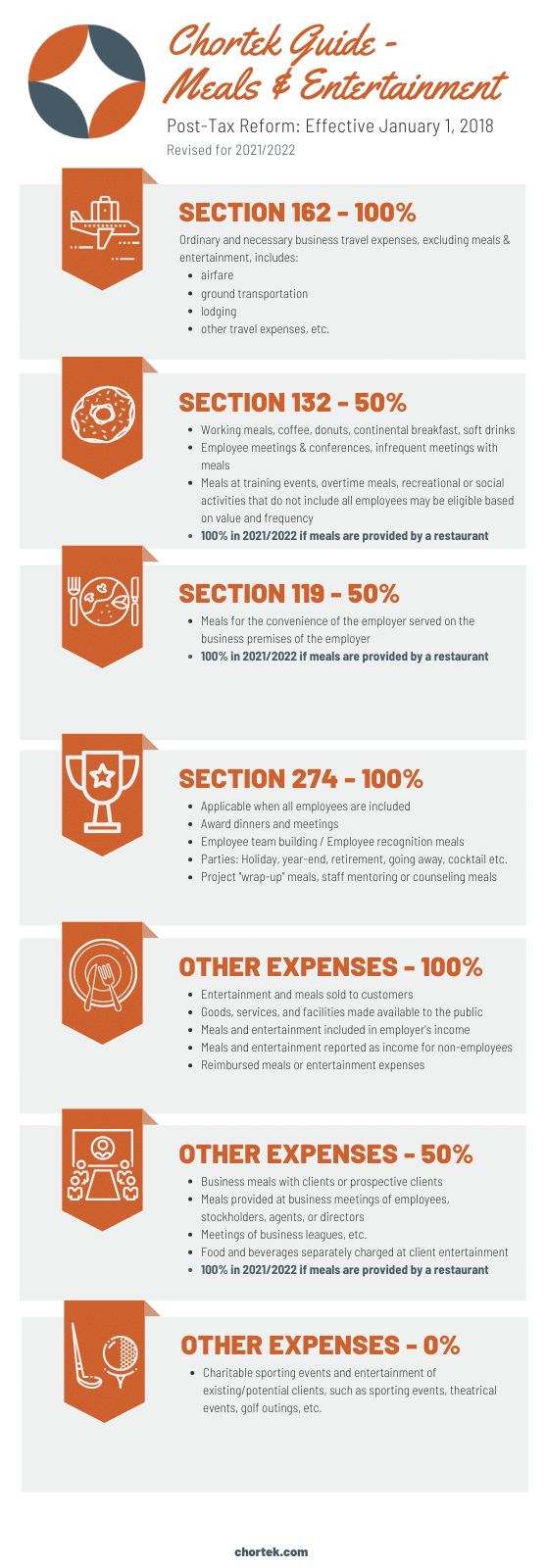

For example, 50% of the cost of a business meal was deductible in 2020. Uncle sam is helping to pick up the tab for certain business meals in 2021 and 2022.

Under this new irs guidance, you may deduct 50 percent of your client and prospect business meals if 2 1.

Tax deductions for meals. However, the consolidated appropriations act, 2021, p.l. You can either keep all your meal receipts and claim your actual expenses, or you can use the per diem method. The 2017 tcja generally eliminated the deduction for any expenses related to activities generally considered.

Meals can be deducted altogether from their taxable income, even if those meals would normally have been 50% deductable. The “taxpayer certainty and disaster tax relief act of 2020” (the act), enacted as part of the “consolidated appropriations act, 2021” (caa 2021), allows a full deduction for certain business meal expenses—an increase from the 50% deduction limit. Similar to passenger goodies, only 50% of the cost for these items can be deducted.

Meals that you purchase while recruiting other drivers are also tax deductible. 274(n)(1), a deduction for any expense for food or beverages is generally limited to 50% of the amount that would otherwise be deductible. Office meetings and partner meetings fall into this category.

50 percent deductible meals (no change): Generally, any meals during business travel. Proposed regulations issued earlier this year permit a taxpayer to deduct meal expenses if (1) the expense is not lavish or extravagant under the circumstances;

Employers and employees can both reap substantial tax benefits when the employer provides or pays for employee meals. Here�s one special consideration to keep in mind: Entertaining clients (concert tickets, golf games, etc.) 0% deductible:

Then, in an effort to help restaurants impacted by the pandemic, congress passed a new law at the end of 2020 that temporarily made certain business meals 100%. Uncle sam is helping to pick up the tab for certain business meals in 2021 and 2022. The act added a temporary exception to the 50% limit on the amount that businesses may deduct for food or beverages.

Under this new irs guidance, you may deduct 50 percent of your client and prospect business meals if 2 1. However, there are detailed rules about what meal expenses qualify for this favored tax treatment. The meal is 50% deductible if:

The expense is an ordinary and necessary business expense the meal isn’t lavish or extravagant under the circumstances the business owner or an employee is present the food and beverages must be provided to a current or potential business customer, client, consultant, or similar business contact, and The new coronavirus tax bill has 100% deduction for business meals and beverages in a restaurant that are incurred after dec. The expense is an ordinary and necessary expense under internal revenue code (irc) section 162(a) that is paid or incurred during the taxable year in carrying on any trade or business;

Meals and entertainment before the new rules. The expense isn’t lavish under the circumstances. Drivers who are subject to “hours of service” regulations can claim 80% of meals purchased on the road.

1, 2023, for food or. The expense is an ordinary and necessary business expense paid or incurred in carrying on any trade or business during. Under a provision in the consolidated appropriations act (caa), the usual deduction for 50% of the cost of business meals is doubled to 100% for food and beverages provided by restaurants for the 2021 and 2022 tax years.

The temporary exception allows a 100% deduction for food or beverages from restaurants. Uncle sam is helping to pick up the tab for certain business meals in 2021 and 2022. Washington — the internal revenue service issued final regulations on the business expense deduction for meals and entertainment following changes made by the tax cuts and jobs act (tcja).

Currently, the deduction for business meals is allowed if the following requirements are met: The taxpayer (or an employee of. The bill temporarily allows a 100% business expense deduction for meals (rather than the current 50%) as long as the expense is for food or beverages provided by a restaurant.

An important deduction to consider during tax preparation is business meals. Beginning january 1, 2021, through december 31, 2022, businesses can claim 100% of their food or beverage expenses paid to restaurants as long as. 31, 2020, and before jan.

Starting in 2018 the rules changed, only meals were allowed the 50% deduction. Although eating is a daily routine, certain meals can also provide a larger tax deduction for your business. 31, 2020, and before jan.

If there is no business function to the meal, it is completely nondeductible for tax purposes. Meal expenses for a business meeting of employees, stockholders, agents, and directors. Under a provision in the consolidated appropriations act (caa), the usual deduction for 50% of the cost of business meals is doubled to 100% for food and beverages provided by restaurants for the 2021 and 2022 tax years.

For example, 50% of the cost of a business meal was deductible in 2020. It�s actually part of the consolidated appropriations act of 2021, which bundled together a number of covid relief measures. In 2021 and 2022, you will be able to deduct 100% of food and beverages purchased at a restaurant from your taxable income, although you’ll need to update your tax return for 2020 based on this change.

With this method, you simply claim a set amount per day, which varies by location.