The federal tax law, which was passed in late december of 2017, allows many entities, including partnerships and sole proprietors, to. For example, $10,000 in additional tax deductions will generate $3,500 in federal income tax savings ($10,000 x 35%), assuming a 35% federal income tax rate.

You can claim a deduction for interest charged on money borrowed to buy shares.

Tax deductions for investors. Dividend and share income expenses. Tax deductions for investors investors might be conducting activities such as trading shares, forex or cfds. Tcja, the new tax code suspended investment fees and expenses along with all other miscellaneous itemized deductions subject to the 2% floor.

Interest, dividend and other investment income deductions interest income expenses. 1 day agocpa shows developers doing renovations or tear down rebuilds huge tax deductions / tax savings. You can claim a deduction for interest charged on money borrowed to buy shares.

Thanks to changes in the tax law, bonus depreciation is 100% through tax year 2022, and used property is now eligible for bonus depreciation. The following 11 tax deductions even the most casual real estate investor (and small business owner) should know: Lacking tts, investors get peanuts in the tax code.

Many investors and even cpas fail to. The federal tax law, which was passed in late december of 2017, allows many entities, including partnerships and sole proprietors, to. Tax law changes affect cost segregation bonus depreciation enables investors to deduct a percentage of the cost of their assets the first year they are placed in service.

While previously there was no limit on the amount that can be taken as a personal deduction for property taxes, the tax cuts and jobs act set a new limit of $10,000. Interest on money borrowed to fund investments that are primarily intended to produce income, as well as prepaid interest up to 12 months; Huge tax savings for real estate developers doing renovations or tear down rebuilds.

Tax deductions reduce taxable income but do not directly reduce taxes. Whatever you do to increase your rental revenue, whether that’s traveling, learning, or eating, could help you reduce or avoid taxes this coming tax season. Some deductions that may be available to investors include:

For example, $10,000 in additional tax deductions will generate $3,500 in federal income tax savings ($10,000 x 35%), assuming a 35% federal income tax rate. As real estate investors, we look for ways to reduce our effective tax rate. Reduce your taxable income without affecting your cash flow.

Because investors already deduct the cost of their rental property, the depreciation deduction offers investors an innovative way to save money every year. Ad answer simple questions about your life and we do the rest. Unfortunately, it appears small real estate investors could miss out on the new tax deductions.

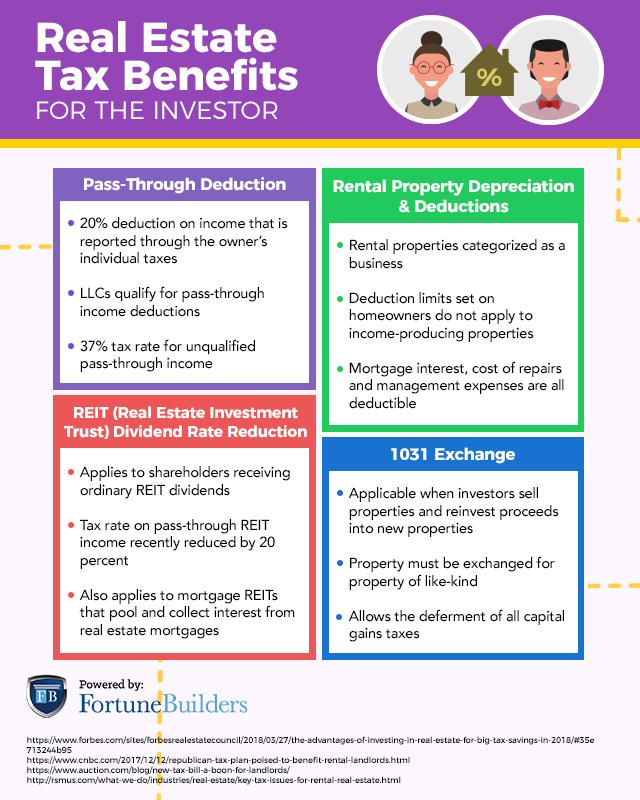

Deductions on property taxes are other real estate taxes that you can deduct when owning an airbnb investment property in 2020. 1031 exchange named for section 1031 of the internal revenue code, a 1030 exchange is a swap of one real estate investment asset for another. Tax deductions reduce taxable income but do not directly reduce taxes.

From simple to complex taxes, filing with turbotax® is easy. Depreciation is an annual deduction that is granted to investment real estate owners or owners of. Instead, the investor is taxed on any dividends received during the year, as well as on capital gains—if and when an investment is sold at a price higher than it was purchased.

Anything above that and up to $40,125, you would pay 12% on, so on and so forth up the scale. Depreciation probably the most important due to the biggest deduction for rental property investors. If you were a single filer, you would pay 10% in taxes on the first $9,875 you make.

But, the structures on the land qualify. For example, $10,000 in additional tax deductions will generate $3,500 in federal income tax savings ($10,000 x 35%), assuming a 35% federal income tax rate. Top ten tax deductions for real estate investors 1.

Interest if you’re using any kind of loan to purchase properties, the interest you pay every year can be written off for tax purposes. Whatever you do to increase your rental revenue, whether. Since most require a cash expenditure, increasing actual expenses to increase tax deductions is not desirable.

Important tax deductions for rental property investors in 2019 the most important tax deductions in 2019 include: