Itemised deductions nurses and other healthcare workers can claim here are some examples of what you can claim 1. Uniform or clothing requirements there is a specific uniform when working in the healthcare field.

Here�s what you should know about self employed health insurance deductions.

Tax deductions for health professionals. If you earn your income as a doctor, specialist or other medical professional, this information will help you to work out what: Health insurance premiums you pay for yourself and your family may deductible. Be sure you don’t overlook any important deductions.

Itemised deductions nurses and other healthcare workers can claim here are some examples of what you can claim 1. Other expenses you can claim a deduction for include: As a therapist, you can still claim the 20% deduction even if you own a private therapy practice if your taxable income is less than $315,000 (if you’re married and filing your taxes jointly) or $157,500 (if filing individually).

Deductions are allowed for payments made to a union as a condition of initial or This will be reflected in your tax return , and this amount goes up to 10% of the adjusted gross income. Tax deductions for healthcare professionals supplies.

The maximum saver’s credit available is $4,000 for joint filers and $2,000 for all others. In order for supplies to qualify as a deduction, they must be something that is ordinarily used in your. A handy journal to record deductible transactions such as automobile usage, meals, entertainment, and travel expenses is also included in each guide.

However, the cost of initial admission fees paid for membership in certain organizations or social clubs are considered capital expenses. Overtime meals travel expenses personal car usage overnight accommodation costs uniforms and protective clothing repair and cleaning of uniforms and protective clothing safety items: Legal and professional fees that are incurred in regular operations of your practice are fully deductible.

Professional services legal fee tax deduction. Income and allowances to report; Any of these allowances shown as a separate amount on the individual�s payment summary need to be included as income in their income tax return.

This is, however, only allowed if you wear your uniform exclusively for work and not for leisure as well. Generally, to be deductible, items must be ordinary and necessary to your medical profession and not reimbursable by your employer. The respective expense paid by the individual can then generally be claimed as a.

Record separately items having a useful life of more than one year. Self employed health insurance deduction. Records you need to keep.

The work related expenses that nurses and health professionals may be able to claim as tax deductions include: Here�s what you should know about self employed health insurance deductions. If you’re using scrubs, lab coats, or medical shoes, you can write them off your taxes.

If you have to travel out of town for your job, then your travel expenses can be deducted from. At ezx co., we specialize in tax preparation and financial services for healthcare professionals: Staff, per diem, registry, travelers, private practice, independent contractors and home healthcare.

We help healthcare professionals maximize their write offs and increase their tax refunds. Tax deductions for medical professionals supplies & expenses: In your field, you could potentially deduct the costs of your uniforms and the cleaning costs thereof from your personal tax return.

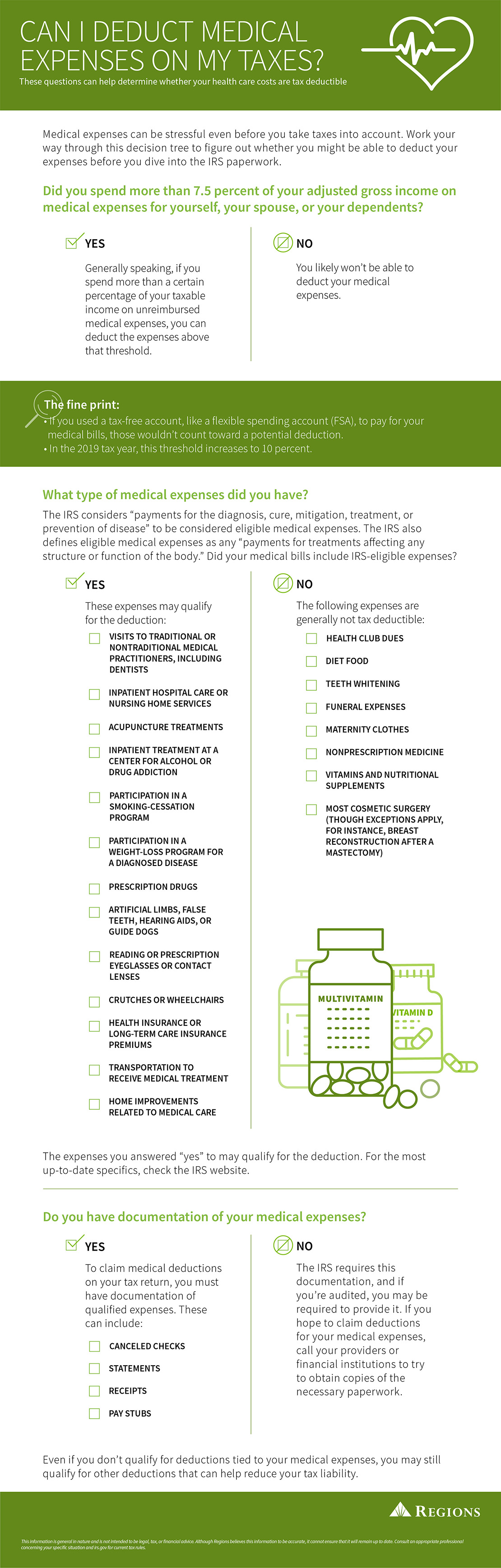

Pay less to the irs. Completely updated to cover changes and updates to tax laws revised because of the coronavirus pandemic. There’s a ceiling where you can only deduct qualified medical expenses if they total more than 7.5% of your adjusted gross income.

Understanding 401k plans and tax deductions helps makes doing your taxes easier. If you are a professional that owns your own business, you may be able to claim a health insurance tax deduction that is not available to many others. Use form 8880 and form 1040 schedule 3 to claim the saver’s credit.

The only know how guide for professionals who want to reduce their tax burden. Medical tax deductions don’t work like other tax deductions. However, the deduction you may take is limited to your business’ earned income.

Dues paid to professional societies related to your medical profession are deductible. Uniform or clothing requirements there is a specific uniform when working in the healthcare field.