Higher deductions for state, local and real estate taxes and charitable donations should benefit those earning more than $550,000, and will necessitate more detailed record keeping, delauro explains. Single and head of household filers covered by a workplace retirement plan.

If this year you’re in the highest tax bracket you’re ever going to be in, this might be the year to get that tax deduction.

Tax deductions for higher income earners. 0% for single filers with taxable income up to $40,400 or joint filers with taxable income up to $80,800. These include mortgage interest and property tax deductions and deductions for charitable contributions. According to a study by the wharton school at the university of pennsylvania, mortgage interest deductions for households with incomes between $40,000 and $75,000 average just $523, while.

You know how it goes, you try donating money to charity or taking advantage of any of the other tax deductions only to find that your deduction is “limited due to your income.” Higher deductions for state, local and real estate taxes and charitable donations should benefit those earning more than $550,000, and will necessitate more detailed record keeping, delauro explains. The benefit of credits and exemptions is also reduced as income rises.

Keeping track of your finances during the pandemic Despite the increases of the standard deduction limits in recent years, it may still make sense for high earners to forgo the standard deduction and opt for itemized deductions. 20% for single filers with taxable income above $445,850 or joint filers with taxable income above $501,600.

The maximum allowable contribution for 2021 was $19,500, but for 2022 the cap has increased to $20,500. High income earners are subject to a higher rate of taxation than other income earners. The number of exemptions claimed and the filing status you choose determines the amount of tax withholding.

“if you bring back these deductions then you need to start keeping track of them again,” he said. Of all the itemized tax deductions for high earners, charitable giving is the one you have the. The irs sets specific limits to how much of a deduction you can take based on your adjusted gross income or agi.

For 2021, the standard deduction is $12,550 for single filers and married filing separately, $25,100 for joint filers, and $18,800 for head of household. Ad answer simple questions about your life and we do the rest. Single and head of household filers covered by a workplace retirement plan.

From simple to complex taxes, filing with turbotax® is easy. Typically, you cannot deduct more than 50% of your adjusted gross income. If this year you’re in the highest tax bracket you’re ever going to be in, this might be the year to get that tax deduction.

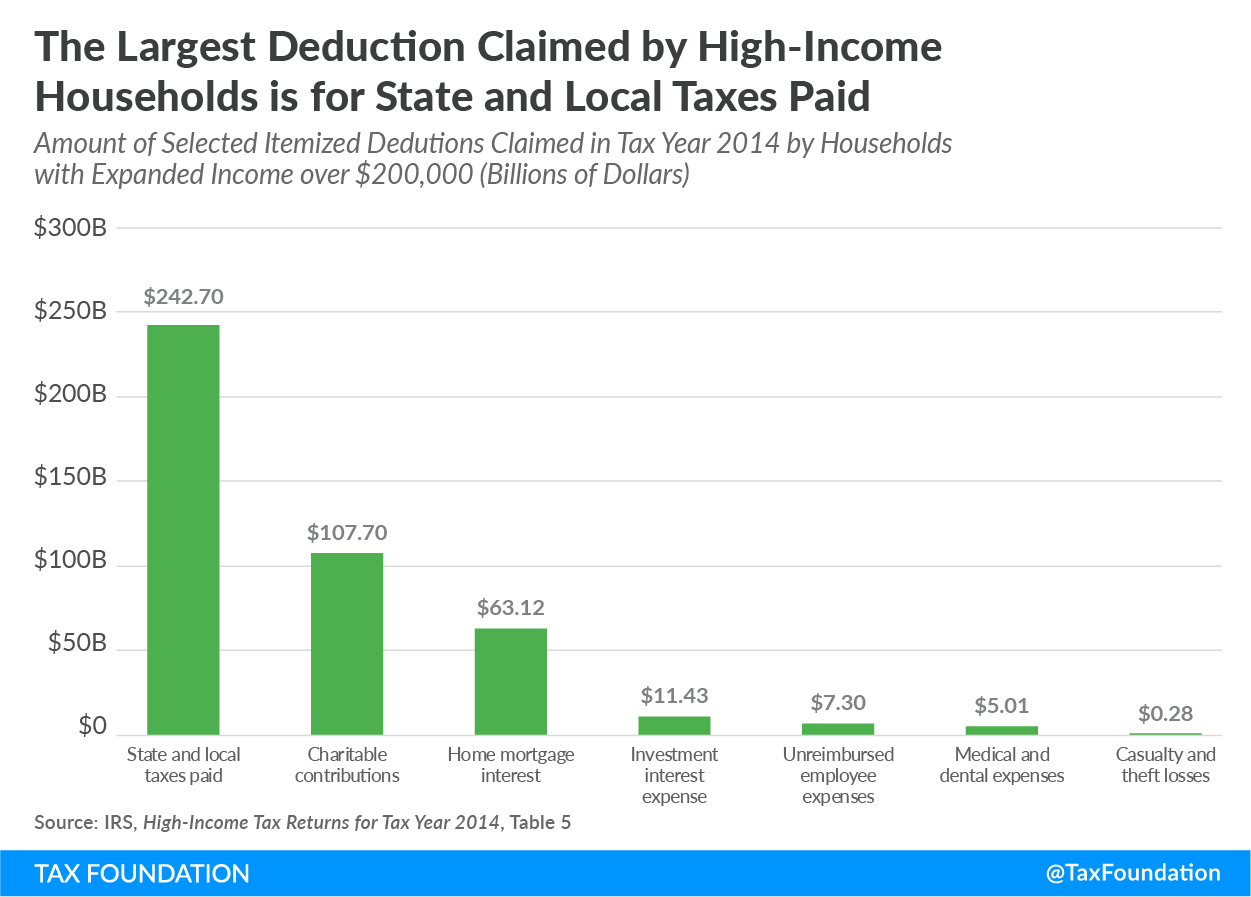

These contributions are removed from your paycheck before taxes, and the most remains tax free in a 401 (k) or 403 (b). The idea of tax deductions for high income earners must sound preposterous, especially if you’re a high income earner. That’s 47 percent of all state and local taxes deducted by us households that year.

5 tax deductions for high earners (plus a tax hack) 1.