Paul carman is a partner in the chicago law firm of Here are the top tax deductions that every professional business owner should know about.

While it has the potential to.

Tax deductions for law firm equity partners. Paul carman is a partner in the chicago law firm of A joins an accounting firm as a partner on january 1, 2014. If you or spouse (heck, or both) made.

Your personal tax return will become much more complicated as an equity partner You will generally be required to make capital contributions to the firm; If you are a partner in your firm, expenses related to your business that your law firm does not reimburse you for, which you paid for personally, may be a deduction you can take on your personal return.

While it has the potential to. You can deduct health insurance premiums paid retirement plans many law firms offer defined contribution and defined benefit plans to partners. On partnership equity for services:

• service provider treated as owner of the partnership interest from the date of grant and takes into account allocations of income, loss, etc. Banoff, paul carman, and john r. Partners cannot deduct expenses they could have turned into the firm and been reimbursed.

The partner’s deduction for 50% of se tax is reported on page 1 of his or her form 1040. However, if your prior year adjusted gross income was over $150,000, this amount increases to 110%. The deduction process can get tricky, so track your expenses carefully.

This change apparently changes the taxes as we now have to do quarterly reporting. Deductible retirement plan contributions made on behalf of a partner (including any elective deferral contributions made by the partner) are not deducted on the partnership’s form 1065 tax return. Turbo tax, for all its faults, is pretty easy to use and has served us well.

In other words, there’s no deduction. The top 6 tax deductions for lawyers and law firms. This reduces their adjusted gross income (agi) and impacts the limitation of some itemized deductions, for.

The collision of section 83 and subchapter k author: Being asked to join the partnership of a firm is a measure of success as a legal professional. For 2020, defined contribution plans allow partners to contribute up to $57,000 annually.

There are a wide array of available tax deductions that are outside the scope of this guide, but we�ve provided information on the most common types and how they work. The law firm employer matches that amount, so up to 15.3% is remitted for social security and medicare taxes per employee. Here are the top tax deductions that every professional business owner should know about.

In determining tax liability • neither partnership nor partners claim a deduction upon grant or vesting of the profits interests distributions and allocations prior to vesting. At the bare minimum, business expenses must be both ordinary and necessary in order to be claimed, but there are particular law firm tax deductions to be aware of when assessing. As a part of terms of his joining the

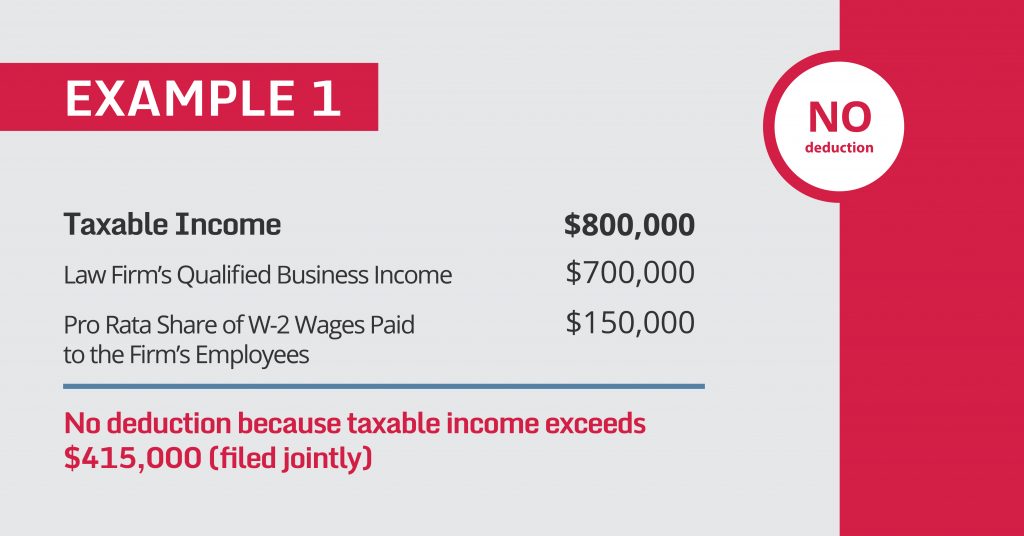

Tax deductions refer to the allowable deductions as outlined by the irs that permit taxpayers to assess against their ultimate adjusted gross income (agi) in order to get to their tax liability. Key tax and financial considerations for new law partners. If the partner’s taxable income exceeds $415,000 (joint filers) or $207,500 (other filers), the 20% deduction is not available.

That way the partner receives an se tax benefit as well as an income tax benefit. The move from law firm associate to equity partner entails significant change to a lawyer’s personal finances, which can be summarized in four areas: Unlike itemized deductions, which are detailed on schedule a of your tax return, the interest is deducted on schedule e to directly offset your partnership income.