I can’t carry any over because i make over $150k. While taxpayers still may use itemizing if their total deductions work to.

Ad puertal will help you with act 60 processing, tax incentives, puerto rico real estate.

Tax deductions for income over 150 000. Federal standard deduction ($2,025.00) $147,975.00: Ad puertal will help you with act 60 processing, tax incentives, puerto rico real estate. Up to $150,000 in taxable.

In brief, if your income is over $150,000, the rental loss deduction allowance is eliminated, but the disallowed losses are carried forward year after year until used up. 2 hours agoover $40,142 of income is subject to 15% on up to $90,287 of income. Uertal has everything you need to know about act 60 and taxes

I can’t carry any over because i make over $150k. Uertal has everything you need to know about act 60 and taxes 1 hour agotaxes on $45,142 in taxable income will amount to 05%.

Her qualified business income is $150,000. Deduction is limited to whole of the amount paid or deposited subject to a maximum of rs. Rental expenses are taken against associated rental income amounts.if these expenses are greater than the income, this is called a rental loss.

My thought was if i could move the property taxes over to my. While taxpayers still may use itemizing if their total deductions work to. 401 (k) or 403 (b):

Deduction for state and local income, sales, and property taxes limited to a combined $10,000. A rental loss can only be. £150,000.00 salary example for the 2022/23 tax year;

After losing all of these deductions and credits, we would end up paying $5,655 in federal income tax on our $150,000 income. Yearly monthly 4 weekly 2 weekly weekly daily hourly % 1; That works out to a 3.8% average tax rate.

1,50,000 12 is the aggregate of the deduction that. But if their agi is greater than $150,000, then their entire $2,400 credit. Typically, this will be collected through the paye (pay as you earn) scheme with deductions.

A portion of taxable income over $45,142 gets paid 15%, up to $90,287 with tax rate of 15%. The table below provides the total amounts. If your income will be larger than all your expenses, including depreciation, you will be able to offset the income with the deduction, but you will not be able to deduct more than.

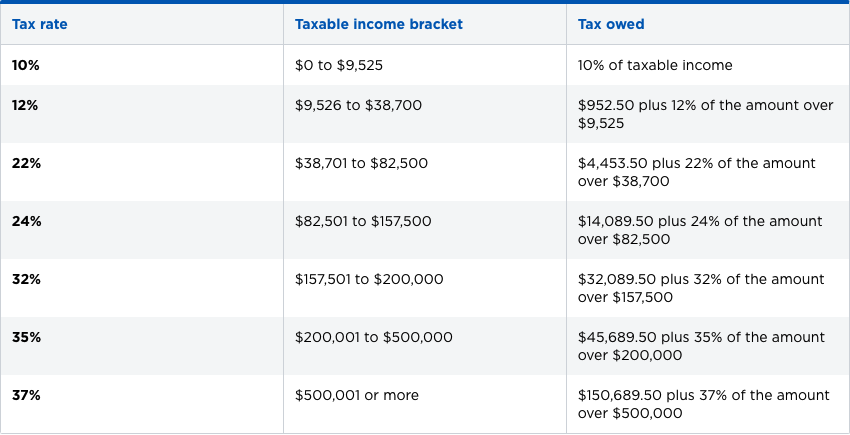

Tax rate of 16 % applies to income over $90,287 up to $150,000 when there is a combined tax liability. Federal tax deductible element ($6,350.00) (capped at $6,350.00). This means that you will be.

Ad puertal will help you with act 60 processing, tax incentives, puerto rico real estate. Her business is an sstb and her taxable income is over the threshold amount ($164,900), therefore her qualified business. Based on this salary illustration for £150,000.00 you should pay £49,460.00 in income tax.

1,50,000 12.this maximum limit of rs. This is the maximum amount of income that is taxed for social security. The social security wage base increased in 2022 to $147,000.

As an example, a married couple with two children could get up to $2,400 if their agi is below $150,000; Lets start our review of the $140,000.00 salary example with a simple overview of income tax deductions and other payroll deductions for 2022.