The married filing separately status cuts the deductions for ira contributions and eliminates certain tax credits, among other tax breaks. Youll also have to decide.

The standard deduction for separate filers is far lower than that offered to joint filers.

Tax deductions for married filing separately. For tax year 2021 the standard deduction is $12,550 for married couples filing separately. • single or married filing separately—$12,550, • married filing jointly or qualifying widow(er)—$25,100, and • head of household—$18,800. Married filing separately taxpayers are prohibited from claiming some tax credits, including:

In tax year 2022 it will rise to $12,950. Filing separately might also exclude you from eligibility for certain tax deductions and credits (see below). Who can file married filing separately (mfs) 2021?

You can snag a partial deduction if your modified adjusted gross income is. You may be able to claim itemized deductions on a separate return for certain expenses that you paid separately or jointly with your spouse. If you and your spouse filed as married filing separately, the income limits for taking the deduction are much lower.

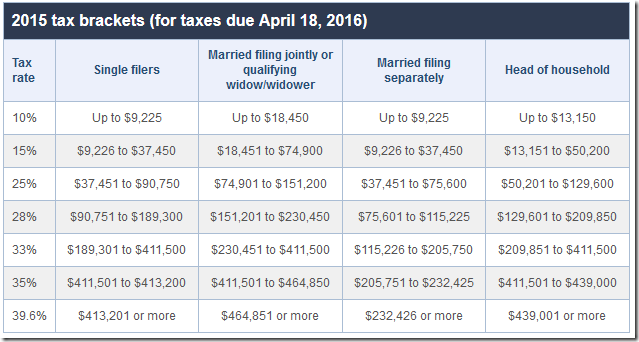

What is the deduction for married filing separately 2015? If one spouse itemizes deductions, then the other spouse must also itemize deductions in order to claim deductions. Review several examples of how taxpayers who are married but filing separately, with or without children, are affected by tax law changes.

You can claim the deduction without itemizing, but cannot also claim other education tax credits. First, the spouse who paid an expense that results in a tax deduction should claim the full deduction. What is the 2021 standard deduction for married filing jointly over 65?

Youll also have to decide. If your spouse itemizes deductions, you cannot claim the standard deduction. Married filing separately with a spouse who is covered by a plan at work $10,000 or more no deduction.

One of the situations in which you might need to file separately is if you have no children, one spouse has substantially higher taxable income, and the spouse with the lower income has large itemized deductions like medical expenses for the year. There are rules to follow for filing separately, though. Single and married filing separately filers will receive a standard deduction of $12,400 more for 2020, as per standard deductions for inflation.

Married, filing separately itemized deductions appears to be a complicated issue, but in reality it can be quite simple if you follow some basic rules. Using miscellaneous deductions by filing separately (for tax years prior to 2018) How married filing separately works.

The standard deduction amount has been increased for all filers. In 2020, married filing separately taxpayers only receive a standard deduction of $12,400 compared to the $24,800 offered to those who filed jointly. Ad answer simple questions about your life and we do the rest.

If you and your spouse file separate returns and one of you itemizes deductions, the other spouse can’t use the standard deduction and should also itemize deductions. The standard deduction for separate filers is far lower than that offered to joint filers. Credit for the elderly and disabled (if they lived with their spouse) child and dependent care credit (in most cases) earned income credit american opportunity or lifetime learning educational credits

If your filing status is married filing separately, the following limitations will apply to your tax return: The standard deduction for separate filers is far lower than that offered to joint filers. Married filing separately as married filing separately if one spouse itemizes deductions, the other spouse can not claim the standard deduction.

For single taxpayers and married individuals filing separately, the standard deduction rises to $12,400 in for 2020, up $200, and for heads of households, the standard deduction will be $18,650 for tax year 2020, up $300. Although most married couples file jointly, they can choose the married filing separately status if they want. In most cases, payments will range from $300 to $600 for individuals and $600 to $1,200 for joint filers.

From simple to complex taxes, filing with turbotax® is easy. Second, if you and your spouse paid the expense from a joint account you will need to divide the deduction according to your interest in. Married filing jointly with a spouse who is covered by a plan at work:

Are there any tax credits for married filing separately? If one spouse itemizes instead of taking the standard deduction, for example, the other spouse must itemize, too. The married filing separately status cuts the deductions for ira contributions and eliminates certain tax credits, among other tax breaks.

In 2021, married filing separately taxpayers only receive a standard deduction of $12,500 compared to the $25,100 offered to those who filed jointly. For married taxpayers who are age 65 or over or blind, the standard deduction is increased an additional amount You may be able to claim itemized deductions on a separate return for certain expenses that you paid separately or jointly with your spouse.

The deduction is worth either $4,000 or $2,000, depending on your income and filing status. Can parents deduct college tuition? 8 rows tax rates and standard deduction for married filing separately for your 2020 tax return, you.

Married couples filing jointly amount to $24,800. Married filing separately with a spouse who is covered by a plan at work less than $10,000 a partial deduction. The standard deduction for the married filing separately is $12,550.

You may also consider separate filings to reduce adjusted gross income if you have high medical bills, said marianela collado, a cfp and cpa at tobias financial advisors in plantation, florida. In order to claim deductions, you will have to itemize as well. What is married filing separately (mfs)?

You may be able to claim itemized deductions on a separate return for certain expenses that you paid separately or jointly with your spouse. This standard deduction table is only here for information purposes. What is the deduction for married filing separately 2020?