Use of home as an. Los angeles, ca 90036 fax:

As tax time draws near, art business owners are prepping up.

Tax deductions for models. This is the easiest deduction to take because there are no calculations to make, there are no receipts to collect, and there are no additional tax forms to prepare. Miracle mile tax service, inc. Mercedes g wagon tax write off.

Promotional models typically have to distribute audition tapes and videos, business cards,. The standard deduction is that amount, a standard dollar amount that the irs sets annually. Don’t get too excited, though.

Tax deductions for fashion models and entertainers. 1) buying through the corp. Below we have put together a list of some of the expense you are entitled to as models.

3 tesla model x tax write off weight 4 tesla model x tax write off california 5 section 179 deduction 6 bonus depreciation 7 learn more>>> Deduct any commision that the agency hiring you takes from every shoot or show. 15 overlooked art expense tax deductions for artists.

In one tax court case, an active actress and model attempted to deduct the cost of clothing, hair preparation, cosmetics, and similar expenses. There is tricky analysis here, but it may end up costing you. Tax deductions might be perplexing whether you’re an online seller or a company that generates money by selling items or services over the internet.

Use excel spreadsheet for bookkeeping or a software which will make your life easier once tax season comes. 15 overlooked art expense tax deductions for artists; Tax deductions have two main types:

The standard deduction and itemized deductions. Record separately from other supplies, items costing over $500 and having a useful life of more than one year. Los angeles, ca 90036 fax:

12 tax tips for bloggers and online influencers. If you operate as a sole proprietorship or an s corporation you now may deduct 20% of qualified business income. Clothing can be an extremely useful expense to claim on your tax return.

Why are keeping track of these expenses important? Coaching and class fees any expense from a modeling coach or other relevant training can be written off. You run into an issue if cra designs your $80,000 model y is only used let�s say 60% or 80% for business.

Most promotional models have to make sacrifices in order to find and obtain work,. Beauty supplies make up, hair treatments, or beauty supplies used for work are partially deductible! 1 tesla model x tax write off 1.1 business percent use 1.2 ordinary and necessary 1.3 gross vehicle weight 2 tesla model x lease vs purchase 2.1 lease example & calculation 2.2 purchase example & calculations:

Possible tax deductions for actors include business travel, agent fees, union dues, promotional expenses (headshot, demo reel, etc.), among other things. These items must be recorded differently on your tax return than other recurring, everyday business expenses. This includes income from construction activities, architectural, and engineering services.

Cadillac escalade tax write off. Audi q7 tax write off. Hybrid car tax credits work by giving you a nonrefundable credit on your income tax return.

Shoeboxes and calculators in hand, artists are looking for forgotten expense receipts with the fervor of a child on an easter egg hunt. As tax time draws near, art business owners are prepping up. Use of home as an.

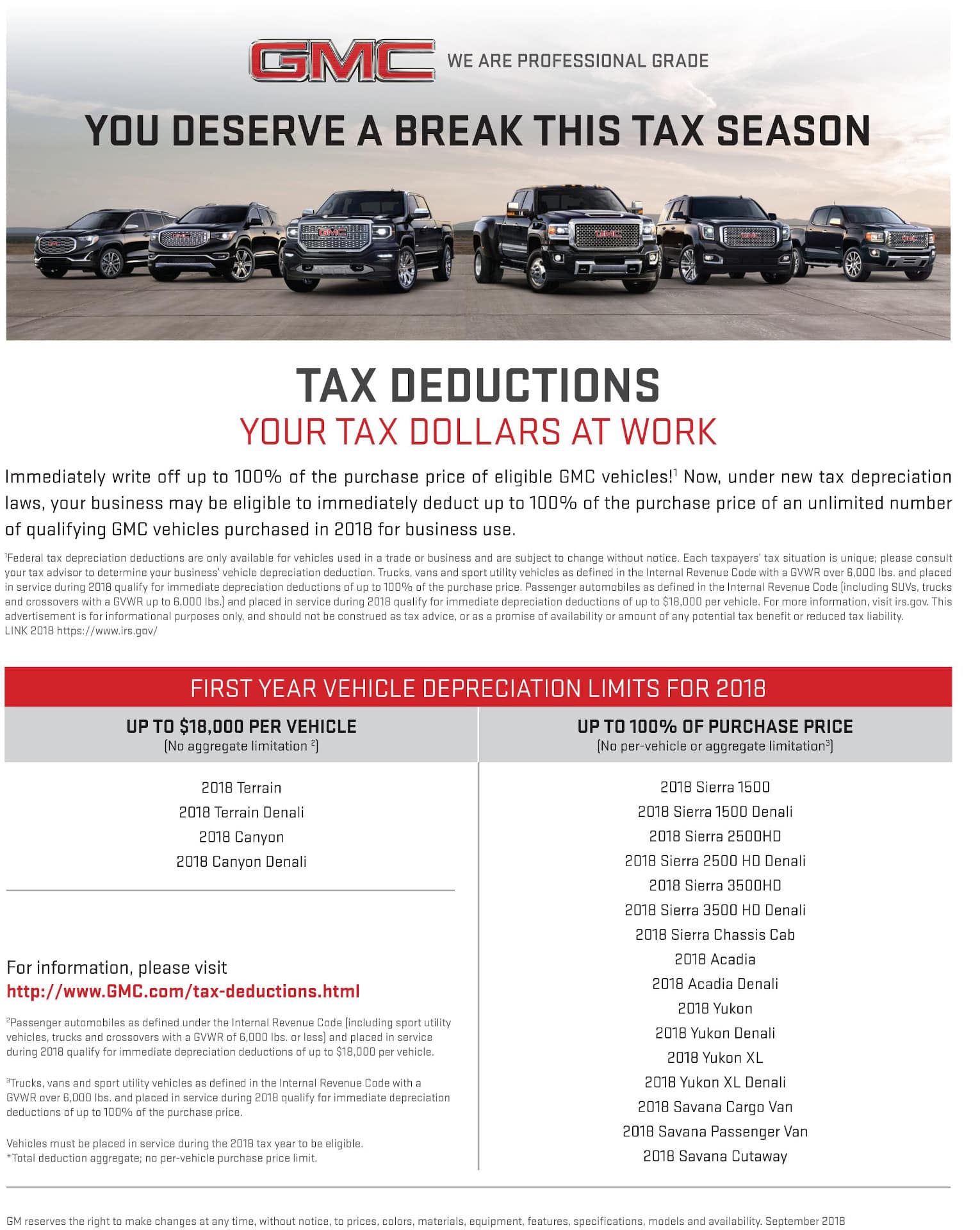

This irs tax credit can be worth anywhere from $2,500 to $7,500. Aside from paying regular taxes, models can also claim tax deductions. Models have a number of tax deductions that are unique to any other industry.

Costs related to maintaining and changing your personal appearance are only tax deductible in. In the end, #3 beat out #2. Ad answer simple questions about your life and we do the rest.

Is this really an entertainment industry deductible? Top tax deductions for actors, musicians, and other performers as a performer, you can save hundreds (even thousands!) of dollars at tax time by deducting business expenses. Create a separate bank account for business only.

- buying personally and paying mileage. Remember tax deductions for bloggers have to be items related to your business. Toyota tundra tax write off.

She was indeed engaged in the business of acting and modeling, as she had an agent and had acted in plays, commercials, television shows, and movies. Agents fees and subscriptions to professional associations, for example, union fees to equity, the model alliance. What kinds of expenses can i claim for?

From simple to complex taxes, filing with turbotax® is easy. Generally, to be deductible, items must be ordinary and necessary to your profession as a fashion model or entertainer.