Here are the tax deductions & expense list for long haul truckers & owner operators: 53 tax deductions & tax credits you can take in 2022.

Credit for sick leave for.

Tax deductions for long form. For instance, you can write off state sales taxes, charitable contributions and qualified medical expenses. You paid $5,000 for health insurance premiums for the year. This includes the special $300 deduction designed especially for.

Your deduction cannot exceed profits earned during the year. If you miss an important form on your tax return, such as income or deduction form, you will have to prepare a tax amendment. Medical, dental, prescription drugs, and other health care costs, including some insurance premiums,.

53 tax deductions & tax credits you can take in 2022. Child tax credit (ctc) 4. For 2022 there are higher hsa contribution limits available.

For 2020, the standard deduction is: Credits can reduce the amount of tax you owe or increase your tax refund, and some credits may give you a refund even if you don�t owe any tax. Enter the total amount of pensions, annuities, dividends, rental income, unemployment compensation, or interest income not included in line 1.

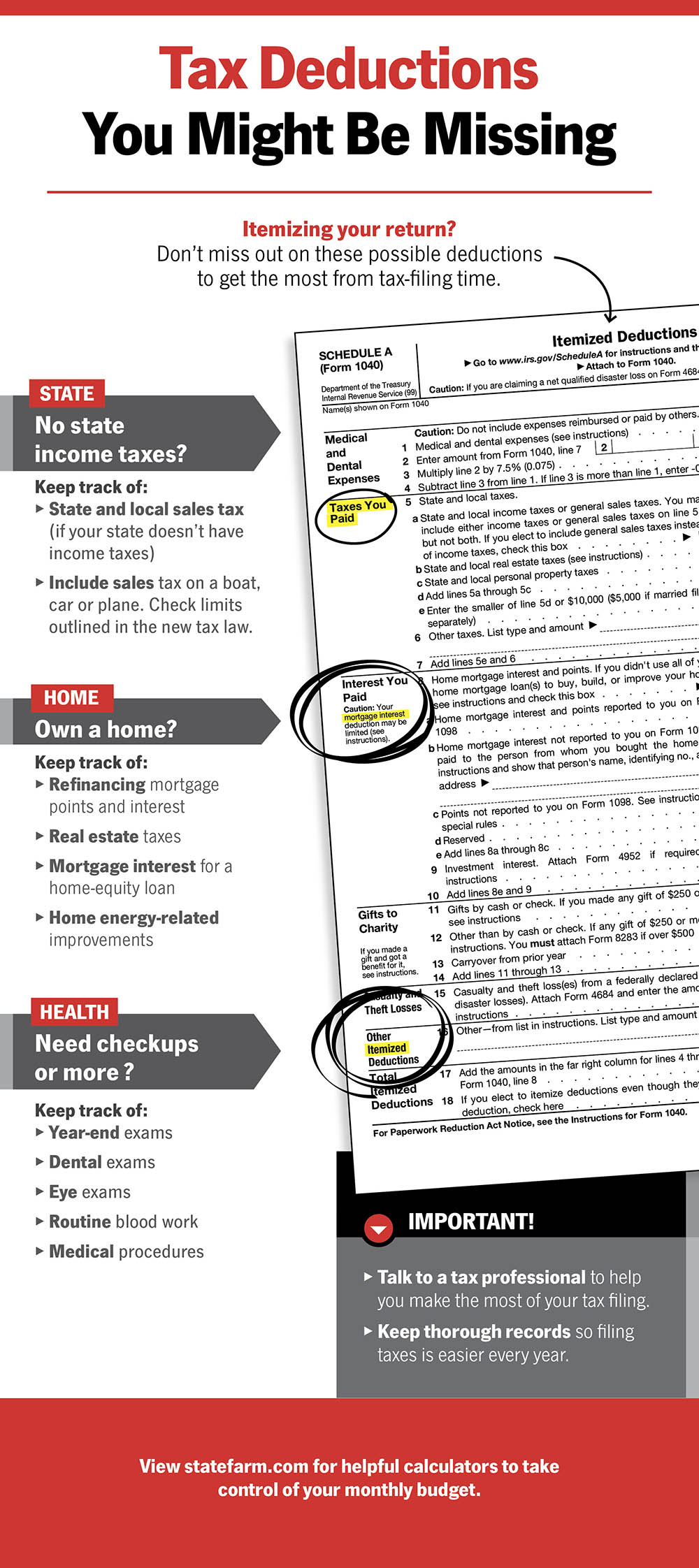

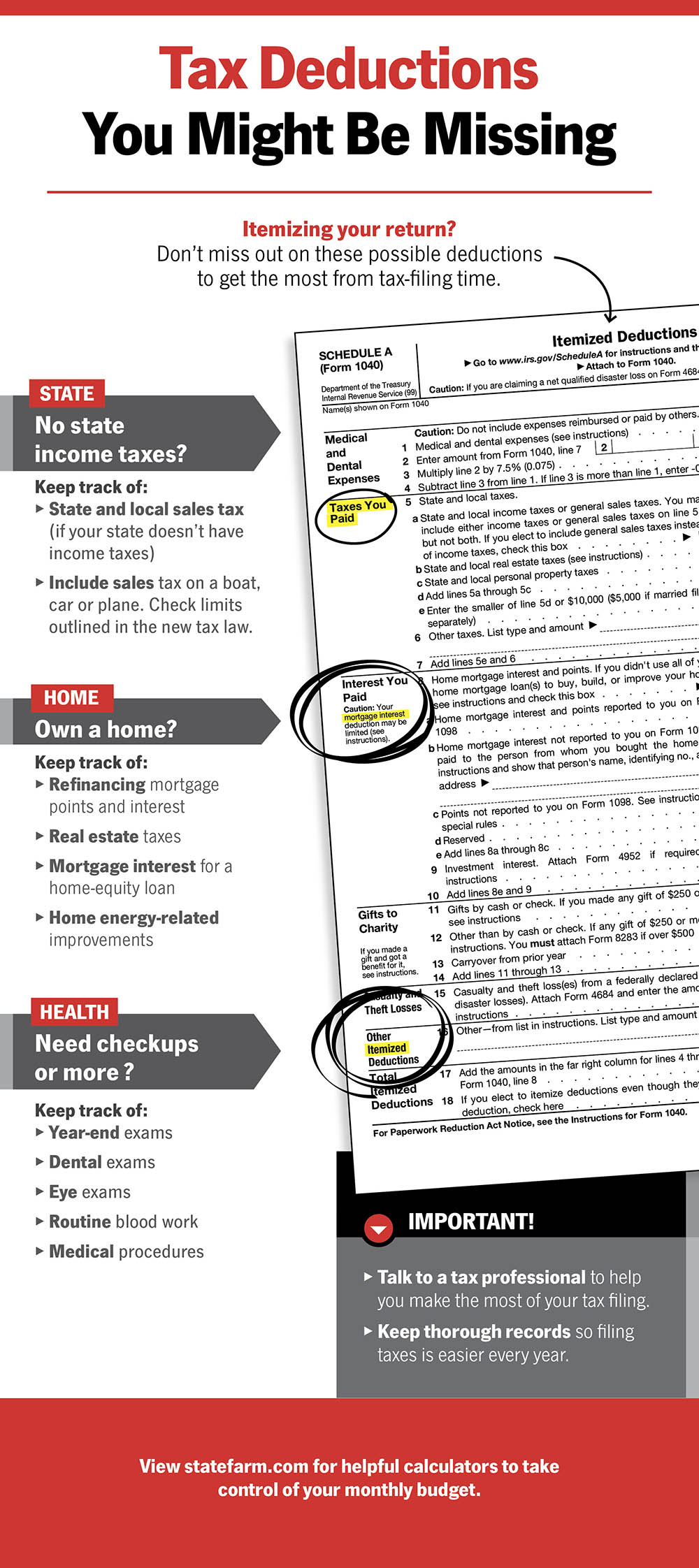

Some of the itemized deductions available include: If you�re married and file jointly, it�s $12,200 as of 2013. State and local income taxes or state and local sales taxes

For example, contributions to a shriners hospital fund are one such deduction. You can contribute $3,650 for individual coverage for 2022, up from $3,600 for 2021, or $7,300 for family coverage, up from $7,200 for 2021. Changes to the earned income tax credit for the 2022 filing season.

The coronavirus aid, relief and economic security act includes several temporary tax law changes to help charities. Deductions can reduce the amount of your income before you calculate the tax you owe. The internal revenue service has released the maximum amount taxpayers can deduct as owners of qualified ltc insurance.

It�s half this amount or $6,100 if you�re single. Fuel for truck, tractor & refer legal & professional fees repair & maintenance highway use tax (form 2290) truck & trailer insurance supplies dmv fees for truck & trailer uniforms, safety shoes & safety equipment contract labor ( 1099 nec required) trailer rent $12,400 if you file as single $18,650 if you file as head of household $24,800 if you�re married and file.

