You can�t deduct expenses that are reimbursed or paid for directly by the government. Armed forces and you had to move because of a permanent change of station.

You cannot deduct your travel meal costs.

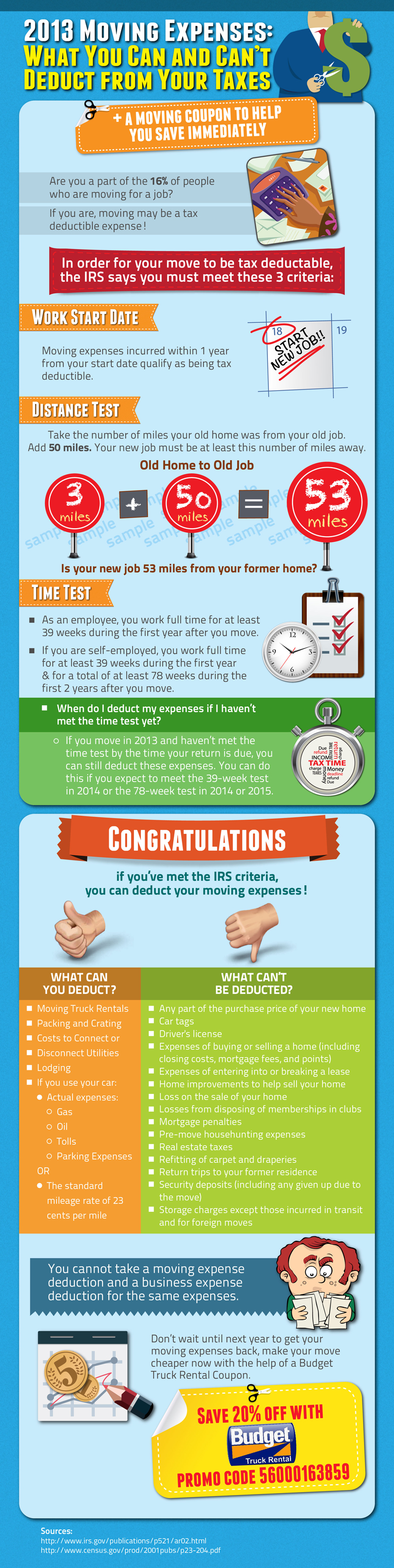

Tax deductions for moving costs. Deductible moving expenses the cost of transportation and storage (up to 30 days after the move) of household goods and personal effects. Citizens or resident aliens for the entire tax year for which they�re inquiring. Moving expenses are an adjustment to income, not an itemized deduction.

However, both the moving expense deduction and the moving expense reimbursement exclusion are set to return as of jan. You’ll need to record your deductible expenses on form 3903 and then follow the instructions to carry the total deduction to your form 1040. Most people can’t deduct moving expenses, but you might be able to written by stephanie moore updated 07/29/2021 the tax cuts and jobs act of 2017 made it so.

How can i get a bigger tax refund? You cannot deduct expenses for which. • expenses that are directly related to traveling from your old location to your new location • gas and oil expenses or • mileage reimbursement which is currently set at ten cents per mile • parking fees • tolls

Deductible moving expenses include the costs of moving the contents of your home, as well as lodging on your route, but not meals. However, there are other moving expenses you cannot deduct such as expenses related to buying and selling a home, real estate taxes, mortgage penalties, etc. If the small business owner runs his business on rental premises, he can deduct the rent paid as a business expense.

Amount you paid to pack and store your household goods and personal items amount it costs to travel from your old home to your new home. Answer simple questions about your life and we do the rest. Travel is limited to one trip per person.

1, 2026, as long as congress doesn’t decide to make the. You can deduct transportation and lodging expenses for yourself and household members while moving from your old home to your new home. You can�t deduct expenses that are reimbursed or paid for directly by the government.

You must satisfy two additional criteria to qualify for counting these expenses as tax deductions: According to the irs, the moving expense deduction has been suspended, thanks to the new tax cuts and jobs act. Moving is a hassle, and with moving expenses no longer providing a tax break for most taxpayers, there’s less incentive to relocate for a new job — at least for now.

How to deduct charitable donations Your business can still deduct these payments as business expenses. But there’s serious talk about making the elimination permanent.

However, each member of the household can move separately and at separate times. In addition, because they reduce your adjusted gross income, moving expenses may also help you qualify for other tax benefits that are limited at higher income levels. Deductible expenses you can deduct these moving expenses:

Travel, including lodging, from the old home to the new home. To qualify for the deduction, your new work location must be a sufficient distance from your old home and you must begin working shortly after you arrive. You cannot deduct your travel meal costs.

Ad turbotax® makes it easy to get your taxes done right. According to the conditions laid down by the irs, which is the internal revenue system, the following counts as reasonable moving expenses: Irs moving deductions are no longer allowed under the new tax law.

For most taxpayers, moving expenses are no longer deductible, meaning you can no longer claim this deduction on your federal return. Effective from 2018 through 2025, all employee moving expenses paid to employees by your business are taxable to the employee. You can deduct your unreimbursed moving expenses for you, your spouse, and your dependents.

Moving expenses are not tax deductible for most people. Travel costs if you weren’t aware, you are eligible to deduct your travel expenses during your move as well! This deduction is capped at $10,000, zimmelman says.

So if you were dutifully paying your property taxes up to the point when you sold your home, you can deduct the. When you file for tax deductions, the moving expenses you file for must be reasonable. If married, the spouse must also have been a u.s.

Most of the rules for qualifying for this deduction as a military member are the same as those that applied to other taxpayers before 2018. Just to be absolutely clear: Starting in 2018, congress did away with the federal tax deduction for moving expenses, with few exceptions.

Types and amounts of moving expenses. Up to 10% cash back you don�t have to itemize your deductions to claim moving expenses. Citizen or resident alien for the entire tax year.

The tool is designed for taxpayers who were u.s. Armed forces and you had to move because of a permanent change of station. The tax cuts and jobs act of 2017 eliminated the deduction just until january 1, 2026.

Meeting the time and distance tests. Your expenses also must be reasonable to claim this deduction. The monthly paystub given to employees is also tax deductions for an employer.

For tax years prior to 2018, federal tax laws allow you to deduct your moving expenses if your relocation relates to starting a new job or a transfer to a new location for your present employer. You cannot deduct expenses for moving furniture or other goods you bought on the way from your old home to your new home. If the employer plans to move his work location to a different location or city, he can deduct these moving expenses while reporting the tax deductions.

This includes mover’s costs, transportation, and lodging along the way. Are moving expenses tax deductible? However, you can’t claim the cost of meals during the move.

Unreimbursed employee moving expenses can�t be deducted by the employee as miscellaneous expenses.