So, let’s say you have an income of $80,000 in taxable income and $20,000 in tax deductions. You can also deduct mortgage.

Additionally, there are other requirements — like you can only claim expenses that exceed 10%.

Tax deductions for hazard insurance. You can only deduct homeowner’s insurance premiums paid on rental properties. Tax deductions are expenses you can subtract from your taxable income. Homeowners insurance isn’t a personal.

June 7, 2019 3:06 pm for a personal home, homeowner�s insurance including hazard insurance is a personal expense and is not deductible. Personal tax deductions for homeowners. Hazard insurance is not deductible.

Generally, insurance premiums paid to. For single filers or married persons filing separately, the standard deduction for 2021 is. Although you might pay them both,.

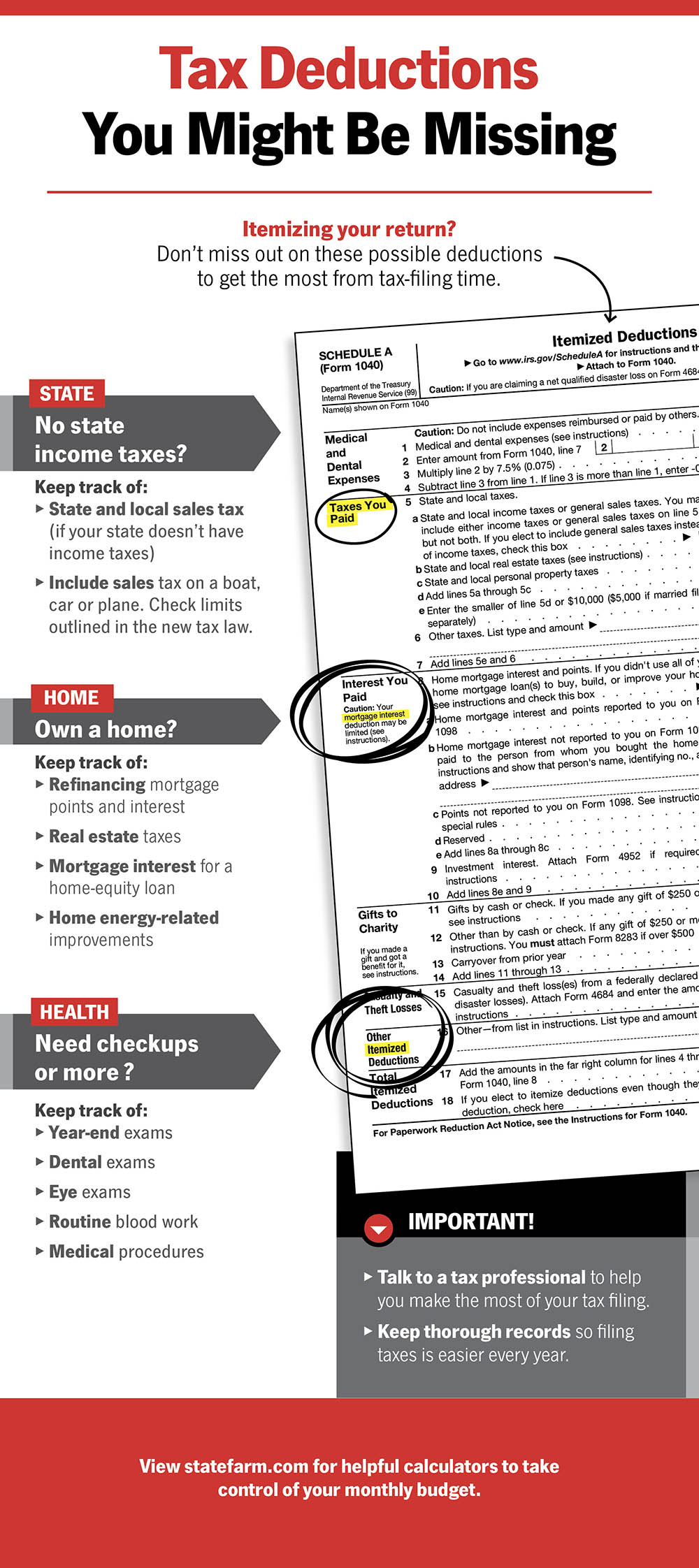

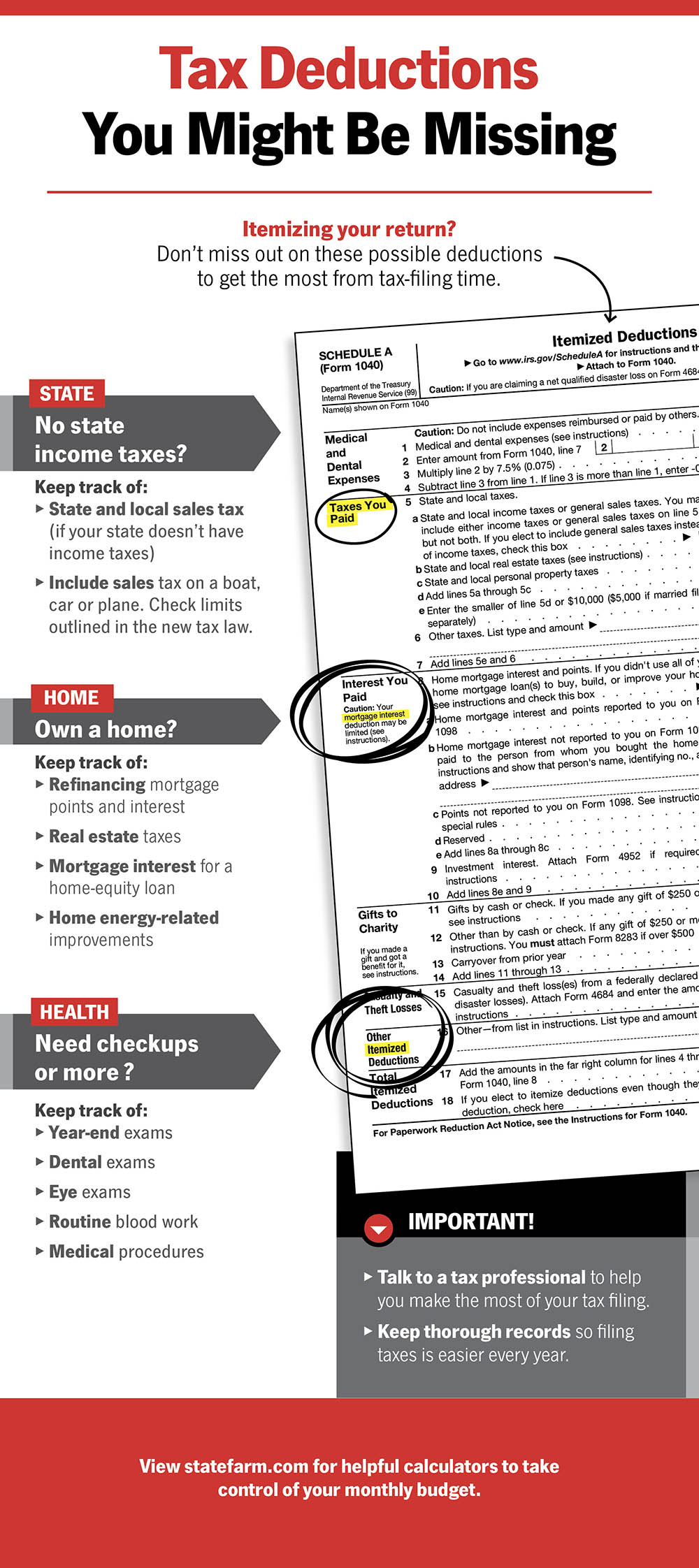

You can also fully deduct in the year paid points paid on a loan to substantially improve your main home if you meet the first. To take this deduction, you’ll also need to itemize using schedule a of form 1040. Deductions include mortgage points, mortgage interest, property tax, rental, home office, home improvement, energy efficiency, medical home improvement deductions and.

10 rows tax deductions for renting out your home. Tax deductions for homeowners · $25,100 for married couples filing jointly, up $300 from the 2020 tax year. You can also deduct mortgage.

