State, local, and foreign taxes m. Tax deductions only apply if you’re looking for a new job in your current profession.

Deductible employee expenses for special categories.

Tax deductions for job. Taxpayers looking for a job in a new field cannot deduct their job search expenses. Fortunately the irs allows you to take tax deductions for at least some of those expenses if you itemize on your return. Appraisal fees for a casualty loss or.

Clothing/uniforms your work outfit has to be specific to the work you do as a. You may be able to. You must also meet what’s called the 2% floor. that is, the total of the.

The tax cuts and jobs act suspended the deduction for moving expenses. Tax deductions for job seekers. Only taxpayers who are looking for a new job in their current (or recent, if unemployed).

Your income is generally lower, which also lowers your income tax and may allow you to qualify for eitc and the additional child tax. You cannot use the tax deductions to look for a job in a different profession. The software lets you enter the expenses because information flows over from your federal return to state returns.

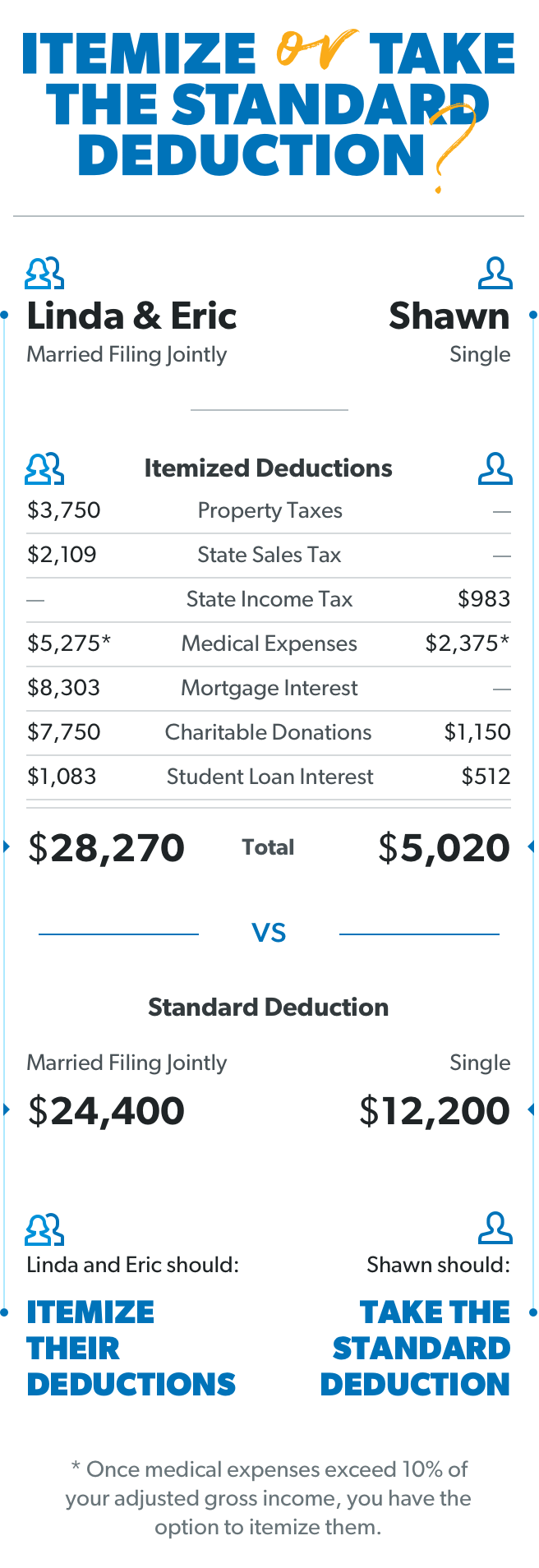

The work location is outside the metropolitan area where you live and normally work. There is no tax credit or deduction for losing your job. To deduct workplace expenses, your total itemized deductions must exceed the standard deduction.

You may be able to deduct certain expenses you incur while looking for a new job, even if you do not get a new job. Property or monetary losses l. If my phone bill is $100 per month, i can take a tax deduction of $41 per month, or $492 per year.

You have at least one regular work. We’ve learned about a lot of common — and possibly substantial — deductions you can take while you’re. If you land a job in another city or state, you can deduct the cost of moving to take the new job.

You can deduct some expensive job hunting expenses, including employment and outplacement. The move must be related both in time. Deductible employee expenses for special categories.

Deductions for job related expenses for workers with w2. For 2017 and earlier, taxpayers can deduct moving expenses if they meet the following requirements: This same calculation can be applied to other expenses that you use for both.

Related to the start of work. State, local, and foreign taxes m. In other words, you can only deduct expenses that exceed 2% of your adjusted gross income.

Tax deductions only apply if you’re looking for a new job in your current profession.