Ask your accountant or a tax professional if it’s possible in your situation. The short answer is most often going to be no, life insurance premiums are not tax deductible if you’re buying a policy for yourself or another family member.

Life insurances such as death cover, tpd and trauma insurance is usually not tax deductible outside of super.

Tax deductions for life insurance premiums. 8,400 on his life insurance policy which is taken in april 2011, deduction will be. Considering the above provisions, deduction in respect of life insurance premium will be as follows: That’s because the irs views life insurance as a personal expense.

- in respect of premium of rs. If you do this with a large group policy, beyond the $50,000 of coverage available for s corps and llcs, this means that all of your employees will get. You may get a tax deduction if you use your life insurance policy as collateral on a loan.

However, the premiums you pay for income protection insurance are tax deductible if you buy the policy outside of your super fund. But the premium paid for parent is not eligible for deductions on income tax though the parents are dependents on self. Life insurance premiums are considered a personal expense, and therefore not tax deductible.

From the perspective of the irs, paying your life insurance premiums is like buying a car, a cell phone or any other product or service. This is because the premiums you are paying relate to your income. You may be wondering whether life insurance premiums are deductible on your tax return, and the answer is generally no.

The premium paid on life insurance product or ulip is allowed as a deduction. Deducting your life insurance premiums as a business expense makes the benefits on the policy become taxable. It’s the same as an individual.

Ask your accountant or a tax professional if it’s possible in your situation. You can never deduct life insurance premiums from your taxes if you bought a policy for yourself (meaning it pays out upon your death). This office permits you to purchase more extra security scope than having a derivation on the premium installments.

A corporation can deduct life insurance premiums if they’re used as collateral for a loan. Here’s a look at what the canada revenue agency (cra) requires: Any amount that you pay towards life insurance premium for yourself, your spouse or your children can also be included in section 80c deduction.

But you may be wondering if you can gain a tax break for yourself during your lifetime by deducting life insurance premiums. However, if you are a business owner and you pay life insurance premiums on behalf your employees, your expenses may be deductible. Generally premiums paid by australian resident individuals for income protection insurance under a policy they own may be claimed as a tax deduction to the extent that the premiums are paid for benefits that are designed to replace the individual’s lost income.

If an employer pays life insurance premiums on. Tax deductions on life insurance premium paid for self, spouse or children is eligible for deductions under section 80c of the income tax act. A group insurance plan makes you pay the insurance premium with the help of pretax dollars, gave the premiums do not go past $50000 of death profits.

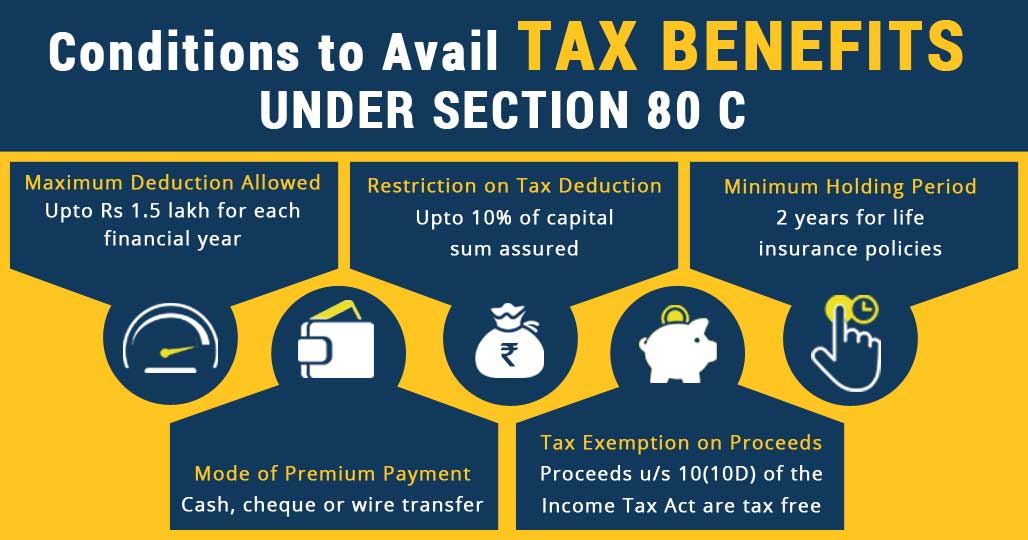

Apart from several other items provided under section 80c, a taxpayer, being an individual or a hindu undivided family (huf), can claim deduction under section 80c in respect of premium on life insurance policy paid by him/it during the year. So, small companies may take a tax deduction for those premiums, but not for any money paid to provide coverage above a $50,000 death benefit. Life insurance premiums, under most circumstances, are not taxed (i.e., no sales tax is added or charged).

The short answer is most often going to be no, life insurance premiums are not tax deductible if you’re buying a policy for yourself or another family member. Keyman life insurance tax treatment As with term policies, sec.

However, if life insurance is a business expense, premiums may be tax. There are limited exceptions for employers and some divorce agreements. 2) deduction under section 80c is.

Life insurance payouts aren�t taxable, with a few exceptions. Deduction on account of payment of life insurance premium. Can you claim a tax deduction for premiums paid for income protection insurance?

Life insurances such as death cover, tpd and trauma insurance is usually not tax deductible outside of super. As an individual, when you pay life insurance premiums, they are not deductible on your income tax return. Are life insurance premiums tax deductibles on group policy?