You may claim these deductions up to 30% of your adjusted gross income (form 1040, line 11). 01:01 1040 long form the advantage of the 1040 is you do have spaces to claim every tax credit and deduction you are entitled to. Donations above required dues are deductible as long as the organization will use them for qualified charitable purposes.

This is for the simple reason that all 2021 forms need to be mailed to you. Missouri standard deduction or itemized deductions. Deductible taxes are reported on form 1040, schedule a in the taxes you paid section.

You must complete schedule a to itemize deductions and probably other forms as well. Losses due to theft or casualty (schedule a, line 15) Let’s say you are a freelancer and report a net profit of $4,500 on your schedule c tax form.

Enter the amount of railroad retirement benefits (not included in line 2) before any deductions. Federal adjusted gross income from federal return You can claim state and local income taxes or sales taxes, real estate (property) taxes, or personal.

Following tax law changes, cash donations of up to $300 made this year by december 31, 2020 are now deductible without having to itemize when people file their taxes in 2021. 8 min read november 11th, 2021. The aggregate deduction for state, foreign income, local income (or sales taxes in lieu of income taxes), and property taxes is limited to $10,000 ($5,000 if married filing separately) per return.

The standard deduction is the same across the board for everyone in each filing status. Credit for sick leave for. Here are the tax deductions & expense list for long haul truckers & owner operators:

The irs began paying the third coronavirus stimulus check (also called an economic impact payment) in march 2021. You can deduct most expenses relating to medical or dental diagnosis, treatment or prevention as long as those expenses are in excess of 7.5 percent of your adjusted gross income (agi). The reimbursable amount through your hsa is based on the same ltc insurance allowed tax deduction aged based irs chart.

Yourself (y) spouse (s) 1.