Claim tax deductions for any expenses related to your rental property. Exception #1 will be covered in the next section under non passive income losses.

While unfortunate, landlords must consider part of the purchase of the property.

Tax deductions for landlords canada. Deducted under one of three safe harbors available to landlords, deducted via 100% bonus depreciation, or must be capitalized and depreciated 4. That is considered a personal line. Join us for our upcoming liv.talk webinar to get the most out of your 2021 canadian tax return before the may 2nd deadline.

Advertising that tries to attract people to your rental property. Generally, interest is the most lucrative deduction for landlords. People who rent property to their family or friends can lose virtually all of their tax deductions.

Common rental property expenses include home insurance, heat, hydro, water, and mortgage insurance. Tax payments, insurance premiums, condo fees, utilities, and advertising are commonly included in the list of deductible expenses. The cost of office supplies (obviously this applies more to large scale landlords).

Rent you paid to others. In case your property was damaged by the natural disaster, such as fire, flood, landslide or volcano eruption you might be able to deduct some of the expenses. For example, if a new roof costs $10,000 and lasts 15 years, you will get a $667 expense deduction each year ($10,000 / 15 years).

Accident, theft, vehicle, flood, fire, as well as health insurance for you and your employees. 21 tax deductions for landlords 1. In order to qualify under the tax code, the operating expense.

Losses from theft or casualty 2. Part of this expense is calculated in capital cost allowances (cca), but these require the help of tax experts to determine eligibility. Property tax (all state and local government taxes on your properties) landlord insurance (any costs associated with landlord or property management insurance policies) building asset depreciation (see the.

If you receive rental income from the rental of a dwelling unit, there are certain rental expenses you may deduct on your tax return. The canada revenue agency (cra) has made the deductions for meals a veritable minefield. Your insurance on the property.

Are you maximizing your tax deductions as a rental property owner? In this case, the landlord may be able to deduct $200,000 from taxable income. Most small landlords can deduct up to $25,000 in rental property losses each year.

Depending on their income, landlords may be able to deduct (1) up to 20% of their net rental income, or (2) 2.5% of the initial cost of their rental property plus 25% of the amount they. Here is a list of the other things you can deduct according to the canada revenue agency: Claim the full amount of expenses if it is for a rental property,.

Is your property (s) insured? A guide to rental property tax deductions in canada advertising. This deduction is a special income tax deduction, not a rental deduction.

Rental losses landlords can deduct up to $25,000 of lost rental income. You�ll need to figure out how much space your home office takes up within your rental. Professional fees (includes legal and accounting fees) management and administration.

Did you pay any insurance premiums towards its coverage? 18 key tax deductions for 2019: Say your apartment is 1,200 square feet and.

You can deduct the ordinary and necessary expenses for managing, conserving and maintaining your rental. May 16, 2015 | news & articles. These expenses may include mortgage interest, property tax, operating expenses, depreciation, and repairs.

Cra is explicitly clear that landlords cannot claim this deduction. Rental property insurance & rent default insurance 12. Exception #1 will be covered in the next section under non passive income losses.

If you advertise your rental property in magazines, newspapers, websites, and other similar places, go. From there, you can deduct a portion of your rent on your taxes. Several different fees from lawyers and mortgage brokers.

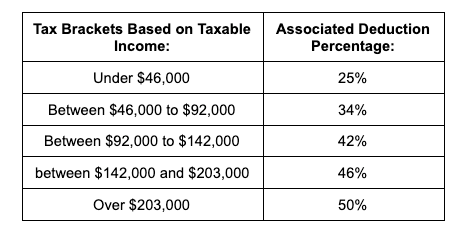

Telephone calls related to your rental property activities. Surprisingly you can deduct premiums you pay on various landlord insurances: Rental income rates and common deductions in alberta range from 25% to 48%.

While unfortunate, landlords must consider part of the purchase of the property. In practice, the calculation is different and is driven by canada revenue agency�s (cra�s) guidelines, but this is. You claim rental income and expenses on form t776.

However, you cannot deduct the first line for local service coming into your home. You can deduct expenses for advertising, including advertising in canadian newspapers and on canadian television and radio stations. Claim tax deductions for any expenses related to your rental property.

Other common tax deductions include: Rental expenses you can deduct. Depreciation depreciation of rental property is deductible, and involves deducting certain costs of the property over several years.

There are certain operating expenses that the irs allows landlords to deduct from their income. Include rent collected from tenants as rental income in the current tax year. Interest can be in the form of mortgage interest payments, credit card interest, and interest invoiced from suppliers for goods and services.

If your answer is yes. A special tax rule permits some landlords to deduct 100% of their rental property losses every year, no matter how much. Typically, cra views any meal or accommodation expense in relation to the rental property as a personal.

Interest is one of the largest tax deductions for a landlord. If you or (or your spouse) are real estate professionals, you qualify for a 100% deduction on any amount of rental losses. Land transfer taxes (a deduction you can’t claim):