In general, you can deduct up to 60% of your adjusted gross income via charitable donations, but you may be limited to 20%, 30% or 50% depending on the type of contribution and the organization. Leverage dedicated software to manage.

You can deduct contributions up to 60% of your agi, but they must be to eligible charities that the irs recognizes.

Tax deductions for in kind donations. According to irs publication 526 (the gospel for qualified charitable contributions):. When you donate items, don’t just drop them off at the donation center. It’s impossible to stress this point enough— keeping organized records of your contributions is one of the.

Tax deduction is given for donations made in the preceding year. Direct payment by a donor of bill owed by the charity to a third party. For example, if a business wants to donate used computer equipment to a charitable cause, the business can contribute the property to the charity and take a tax deduction equal to.

The amount you can deduct for charitable contributions generally is limited to no more than 60% of your adjusted gross income. A written acknowledgement of donations over $250 must be provided by the nonprofit there are specific forms donors need to fill in to claim their charitable giving, more information from the irs can be found here Examples would be the donation of clothes, appliances, household items, your time or your professional services.

For example, if an individual makes a donation in 2020, tax deduction will be allowed in his tax assessment for the year of assessment (ya) 2021. Learn what kind of pro bono work is deductible at tax time. If you itemize deductions, you can deduct the fair market value of physical items you contribute and the miles driven for charitable purposes.

Ask for a receipt, preferably an itemized one, before you leave. You must fill out one or more forms 8283, noncash charitable contributions and attach them to your return, if your deduction for each noncash contribution is more than $500. Your deduction may be further limited to 50%, 30%, or 20% of your adjusted gross income, depending on the type of property you give and the type.

You can deduct contributions up to 60% of your agi, but they must be to eligible charities that the irs recognizes. How much can you deduct for donations? This 100% limit doesn�t apply automatically, though.

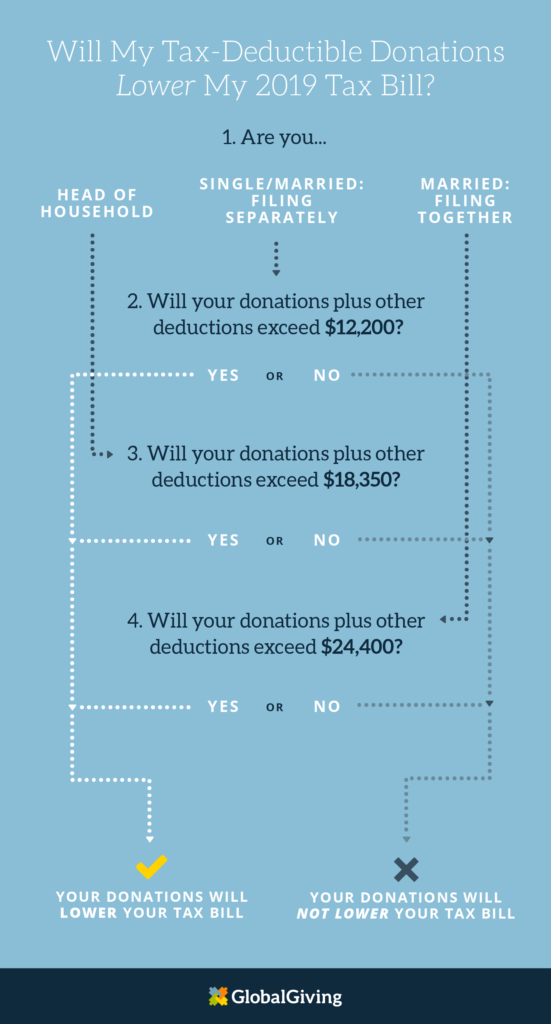

That�s right — you can theoretically eliminate all of your taxable income through charitable giving. Charitable contributions are itemized deductions, so you can�t take them if you want to take the standard deduction. 21 hours agoif you made cash donations to eligible charities in 2021, you might qualify for a tax deduction.

$1,500 for contributions and gifts to independent candidates and members. Donors are able to claim a tax deduction for gifts made, and the gift can be in the form of cash or property/goods. Use form 8880 and form 1040 schedule 3 to claim the saver’s credit.

Leverage dedicated software to manage. In general, you can deduct up to 60% of your adjusted gross income via charitable donations, but you may be limited to 20%, 30% or 50% depending on the type of contribution and the organization. You do not need to declare the donation amount in.

However, donors cannot deduct for any time or services contributed to a 501 (c) (3) organization. The maximum saver’s credit available is $4,000 for joint filers and $2,000 for all others. Cash donations will (probably) need to be deposited into your nominated gift fund.

Vet organizations for fit and compliance. Your gift or donation must be worth $2 or more. Eligible individuals can deduct up to $300, and eligible couples can deduct up.

Normally, you can deduct up to 60% of your adjusted gross income (agi) for gifts to charity. If the gift is property, the property must have been purchased 12 months or more before making the donation. Record and document your contributions.

If your donation is worth less than $250, the charity must give you a receipt showing its name and address, date and location of donation, and a reasonably detailed description of the property. How the charitable contributions deduction works. $5 to $60 2 3.

In 2020 and 2021, though, this limit has been raised to 100%. Donations made to a qualified charity are deductible for taxpayers who itemize their deductions, within certain limitations.typically for cash contributions made between 2018 and 2025, the amount that can be deducted is limited to no more than 60% of the taxpayer’s adjusted gross income (agi). If you claim a deduction of more than $500, but not more than $5,000 per item (or a group of similar items), you must fill out form 8283, section a.