” you open an account at vanguard (or wherever) and make a contribution. Charitable giving can be one of the most attractive tax shelters for high income earners who want to do good while getting a tax break.

If this year you’re in the highest tax bracket you’re ever going to be in, this might be the year to get that tax deduction.

Tax deductions for high earners. 401 (k) or 403 (b): Here are just a few points to keep in mind about charitable donations as a high income earner. According to a study by the wharton school at the university of pennsylvania, mortgage interest deductions for households with incomes between $40,000 and $75,000 average just $523, while.

Here’s an example from my friend at physician on fire: If this year you’re in the highest tax bracket you’re ever going to be in, this might be the year to get that tax deduction. Charitable giving can be one of the most attractive tax shelters for high income earners who want to do good while getting a tax break.

Just as it sounds, this option allows high earners to bypass the income limits and still utilize the tax advantages of a roth ira account. For 2021, the standard deduction is $12,550 for single filers and married filing separately, $25,100 for joint filers, and $18,800 for head of household. 50% limitation of your agi the irs sets specific limits to how much of a deduction you can take based on your adjusted gross income or agi.

To create a backdoor roth ira, you’ll need to: This form isn’t needed to file your taxes, but make. If you are a high earner with an income above the irs’s income limit for roth ira accounts, you still have the option to create a backdoor roth ira.

Just as it sounds, this option allows high earners to bypass the income limits and still utilize the tax advantages of a roth ira account. Keeping track of your finances during the pandemic Under the tcja, the irs allows you to deduct cash contributions to eligible charities, with the deduction maxing out at 60% of adjusted gross income (agi).

It is recommended that you donate valuable assets such as real estate, bonds, or stocks for the long term. The second option is to use a method called itemizing deductions. These include mortgage interest and property tax deductions and.

” you open an account at vanguard (or wherever) and make a contribution. You will not be taxed on their profits and can claim a tax deduction of generally up to 30% of your adjusted gross income. If you are a high earner with an income above the irs’s income limit for roth ira accounts, you still have the option to create a backdoor roth ira.

To create a backdoor roth ira, you’ll need to: Because it allows you to take current and future year contributions and deduct them all in the current year. Invest in companies that pay dividends you’re not alone if you’ve ever questioned why billionaires pay lower taxes.

The deduction is even higher for taxpayers who are over age 65. Despite the increases of the standard deduction limits in recent years, it may still make sense for high earners to forgo the standard deduction and opt for itemized deductions. In 2017, the tax cuts and jobs act (tcja) nearly doubled the standard deduction from $6,500 to $12,000 for single filers and $13,000 to $24,000 for married taxpayers filing jointly.

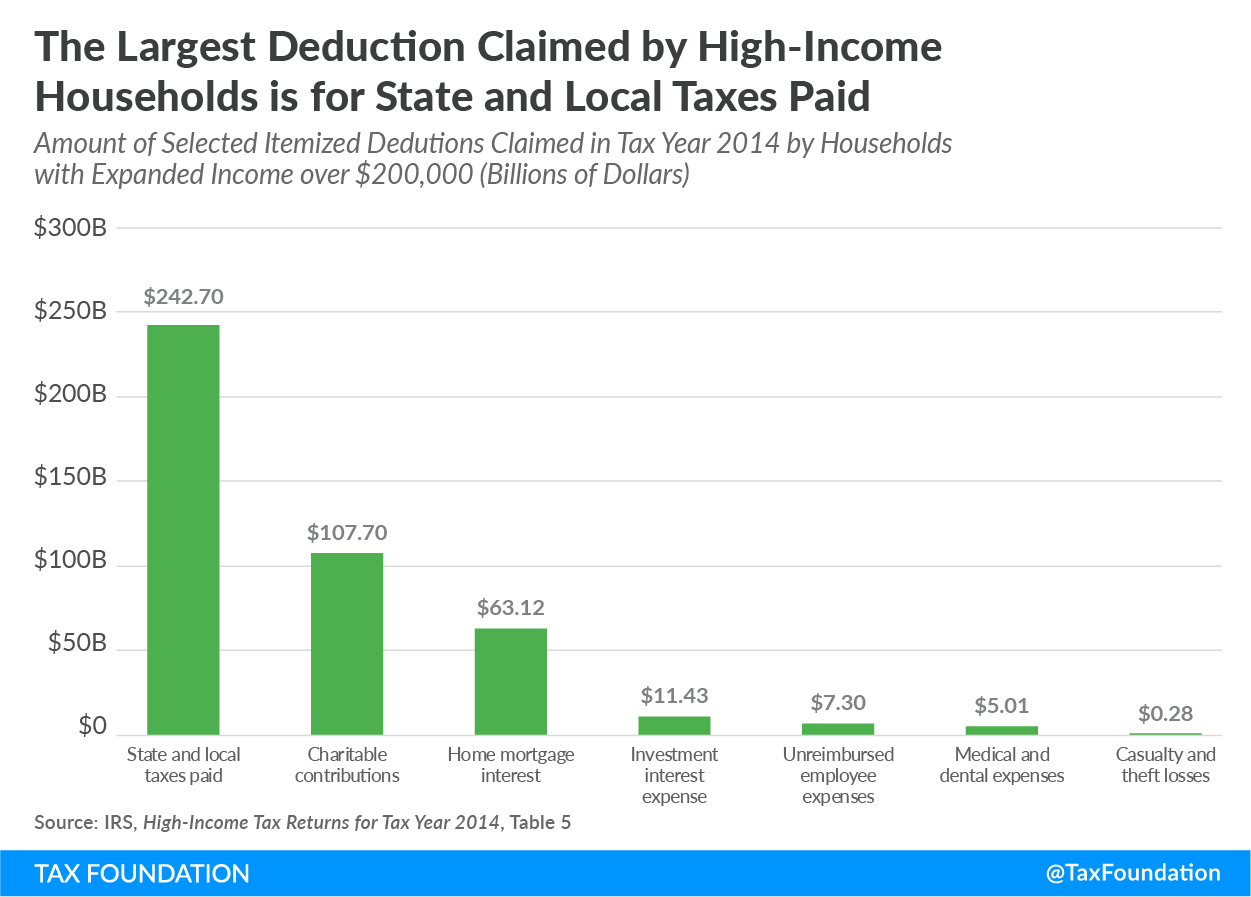

Here are the 5 tax deductions for high earners plus a 6th tax hack at the end of the post. Higher deductions for state, local and real estate taxes and charitable donations should benefit those earning more than $550,000, and will necessitate more detailed record keeping, delauro explains. Typically, you cannot deduct more than 50% of your adjusted gross income.

50 best ways to reduce taxes for high income earners 1. Just as it sounds, this option allows high earners to bypass the income limits and still utilize the tax advantages of a roth ira account. To create a backdoor roth ira, you’ll need to:

Even worse, high income earners are working monday, tuesday and some of wednesday just to pay the tax man. According to the ato, you’re classified as a higher income earner if you earn over $180,000 a year. For every dollar you earn, you’re giving up nearly half to the tax man.

If you are a high earner with an income above the irs’s income limit for roth ira accounts, you still have the option to create a backdoor roth ira. For example, in 2020, we plan to deduct all of the following from our taxable income: That’s 47 percent of all state and local taxes deducted by us households that year.

In fact, if you’re earning in excess of $180,000, you’re taxed at 47% for the privilege. “if you bring back these deductions then you need to start keeping track of them again,” he said.