As an itemized medical deduction. You would add the $2,500 to your other deductible personal expenses and, if they total more than.

Upgrades to your property can additionally be subtracted from your.

Tax deductions for home upgrades. You owned the home in 2020 for 243 days (may 3 to december 31), so you can take a tax deduction on your 2021 return of $946 [ (243 ÷ 366) × $1,425] paid in 2021 for 2020. Make improvements and sell your house. Where do home improvement budgets come from?

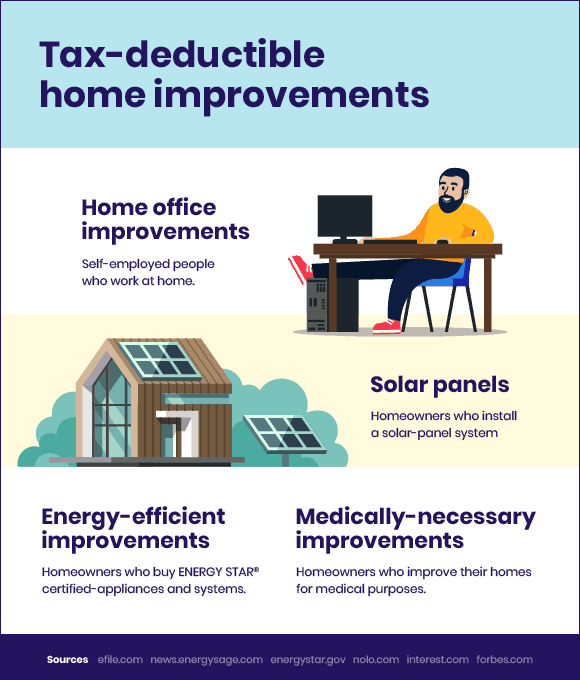

You can claim a tax credit for 10% of the cost of qualified energy efficiency improvements and 100% of residential energy property costs. A home office can get you a deduction if you’re using this space exclusively for business and regularly. If you renovated a few rooms to make your home more marketable (and so you could fetch a higher sales price), you can deduct those upgrade costs as well.

When you make a home improvement, such as installing central air conditioning or replacing the roof, you can�t deduct the cost in the year you spend the money. Another way to depreciate home improvement costs is to rent out a portion of your home. Insulation in the attic, wall, or piping is also eligible, as it increases the value and reduces energy costs.

This includes painting the house or. Thus, for example, if your agi is $100,000, you can deduct your home improvements and other medical expenses as an itemized deduction only to the extent they exceed $7,500. Home improvement projects for medical purposes

This credit does not include installation costs. But, if you keep track of those expenses, they may help you reduce your taxes in the year you sell your house. Energy efficiency through the end of 2010, you can deduct 30 percent of the purchase price.

Any qualifying deduction must be for upgrades purchased by the homeowner and shall not include any upgrades made with available grant funds. Federal tax deductions for home renovation making use of your mortgage to make property upgrades. You can deduct the cost for window or door replacements that increase wind resistance or improve storm resistance from your tax return.

You would add the $2,500 to your other deductible personal expenses and, if they total more than. As an itemized medical deduction. An excellent way to reduce home remodeling expenses would be to.

Tax deductible home improvement & repairs for 2022. Of that combined $500 limit, turbotax will search over 350 deductions to get your maximum refund, guaranteed. Improvements that benefit your entire home are depreciable according to the percentage of home office use.

You may use up to 30 percent of the cost of the product up to $1,500 as a tax credit. If you have $10,000 in total medical expenses, you can deduct only $2,500. Upgrades that are eligible as medical expenses.

Well, often they�re scraped together from savings — and possibly a loan or two. This one gets a bit tricky. For example, if you use 20% of your home as an office, you may depreciate 20% of the cost to upgrade your home heating and air conditioning system.

For the 2020 tax year, just multiply $5 by the area of your home. Note that this deduction is limited to 300 square feet. Upgrades to your property can additionally be subtracted from your.

You can potentially deduct any remodeling or renovations made to increase your home�s resale value—but you can only claim it the year you actually sell the home. This tax deduction cannot be used when you spend the money, but it can reduce your taxes in the year you decide to sell your house. 10 tax deductions for home improvements.

The federal government offers several ways to deduct improvements to your home on your annual tax return. If you need to make changes to your home to improve access or ease worsening medical problems, you can deduct the costs on your entire tax return. In 2021, the standard deduction breaks down like this:

The interest on these loans can be deducted only if you use the money acquired through a loan for home improvements on your main or second home. You rent out part of your home. The windows, doors and skylights must have a.

In 2018, 2019, 2020, and 2021, an individual may claim a credit for (1) 10% of the cost of qualified energy efficiency improvements and (2) the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year (subject to the overall credit limit of $500). If all the math above seems like a pain to sort through, you can instead take the simplified home office deduction. You add the remaining $479 ($1,425 − $946) of taxes paid in 2021 to the cost (basis) of your home.

Improvements based on medical care. All medical deductions are first reduced by 10% of agi and all itemized deductions must exceed the standard deduction before there will be any tax benefit. These “improvements” are considered medical expenses and cannot be lost on projects that increase the value of.

In order to claim a tax deduction on repairs necessary due to a natural. Taxpayers are not entitled to a deduction for upgrades that were purchased with available grant funds. For married couples filing jointly, the standard deduction is $25,100.

For single and married individuals filing taxes separately, the standard deduction is $12,550. A home equity loan functions much like a second mortgage on your home. This credit is worth a maximum of $500 for all years combined, from 2006 to its expiration.

For a $2,000 square foot office, that’s a $1,000 deduction.