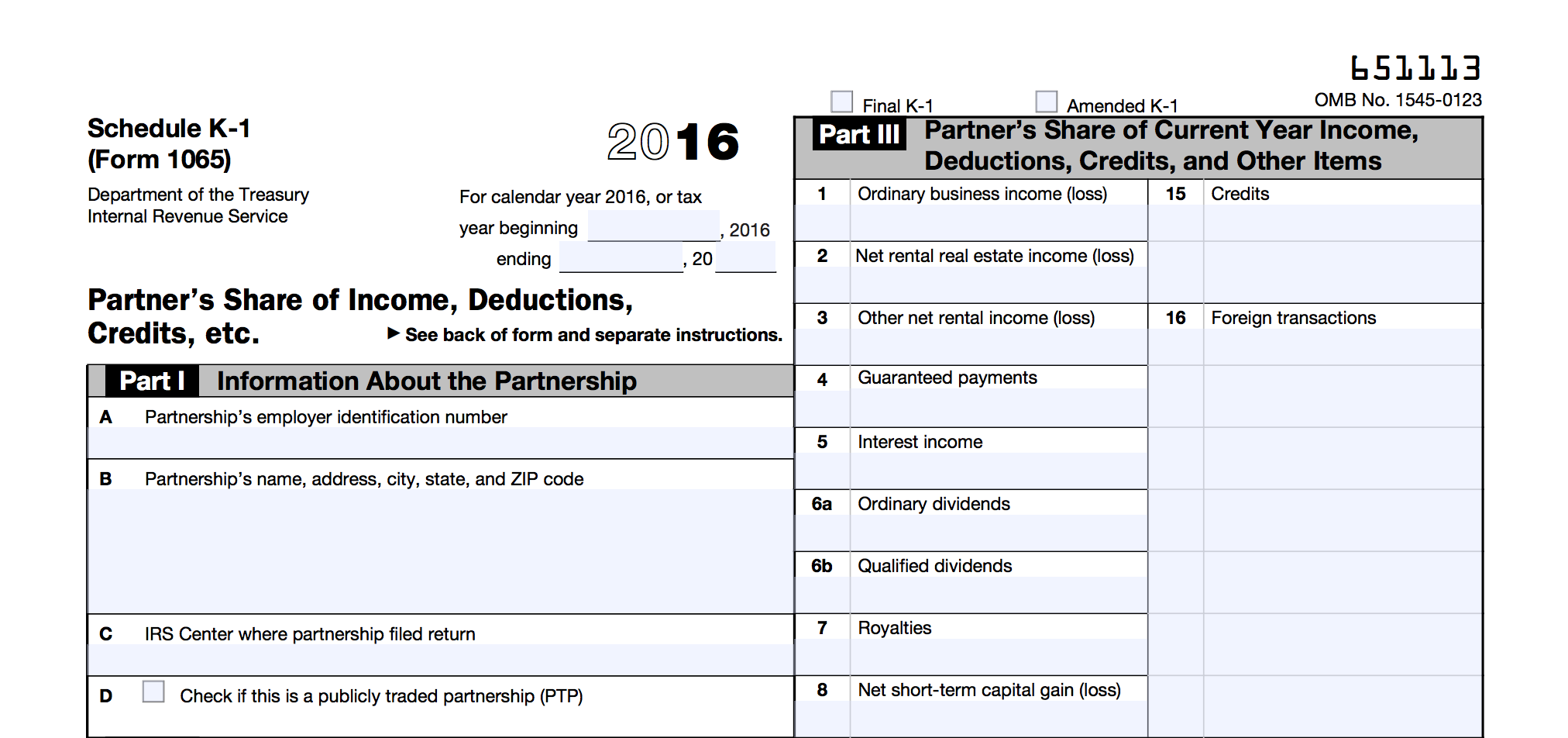

Real estate agent car tax deduction. The schedule k1 tax form indicates one’s share of an estate/trust, partnership, or corporation.

/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Whenever a beneficiary receives a distribution of income, the trust or estate reports a deduction for the same amount on its 1041.

Tax deductions for k1. Owners report their share of the partnership’s income, deductions, losses, credits, and the like. The general rule under section 162 is that you may be permitted to deduct unreimbursed ordinary and necessary expenses made on behalf of a partnership, which you paid in accordance with the partnership agreement or they may be subject to section 162 business or trade activity. Expenses paid on clients behalf;

Schedule k1 is similar in nature to form 1099. Many individuals, including owners of businesses operated through sole proprietorships, partnerships, s corporations, trusts and estates may be eligible for a qualified business income deduction, also called the section 199a deduction. An application for and amendments to an application for registration as a national securities exchange or exemption from registration pursuant to section 5 of the securities exchange.

You have to spend money to make money. what you might not realize is that spending that. The schedule k1 tax form indicates one’s share of an estate/trust, partnership, or corporation. The tax credit amounts will increase for many qualifying taxpayers, giving parents or guardians up to $3,600 per child.

It is where partners and shareholders report profit amounts that were “passed through” from the business to each individual. What is ubia of qualified property on k1? Only number 1 specifically allow reimbursement permits the deduction according to the irs instructions.

Ordinary and necessary costs you incur in running your business can be deducted from your income, which reduces the amount of tax that you will owe. Some trusts and estates may also claim the deduction directly. Savings bonds the exclusion under 137 for adoption expenses rental losses

8.2 detailed method for realtors; Real estate agent car tax deduction. Qbi deduction for k1 i�m using turbo tax home and business 2019 go to personal income,select k1,entered information from box 20 with code z stmt ,then entered qbi pass through from statement a but no qbi deduction was figured out.

Income, credit, deductions, and other items. What deductions can i claim with a k1? Business gifts ($25 deduction limit) 11 12.

Individuals can deduct up to 20 percent of their qualified business income (qbi), 20 percent of dividends from real estate investment trusts. This keeps the trust or estate from being taxed on this income so that the income is only taxed once. The k1 tax form signifies the transfer of tax responsibility from the person or company earning income to the one who actually benefits from it.

The total amount of unreimbursed partnership expenses will flow to schedule e, page 2. Section 199a details the deduction, so you may also see it called the section 199a deduction. 8.1 simplified method for realtors;

This share may come in any form: Your employment wages and tips should have a 6.2% deduction for social security from your pay, and an additional 6.2% payment from your employer that does not appear on your paycheck. 6.1 simple method (standard mileage deduction) 6.2 actual method 7 7.

Whenever a beneficiary receives a distribution of income, the trust or estate reports a deduction for the same amount on its 1041. The qbi deduction was created by the tax cuts and jobs act of 2017, a major reform of the federal tax code. Up to 10% cash back business deductions are critical for tax savings.

It is an advance payment of a tax credit you qualify for on your 2021 tax return due on tax day, april 18, 2022. The advance child tax credit for 2021 or advctc, as part of the american rescue plan act, is a refundable tax credit.