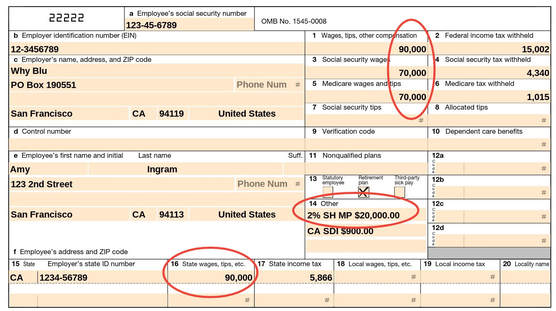

In comparison, the tax year 2020 limit was $10,860. Take a look at the fica tax now:

Withhold the taxes for the employee based on $1,700 instead of $2,000.

Tax deductions for health insurance premiums. The iowa 1040 departs from the federal 1040 in the treatment of health insurance premiums by allowing taxpayers to elect to deduct qualifying health insurance premiums as an adjustment to iowa gross income. Withhold the taxes for the employee based on $1,700 instead of $2,000. You can deduct common items such as medical appointments, surgeries, tests, prescription drugs and durable items like wheelchairs and home care etc., from taxes.

The premiums you listed are deductible federally if you itemize your deductions, and these expenses along with other medical expenses exceed 7.5% of your adjusted gross income. If you are paying premiums under a plan managed by your employer, you will find the exact amount paid on your t4 statement of remuneration slip in box 85 of the “other information” section. In 2021, the irs allows all taxpayers to deduct their qualified.

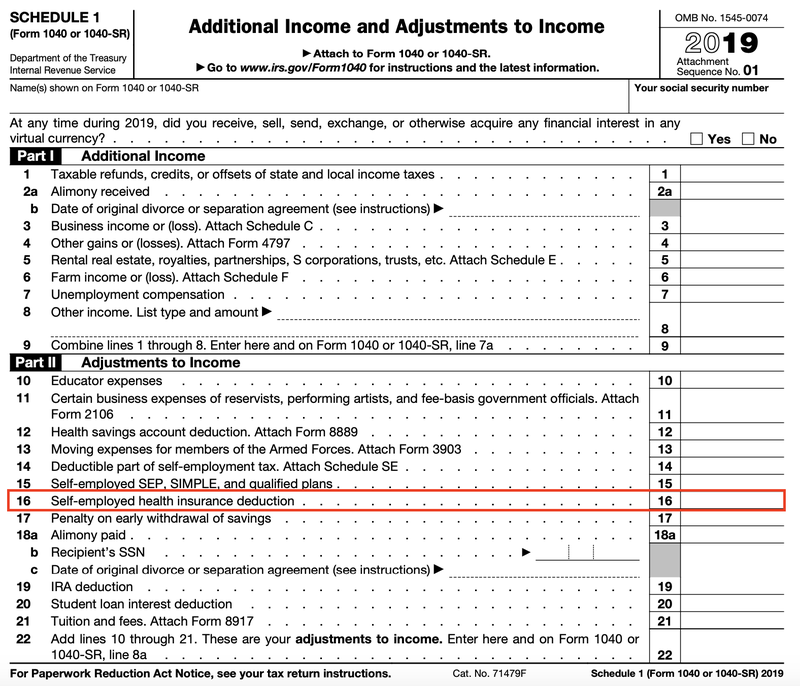

The iowa 1040 departs from the federal 1040 in the treatment of health insurance premiums by allowing taxpayers to elect to deduct qualifying health insurance premiums as an adjustment to iowa gross income. The farmer must itemize (instead of claiming the standard deduction) in order to benefit from this method of claiming health insurance premiums the overall amount deductible is limited to the amount in excess of 10% of agi (or 7.5% of agi if the farmer or farmer’s spouse is age 65 or older before the end of the tax year) [9] You can then transfer the total of part 2 of schedule 1 to your tax return.

This limit applies to the premium paid towards health insurance purchased for you, your spouse, and your dependent children. To take the deduction, you must meet certain criteria. Track your spending on all travel and purchases related to treatment or called for by a health care provider.

5 rows you paid $5,000 for health insurance premiums for the year. You can only deduct medical expenses after. For example, if you�re a federal employee participating in the premium conversion plan of the federal employee.

Under section 80d, you are allowed to claim a tax deduction of up to rs 25,000 per financial year on medical insurance premiums. You can deduct your health insurance premiums—and other healthcare costs—if your expenses exceed 7.5% of your adjusted gross income (agi). In 2021, taxpayers can deduct qualified unreimbursed medical expenses over 7 1/2% of the adjusted gross income.

Take a look at the fica tax now: The iowa return allows a deduction for certain health insurance premiums on line 18 of the ia 1040, rather than reporting those same premiums as a medical expense. The iowa return allows a deduction for certain health insurance premiums on line 18 of the ia 1040, rather than reporting those same premiums as a medical expense.

To claim the payments of your health plan premium, include them with your other eligible medical expenses and claim the credit on line 33099 of your return. We’ll go over those rules in this post and explain how you can deduct them on your return. You can deduct insurance premiums and most other upfront costs or standard fees that you pay out of pocket.

In comparison, the tax year 2020 limit was $10,860. $1,7000 x 7.65% = $130.05 Itemized deduction for medical expenses.

It depends, the premiums purchased through the health insurance marketplace are deductible on federal return, and may be on state return. Over the counter drugs, medical marijuana, cosmetic surgery and health. Medical costs that exceed 7.5% of your adjusted gross income (agi) can be deducted for tax purposes.

Health insurance premiums are deductible on federal taxes, as these monthly payments for coverage are classified as a medical expense. In this case, you can deduct up to. This is one deduction you don’t want to miss on your taxes.