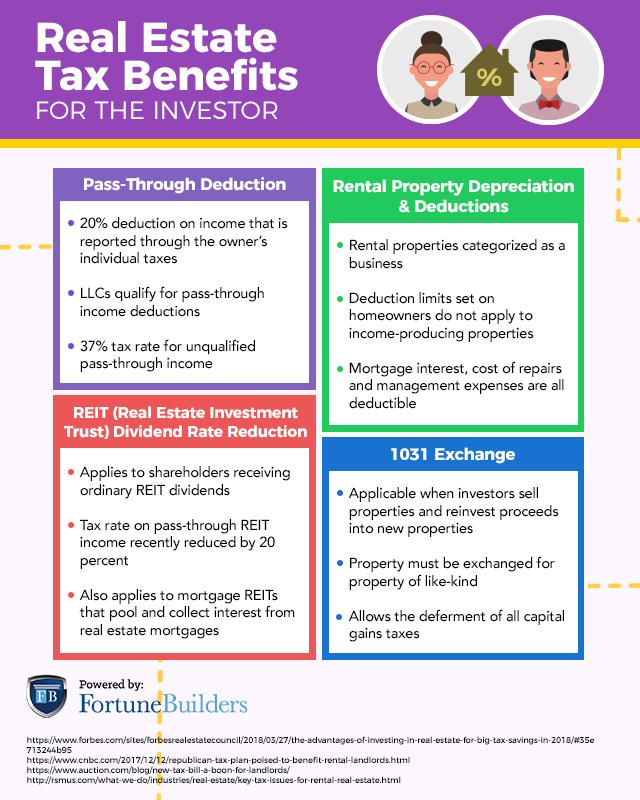

Any points you paid when you bought your home to reduce the interest rate on your loan are deductible on that year�s taxes. From 2018 through 2025, homeowners may deduct a maximum of $10,000 of their total payments for:

It allows homeowners to deduct $5 per square foot of home office space, but the entire deduction is limited to $1,500.

Tax deductions for home owners. From simple to complex taxes, filing with turbotax® is easy. Ad answer simple questions about your life and we do the rest. A portion of every mortgage.

You can deduct up to $10,000 of state and local income taxes, including property taxes. While i don’t think a $1,500 tax deduction will change your. New homeowner tax credits and deductions.

The way it works is if. Deductions can reduce the amount of your income before you calculate the tax you owe. Just remember that under the 2018 tax code, new homeowners (and home sellers) can deduct the interest on up to only $750,000 of mortgage debt, though homeowners who got.

You don’t have to be a homeowner to claim the deduction — apartments are eligible, as are mobile homes, boats or other similar properties, according to the irs. Although that income is not taxed, homeowners still may deduct mortgage interest and property tax payments, as well as certain other expenses from their federal taxable income if they. This is usually the biggest tax deduction for homeowners who itemize.

As a homeowner, you pay property taxes at both a state and local level. As a homeowner, you may be able to claim property taxes on your tax return this year. Tax deductions for homeowners mortgage interest.

Mortgage more than certified indebtedness. One of the most common questions we get from our clients at cook martin poulson is about tax deductions. Most people don’t realize that within certain limits, you can deduct your mortgage interest.

Credits can reduce the amount of tax you owe or increase your tax refund, and some. Figuring the credit mortgage not more than certified indebtedness. From 2018 through 2025, homeowners may deduct a maximum of $10,000 of their total payments for:

If you paid points to reduce your interest rate on a. Property tax, and state income tax or state and local sales tax. Reducing your home mortgage interest deduction.

Ad answer simple questions about your life and we do the rest. When you file your tax return,. Any points you paid when you bought your home to reduce the interest rate on your loan are deductible on that year�s taxes.

As a married couple filing jointly, you can deduct up to $10,000 of your property taxes. It allows homeowners to deduct $5 per square foot of home office space, but the entire deduction is limited to $1,500. From simple to complex taxes, filing with turbotax® is easy.

Tax deductions on a second home. If the home counts as a personal residence, you can generally deduct your mortgage interest on loans up to $750,000, as well as up to $10,000 in state and local taxes.