In this case, you can now deduct $2,100 in medical expenses from your tax return. @ritchb the portion of the care that is associated with medical care, as opposed to household chores, would be allowed as a medical itemized deduction.

In this case, you can now deduct $2,100 in medical expenses from your tax return.

Tax deductions for health care costs. En español | lots of things qualify for the medical deduction, and that�s a positive for taxpayers. 1, 2019, all taxpayers may deduct only the amount of the total unreimbursed allowable medical care expenses for the year that exceeds 10% of their adjusted gross income. You also cannot deduct the.

Maintenance and personal care services covers help with activities of daily living, such as bathing, dressing, and eating. For example, scrubs, lab coats, or medical shoes are items you can write off when doing your taxes. For 2022 there are higher hsa contribution limits available.

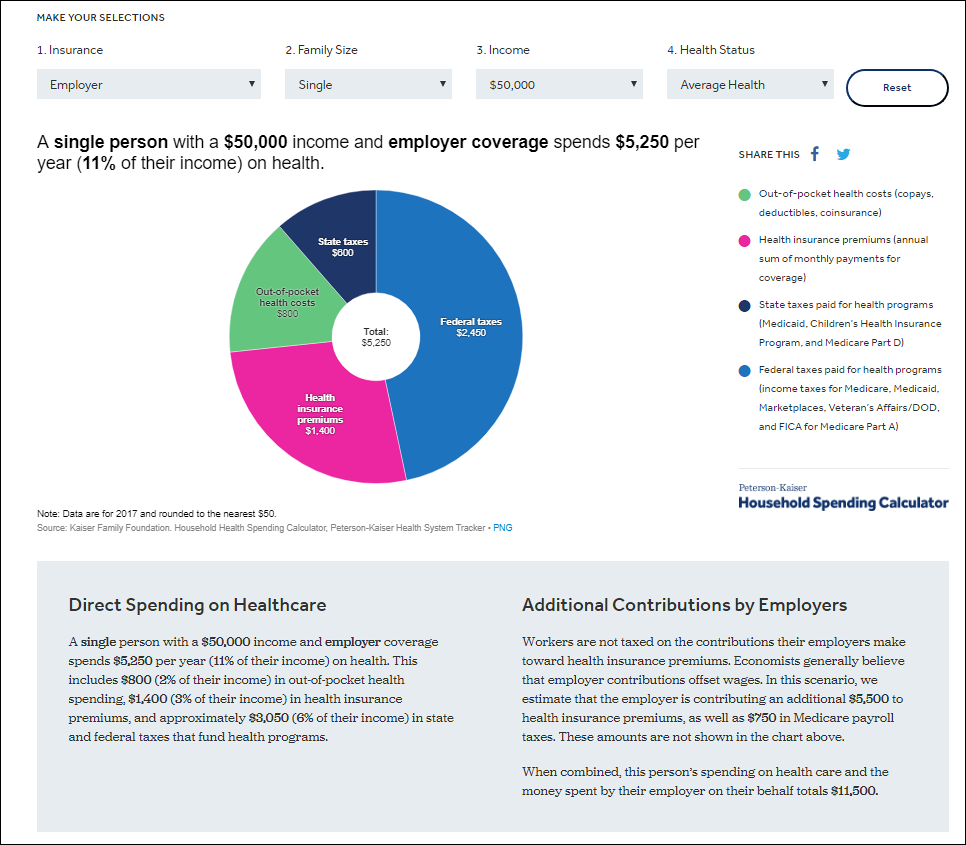

If you’re itemizing your expenses, write down your adjusted gross income, enter 7.5% of this figure and the difference between your costs and the 7.5% you just wrote down. As an example, if your agi is $50,000, you’ll need more than $3,750 in itemized medical expenses to qualify for a deduction. Health (5 days ago) answer.

@ritchb the portion of the care that is associated with medical care, as opposed to household chores, would be allowed as a medical itemized deduction. You can only deduct medical expenses after. Yes, in certain instances nursing home expenses are deductible medical expenses.if you, your spouse, or your dependent is in a nursing home primarily for medical care, then the entire nursing home cost (including meals and lodging) is deductible as a medical expense.

This leaves you with a medical expense deduction of $2,100 ($5,475 minus $3,375). But if your medical bills are substantial, you still might be able to get a tax break from the irs despite those barriers. If your medical expenses over the course of a tax year exceed 7.5 percent of your adjusted gross income (agi), you can deduct that difference.

You can deduct insurance premiums and most other upfront costs or standard fees that you pay out of pocket. Health (5 days ago) if you itemize your deductions for a taxable year on schedule a (form 1040), itemized deductions, you may be able to deduct expenses you paid that year for medical and dental care for yourself, your spouse, and your dependents.you may deduct only the amount of your total medical expenses that. Clothing/uniforms your work outfit has to be specific to the work you do as a healthcare professional, pharmacist, or nurse.

Maintenance and personal care services; Uncle sam, however, has put some big barriers in the way for people who want to qualify to write off their health care costs. Additionally, as a result of the tax cuts and jobs act (tcja) of 2017, the standard deduction has nearly doubled from where it was in 2016.

Any qualifying medical and health care costs beyond that amount are tax deductible. In this case, you can now deduct $2,100 in medical expenses from your tax return. The insurance premiums you pay to cover the cost of medical care are also deductible, provided that you don’t claim the portion of the premium your employer pays toward a group health plan.

This is true for anyone, whether you live in a retirement community like a ccrc or not. Next, calculate the amount spent on home care that exceeds 7.5% of the amount of your agi. If you have $15,000 in qualified expenses, you can deduct $7,500 from your taxable income when you file your taxes if you don’t take the standard deduction.

The total of all allowable medical expenses must be reduced by 7.5% of your adjusted gross income. Put another way, any expenses over 7.5 percent of your agi are deductible from your taxes. Generally, health insurance premiums may be tax deductible if you�re not receiving a reimbursement anywhere else.

Additional information can i deduct my medical and dental expenses? Under irs guidelines, you can only deduct the amount of your total medical expenses that exceeds 10 percent of your adjusted gross income. You can contribute $3,650 for individual coverage for 2022, up from $3,600 for 2021, or $7,300 for family coverage, up from $7,200 for 2021.

Medical costs that exceed 7.5% of your adjusted gross income (agi) can be deducted for tax purposes. You can deduct your health insurance premiums—and other healthcare costs—if your expenses exceed 7.5% of your adjusted gross income (agi). As such, it is deductible to the extent the amount is over 7.5% of your adjusted gross income.

From simple to complex taxes, filing with turbotax® is easy. In 2019, the irs allowed you to deduct medical expenses that exceeded 7.5% of your adjusted gross income. Track your spending on all travel and purchases related to treatment or called for by a health care provider.

The reimbursable amount through your hsa is based on the same ltc insurance allowed tax deduction aged based irs chart. Deduct medical expenses on schedule a (form 1040), itemized deductions. Other taxpayers can deduct the cost of health.

Are home health aides a deductible medical expense. Table of contents [ show] The calculation is the same, regardless of your adjusted gross income.

If that individual is in a home. Use schedule 1 to claim this deduction. Ad turbotax® makes it easy to get your taxes done right.

For 2021, the standard deduction is $12,550 for single taxpayers and $25,100 for married taxpayers filing jointly.