March 21, 2022 no comments one of the most advantageous things about investing in rental properties is the deductions you can take at tax time. Investment property tax deductions list for merrillville income sources you can potentially deduct.

One thing to keep in mind, though:

Tax deductions for investment rental property. What are rental property tax loopholes? Considering you tax bracket it might be a good idea to accelerate income by receiving january income in december. Income timing is not easy, and you should consider its impact on various deductions.

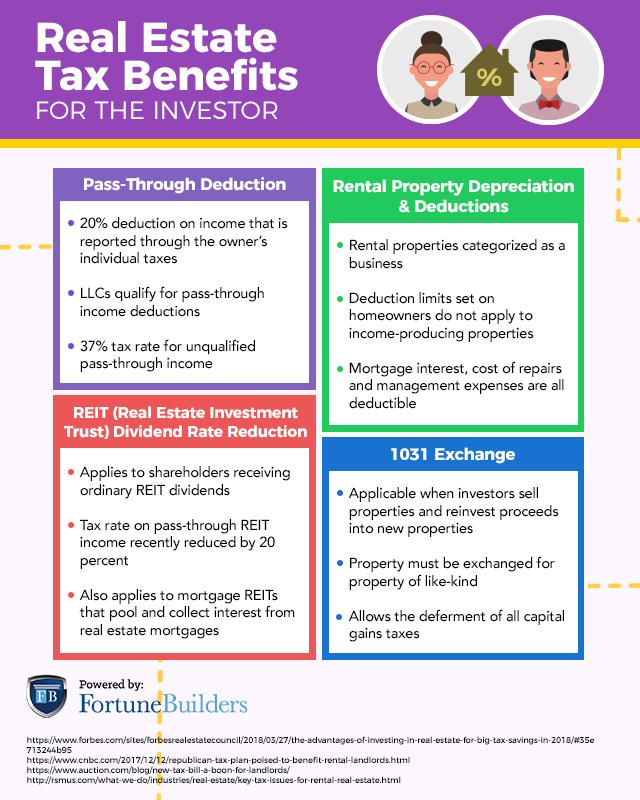

Renting your investment property to residential tenants is a great way to make passive income. However, one of the many benefits aside from additional income of owning rental property, are the rental property tax deductions of owning these assets. Rental property tax loopholes are provisions in the tax code that allow landlords to reduce tax liability.

Come tax time, you must have already spent money on these purchases to qualify. If you’re going to claim a deduction, make sure you can provide. Many people don�t know about these tax deductions you can take.

The top 8 tax deductions for rental property owners. The cost of insuring your rental property the rates for the property payments to agents who collect rent, maintain your rental, or find tenants for you fees paid to an accountant for managing accounts, preparing tax. March 21, 2022 no comments one of the most advantageous things about investing in rental properties is the deductions you can take at tax time.

You may not be able to deduct any investment property rental expenses but you can deduct interest, property taxes if you itemize deductions. As long as your property is used as a rental property for at least 14 days a year, it is considered an investment property and is tax deductible. For your primary residence, deductions for mortgage interest are limited to $750,000 for a calendar year.

Rental owners frequently overlook the deduction. Real estate by income deduction so, if you are making $100,0000 or less, you can write off up to $25,000 a year in passive rental real estate losses. However, this increased business income can mean a higher tax bill come tax time.

The expenses you can deduct from your rental income are: Ad we�ll search hundreds of tax deductions to get every dollar you deserve. To figure out the amount of annual depreciation expense, take the cost of the item being depreciated and divide it by 27.5.

A security deposit is not taxable, based on the thought that your intent is to return this deposit. If you own rental real estate, you should be aware of your federal tax responsibilities. Luckily, investment property owners can claim many rental property tax deductions to reduce their taxable income.

One thing to keep in mind, though: Although there�s a new limit on the property tax deduction ($10,000, or $5,000 if married filing separately, for property taxes and either state and local income taxes or sales taxes combined) — that limit doesn�t apply to business activities. Investment property tax deductions list for merrillville income sources you can potentially deduct.

Most real estate investors purchase rental property for the monthly income, potential appreciation in property value over the long term, and the available tax deductions.in this article, we’ll take a quick look at how deductions on a rental property work, then review 30 rental property tax deductions, including a few that many investors overlook. Tips on rental real estate income, deductions and recordkeeping. Homeowners can deduct up to a total of $10,000 ($5,000 if married filing separately) for property taxes and either state and local.

In addition to mortgage interest, you can deduct origination fees and points used to purchase or refinance your rental property, interest on unsecured loans used for improvements and any credit card interest for purchases related to your rental property. On a residential investment property, investors can deduct depreciation expenses over 27.5 years. Brought to you by stessa, the free financial tool for landlords.

Property taxes are an ongoing expense for rental property owners. Repairs and expenses paid by rental tenants are considered income. This is an “above the line” deduction that comes off your taxable rental property income.

Investment property tax deductions also include a second home. Watch for opportunities to take deductions for these common real estate investment expenses: Ad stay informed with our 2022 tax guide so you don�t leave money on the table.

Turbotax® premier is the resource needed to file your investor taxes easily & confidently. There are restrictions, of course. If a rental property is used more than 50% of the time for commercial rental, there is no section 179 penalty.

If your income is above $100,000, then the deductions go down by 50 cents for every dollar of income until it eventually phases out at the $150,000 income level. Tax write off for rental property #1: All rental income must be reported on your tax return, and in general the associated expenses can be deducted from your rental income.

That said, rental property tax loopholes depend on many things, such as obtaining the property, what type of investment it is, and other important factors. From lease up to move out, and everything in between, owning rental properties can be a lot of work. We’ll also say that you have the following expenses of ownership:

In addition, any interest you pay on rental property loans is tax deductible. Many rental home expenses are tax deductible and often offer larger deductions and tax benefits than most. You can deduct property taxes against your rental income, though, provided the property tax is uniformly assessed throughout the jurisdiction and is not a special assessment.

Tax deductions for rental or investment properties. If you are a cash basis taxpayer, you report rental income on your return for the.