In general, homeowners insurance and. 8 tax breaks for homeowners. If you have a home office or business, you can deduct a portion of your homeowners insurance premium.

Consider residential renewable energy credits. Additionally, there are other requirements — like you can only claim expenses that exceed 10%. Single and married filing separately:

21 hours agothe taxpayer certainty and disaster tax relief act of 2020 extended this tax provision for the 2021 tax year and made an update that benefits joint tax filers. We talked earlier about the difference between personal deductions and business expenses. When you receive the estimate from your insurer, the math kicks in.

Never is homeowner’s insurance tax deductible your main home. Based on the amount of damage costs not covered by insurance, a certain limit will be subtracted (usually. If you have a mortgage on your home, you can take advantage of the mortgage interest deduction.

If you rent out an extra room, garage apartment, or second home, you may be able to deduct those insurance payments from your taxes. $12,950 (up from $12,550 in 2021) married filing jointly and surviving spouses:. Tips on tax deductions for homeowners.

Tax deductions for home offices and business. So, let’s say you have an income of $80,000 in taxable income and $20,000 in tax deductions. · $12,550 for single filers and (10).

If you have a rental property, you. The standard deduction breakdown for 2022 is as follows: Homeowners can always claim the standard deduction, which has increased since 2020.

Annual homeowners insurance premiums on.