000 last year and donated $25,000 to an organization, you can only claim $20,000 in deductions. How much can i write off for goodwill donations?

For the 2021 tax year, however, those who are married and filing jointly can each take a $300 deduction, for a total of $600. If you donate $10 worth of clothes to your local goodwill store and it has a retail value of $5 you can only deduct $5 as your contribution.