What medical travel expenses are tax deductible? 14 cents per mile driven in service of charitable organizations.

What medical expenses are includible?

Tax deductions for medical travel. Yes, the airfare required for medical care is deductible as a medical expense on your schedule a, subject to certain limitations. You may claim $62.40 as an. This will tell you how much can.

Get started tracking mileage today with triplog. For example, if you use the standard medical rate and drive 1,000 miles for medical treatment. For the current tax year, you have had $5,475 of qualifying medical expenses.

The way to do it is to multiply your adjusted gross income by 0.075. Record the distance of travel, calculate your mileage according to the province in which you reside. 1 say you have an agi of $50,000, and your family has $10,000 in medical.

52¢ x 120km = $62.40; If you are in the 15% bracket, the same $1,000 deduction counts as a $150 credit. Instead, you may deduct 20 cents per mile you drive for medical treatment in 2019.

What medical travel expenses are tax deductible? 1 day agothe medical expense deduction is a deduction for medical expenses. 18 cents per mile driven for medical or moving purposes.

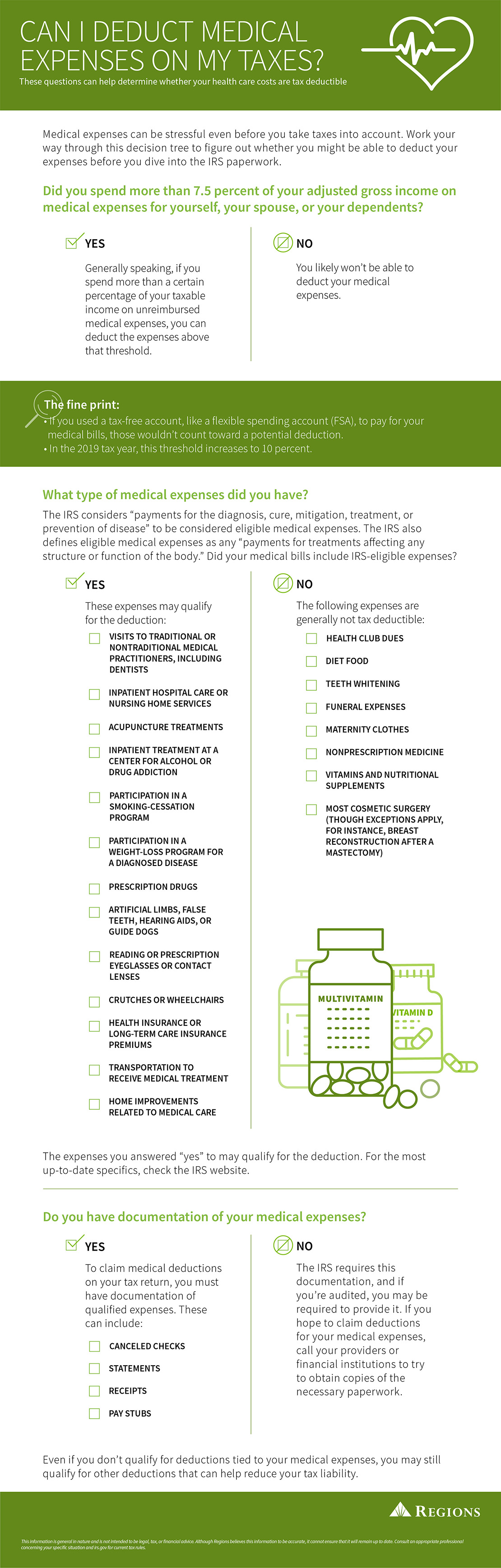

You can include qualified medical expenses you. What medical expenses are includible? If you itemize deductions (schedule a), you can deduct mileage for trips to your doctor appointments.

You can deduct the cost of transportation to and from a health care facility if you can’t receive medical care without traveling. 17 cents per mile driven for medical or moving purposes, down three cents from the rate for 2019, and; However, your medical expenses are only deductible to the extent they.

While you may get quite a deduction for your itemizations, the standard deduction is also quite significant, and itemizing your deductions is a lot of work. 14 cents per mile driven in service of charitable organizations. Additionally, as a result of the tax cuts and jobs act (tcja) of 2017, the standard.

In 2019, the irs allowed you to deduct medical expenses that exceeded 7.5% of your adjusted gross income. Thus, a $1,000 deduction for someone in the 28% tax bracket counts as a $280 credit. You can deduct unreimbursed, qualified medical and dental expenses that exceed 7.5% of your agi.

Certain expenses incurred in traveling for medical purposes are deductible for u.s. You can include in medical expenses the amount you pay for a legal abortion. Section 213 allows a deduction for expenses paid for medical care to.

Read the excerpts from irs publication 502. Transportation costs you can deduct include:. All documented transportation to and from the medical destination allowable lodging expenses during treatment and recovery and hospital.

This leaves you with a medical expense deduction of $2,100 ($5,475 minus $3,375). Taxpayers whose medical expenses exceed seven percent qualify for the deduction for tax returns filed in. 14 cents per mile driven in service of charitable organizations.

Did you know medical transportation costs are tax deductible? Take the situation of a parent who accompanies a dependent child on a trip for medical reasons. The following expenses can be included in the.

1, 2019, all taxpayers may deduct only the amount of the total.