Leos must sometimes purchase a second landline or cell phone to respond to emergency. When the taxpayer is an eligible retired public safety officer, defined by the irs as a law enforcement officer, firefighter, chaplain, or member of a rescue squad or ambulance crew, they can elect to exclude up to $3,000 of the distributions they receive from an eligible retirement plan from their taxable income.

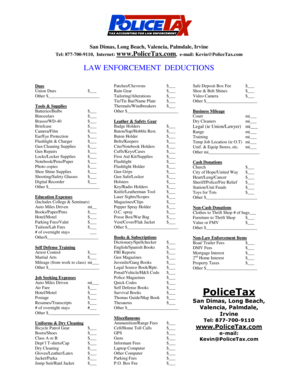

Law enforcement deductions uniforms uniforms belts boots, shoes gloves hat, helmet jacket pants shirts ties emblems, insignia dry cleaning laundry rain gear other total telephone long distance faxes pay phone cellular 2nd line beeper/pager answering service other other total vehicle & travel

Tax deductions for law enforcement. Download, copy of print the pdf for free. Kevin chinnock, m.a.,ea, police tax returns, police tax deductions, Steve halloran, sponsor of lb1265, said the tax benefit would help nebraska communities recruit and retain officers.

Tax deductions for law enforcement uniforms. When the taxpayer is an eligible retired public safety officer, defined by the irs as a law enforcement officer, firefighter, chaplain, or member of a rescue squad or ambulance crew, they can elect to exclude up to $3,000 of the distributions they receive from an eligible retirement plan from their taxable income. Common deductions for law enforcement include uniform costs, uniform maintenance (inlcluding dry cleaning & tailoring) equipment and accessories.

Answer yes to the question, if you were employed as a public safety officer (law enforcement officer, firefighter, chaplain, or member of a rescue. In general, less people are itemizing because of the standard deduction nearly doubling. San dimas, long beach, valencia, palmdale, irvine tel:

Therefore all of the following information applies only to a california tax return. Public safety officer tax deduction. Clothingthe purpose of this worksheet is to help you uniforms organize your tax deductible business expenses.

Other items can include mileage (standard rate is. Kevin@policetax.com law enforcement deductions dues. A free checklist of tax deductions and expenses for police officers.

Belts in order for an expense to be deductible, it must boots, shoes be considered an ordinary and necessary gloves expense. Beginning in 2023, officers would be allowed to deduct 25% of their salary, with the adjustment increasing an additional 25% each year until 2026, when 100% of a police officer’s wages would be exempt from state taxes. The amount excluded from your income can�t be used to claim a medical expense deduction. click irs publication 575 for additional pso deduction information.

Law enforcement deductions uniforms uniforms belts boots, shoes gloves hat, helmet jacket pants shirts ties emblems, insignia dry cleaning laundry rain gear other total telephone long distance faxes pay phone cellular 2nd line beeper/pager answering service other other total vehicle & travel You may include other applicable hat, helmet expenses. 26370 diamond place, unit 511 santa clarita, ca 91350 phone:

Tony luetkemeyer is proposing senate bill 1181 which would eventually eliminate the state income. The deduction of firearms is very problematic and is one of the most controversial areas in litigation with the franchise tax board. Along with a higher standard deduction, itemized deductions such as unreimbursed employee expenses were eliminated.

What we colloquially refer to as the “pso deduction” at molen & associates is a deduction for retired public safety officers. Leos must sometimes purchase a second landline or cell phone to respond to emergency. No employee business expenses, including firearms are deductible for a federal tax return.

Nebraska law enforcement officers could deduct 50 to 100 percent of their pay from state income tax under a bill heard feb. With it being national police week, we thought we would share a quick tip for police and any other public safety officers. 16 by the revenue committee.

Mostly this applies to those in law enforcement and emergency services,. Congress has capped the state and local tax (salt) deduction at $10,000 from what has been unlimited. What law enforcement expenses are tax deductible?

The tax cuts and jobs act of 2017 have changed the way police officers, and every other taxpayer is able to claim deductions. The deduction would go into effect in tax year 2023. Public safety budgets across the us are largely drawn from state and local property sales and income taxes.

Police tax is a full service tax, accounting and business consulting firm specializing in law enforcement located in long beach, san dimas, valencia, palmdale, corona, santa ana, irvine ca. A law enforcement officer can deduct the cost of his uniforms if his employer requires them in the performance. The salt deduction helps support these vital investments at the state and local level.

March 17, 2022 by joey parker.