Maximize tax optimization by bunching deductions A solo 401k for your business delivers major opportunities for huge tax deductions every year.

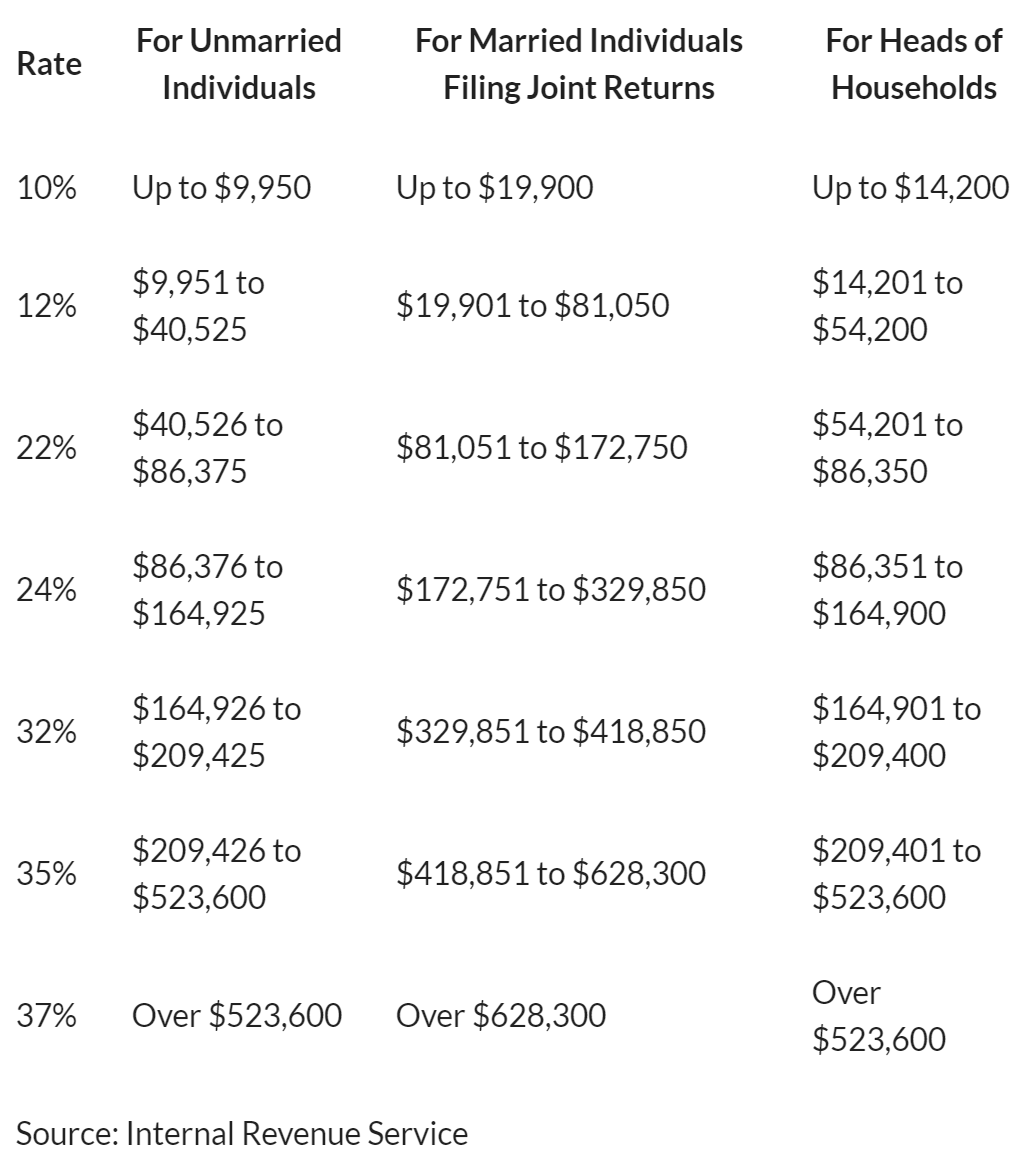

Single and head of household filers.

Tax deductions for high income earners 2021. 1 day agohow do you get tax deductions? Here are the standard deduction amounts for 2021 (taxes filed in 2022): Max out your retirement contributions.

Bonuses that are much more deferral… reducing costs and increasing income are among the strategies. Fsa accounts are good for spending your money. It is very important for you to give money to charity.

If yes, then you’re able to deduct up to $2,500 from your taxable income. Casualty and theft loss deduction: There’s nothing unusual about business expenses.

The maximum allowable contribution for 2021 was $19,500, but for 2022 the cap has increased to $20,500. Costs associated with health insurance. For federal income tax purposes, you can take a deduction for your sales tax or state income tax.

But, if your magi hits $85,000 ($170,000 for taxpayers filing a joint return) this deduction is not eligible. Single and head of household filers. The annual contribution limit for employees who participate in 401 (k), 403 (b), most 457 plans and the federal government’s thrift savings plan is $19,500 for 2021—for the second year in a row.

There are two more ways to make. The benefit of credits and exemptions is also reduced as income rises. How can i reduce my taxable income 2021?

Every year can be different.”. A portion of your donation will go towards charity… you should maximize the length of your retirement. A solo 401k can be the single most valuable strategy among all the tax saving strategies for high income earners.

Your guide to 2021 tax deductions. Maximize tax optimization by bunching deductions Just note that will phase out if you’re modified adjusted gross income (magi) is $70,000 ($140,000 for taxpayers filing a joint return).

Medical and dental expense deduction: These include mortgage interest and property tax deductions and deductions for charitable contributions. Buy when you want to, sell when you don’t…

$168,000 using this technique, you would give the same amount to charitble causes ($25,000 per year on average). Mitigating consequences regardless of the laws enacted, taxpayers can develop strategies now to help make the most of. Learning is a lifetime process.

Normally, employees pay a tax of 7.65% on their income (fica taxes) and their employers also pay that amount for a combined tax of 15.3%. Mitigating consequences regardless of the laws enacted, taxpayers can develop strategies now to help make the most of the changes or mitigate any unfavorable consequences. 9 ways for high earners to reduce taxable income (2022) 1.

“this data has a clear takeaway: Despite the same charitable giving effort, you would save an additional $28,000 in taxable income over the same time period, becuase you are maximizing the deduction provided by the government in years 1 and 3. 50 best ways to reduce taxes for high income earners.

The standard deduction for 2021 is $12,550 for single filers and $25,100 for married couples filing jointly. A solo 401k for your business delivers major opportunities for huge tax deductions every year. Let’s start with retirement accounts.

The standard deduction for 2021 is $12,550 for single filers and $25,100 for married couples filing jointly. (3) the 2021 irs contribution limits for hsas are $3,600 for individuals and $7,200 for families.