How do i get a copy of. What amounts are tax deductible on my hud settlement statement.

Tips the hud statement changed in 2015 and the tax cuts and jobs act tweaked some of the rules a little in 2018, but you can still claim tax deductions for mortgage interest, points and real estate taxes if you itemize.

Tax deductions for hud settlement statement. Below is a helpful table of typical tax treatments of major line items from your. Generally, the only truly deductible items on the hud are interest and points. Interest paid at the time of purchase (the charge at closing would normally be done for interest up to the date of first payment).

What amounts are tax deductible on my hud settlement statement. Click to see full answer. The hud settlement statement was not designed for tax purposes, rather to calculate amounts due from the buyer to the seller on settlement day.

The only settlement or closing costs you can deduct on your tax return for the year the home was purchased or built are mortgage interest and certain real estate (property) taxes. This knowledge will help you when reviewing your tax practioner’s work. What items on settlement statement are tax deductible?

Unfortunately, most of the other items are not tax deductible. Other items such as escrow deposits are not deductible nor do. Select federal taxes>deductions & credits.

The only settlement or closing costs you can deduct on your tax return for the year the home was purchased or built are mortgage interest and certain real estate (property) taxes. Select federal taxes>deductions & credits. Some of the more common examples of deductible expenses include loan origination fees, mortgage insurance premiums, and real estate tax payments.

Tips the hud statement changed in 2015 and the tax cuts and jobs act tweaked some of the rules a little in 2018, but you can still claim tax deductions for mortgage interest, points and real estate taxes if you itemize. Fees for an appraisal fees to hire an attorney costs for the home inspection What is tax deductible on a hud settlement statement?

Any prorated real estate taxes a home seller pays at closing are tax deductible. Enter interest, points, mortgage insurance and property taxes in the your home section. What is tax deductible on hud settlement statement?

Likewise, people ask, what items on settlement statement are tax deductible? Now that both parties’ debits and credits have been identified in the hud settlement statement, these will be entered. Some of the more common examples of deductible expenses include loan origination fees, mortgage insurance premiums, and real estate tax payments.

However, many of the closing costs listed on a settlement statement are deducted from sale proceeds. Items such as attorney fees, tax certificates, etc. They must itemize the deductions on form 1040, schedule a.

Some of the more common examples of deductible expenses include loan origination fees, mortgage insurance premiums, and. It’s the same thing if you kept your current mortgage and kept paying the mortgage interest. Gross amount due from borrower c.

This hud statement for taxes details all the money that changed hands at closing, and what each dollar was spent on. Itemizing is not always the optimal deduction method, though; When you buy or sell a home, you will only be able to claim a deduction for a limited amount of the closing costs.

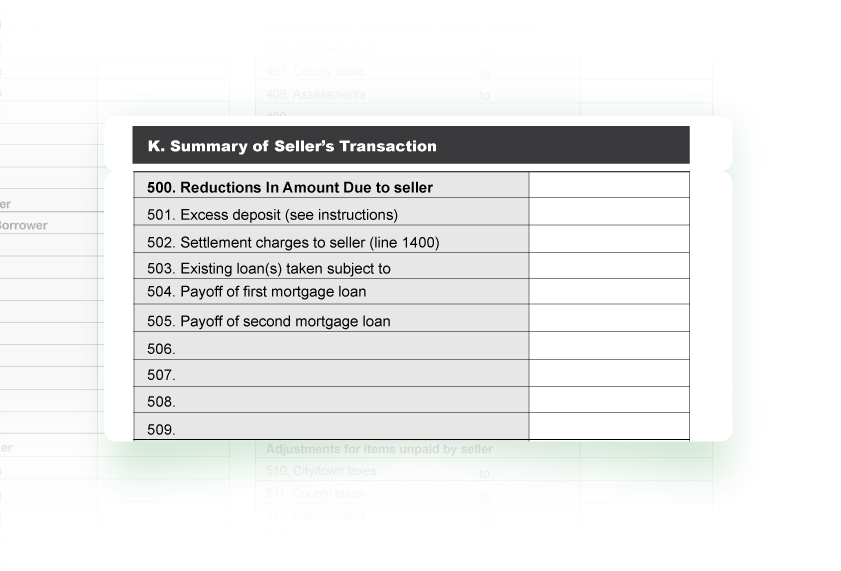

Treatment of closing statement line items differ depending on whether property is business (rental) property or used as a personal residence. Gross amount due to seller this form is furnished to give you a statement of actual settlement costs. Yet the settlement statement contains important tax information.

These can be deducted in the year you buy your home if you itemize your deductions. Summary of borrower’s transaction 100. Refinancing and tax deductions even if you refinance, you may be able to deduct some of the costs on your settlement statement.

Enter interest, points, mortgage insurance and property taxes in the your home section. How do i get a copy of. Items on hud settlement statement that may be deductible:

Be careful not to duplicate the expenses. You used the mortgage to buy or build a main home that secures the mortgage. Some of the items shown on the settlement statement when you buy or sell a home may be tax deductible either all at once or by amortization.

The points paid must be based on a percentage of the principal amount of the. Settlement statement items you can’t deduct of course, your settlement statement is comprised of more than interest, points, and real estate taxes. The closing statement to a real estate purchase contains many potential tax deductions for you.

In some cases, the standard deduction is greater than the total of itemized expenses, bankrate says. These can be deducted in the year you buy your home if you itemize your deductions. What is a hud form for taxes?

Are not deductible but do increase your cost basis in the house. Amounts paid to and by the settlement agent are shown. When taking a look at a hud statement example, you�ll find mortgage loan discount points.