Yes, this is a bit flexible, but in general it would cover any of the following mining expenses mining hardware (gpus, asics, and component parts) electricity internet service Tax deductions for airport baggage handlers.

Interest (cars and other expenses) a portion of this interests is eligible for deduction

Tax deductions for mining employee. How to report crypto mining taxes to the ato Method 1 you may claim home office electricity based on floor area e.g. For a summary of common claims, see mining site employees deductions (pdf, 839kb).

From a tax perspective, however, some coin miners prefer to own their mining equipment through a company and be treated as business entities rather than as. With the onset of the coronavirus pandemic in early 2020, many people saw a disruption to their normal working life. Allowable expenses include your electricity and equipment costs.

Mining businesses can deduct expenses to find and sell resources: The miners can’t do their work without the housing so it meets the. A document published by the internal revenue service (irs) that provides information on how taxpayers who use.

Self education costs for attending any courses, training or. Answer simple questions about your life and we do the rest. The morrison government was no different and allowed an array of new tax deductions for remote workers.

Employee wages and benefits are some of the most common and important deductions to include on a tax return. Tax deductions for ambulance officers. Some governments decided to implement tax deductions to certain expenses.

If your group has hired staff members, be sure to make note of wages, payroll, and benefits. You will compute this amount as part of schedule se. Here is that list of specific tax deductions relevant to mining site employees:

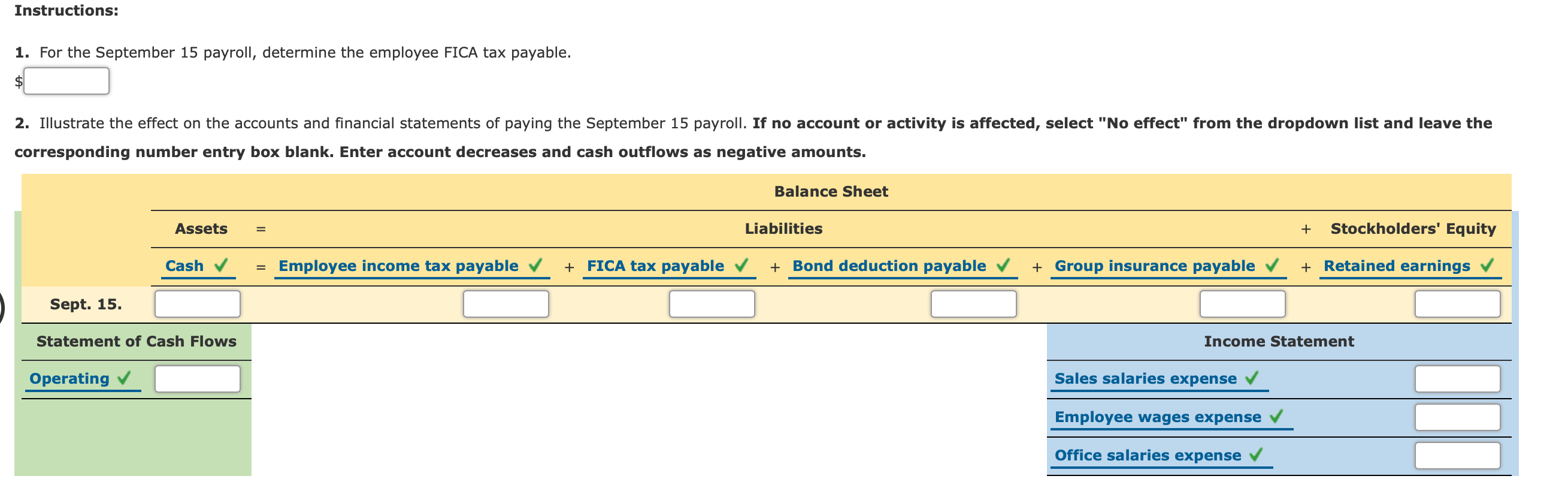

Tax code specifies any ordinary and necessary expenses can be deducted, which means anything that’s typical, helpful and appropriate to mining activities. Your goal in this process is to get from the gross pay amount (gross pay is the actual amount you owe the employee) to net pay (the amount of the employee�s paycheck). After you have calculated gross pay for the pay period, you must then deduct or withhold amounts for federal income tax withholding, fica (social security/medicare) tax , state and local income.

Expenses related to the mining business activity including but not limited to the depreciation of mining equipment, electricity, and hardware may be deducted for tax purposes. Interest (mortgage) interest on properties and you can use form 1098 to make these deductions. If the mining equipment exceeds $1 million in costs, the taxpayer may need to use the modified accelerated cost recovery system (macrs) to determine how to depreciate equipment for tax purposes.

You too can be taxed just like your traditionally employed peers by claiming an seca deduction on line 27 of form 1040. Or use the list of expenses below to learn more. Mining companies are entitled to upfront deductions on qualifying capex and partial deductions on employee related and transport specific infrastructure.

The cost of buying, repairing and cleaning any clothing items (including footwear) that are protective (such as steel. Tax deductions for airport baggage handlers. Miners may deduct the cost of their mining equipment from their ordinary mining income.

To report business income from mining, the taxpayer will report. Tax deductions for administrative and clerical employees. Interest (cars and other expenses) a portion of this interests is eligible for deduction

This is partly due to how much of the budget these costs take up throughout the year. Ad turbotax® makes it easy to get your taxes done right. Yes, this is a bit flexible, but in general it would cover any of the following mining expenses mining hardware (gpus, asics, and component parts) electricity internet service

These are expenses you incur to earn your income as a mining site employee. There is a wide range of deductions you can claim as a mining site employee, such as: Tax deductions for employee lodging.

For details of the tax deductions that you can claim in the following industries, just click on the relevant page: X $400 (electricity bill per quarter) x 4 = $80. This is usually claimed by mining workers employees who have to stay in contact with the mining company or staff whether at home or at the mining site.

The pandemic forced many into working from home. Tax deductions for bank and finance industry employees.