You also have to work at the new job for 39 weeks during the year after your move [source: The time test requires that deductions are for moving expenses incurred within one year of starting a new job or moving to a new job location.

Keep in mind though, that under the tax cuts and jobs act, this money will count as taxable income.

Tax deductions for moving for a job. The move must be related both in time and place. Up to 10% cash back if you move, you may be able to deduct your moving expenses. You also have to work at the new job for 39 weeks during the year after your move [source:

The move must closely relate to the start of work. For most taxpayers, moving expenses are no longer deductible, meaning you can no longer claim this deduction on your federal return. Here are some tips for deducting moving.

Another time requirement is that you must work for a minimum. If you’re relocating for a job, negotiate reimbursements for moving costs with your new employer. Related to the start of work.

So, if you drove 2,000 miles for work, the deduction would be: Taxpayers moving for a job and interested in deducting their eligible moving expenses, should know these numbers: The time test requires that deductions are for moving expenses incurred within one year of starting a new job or moving to a new job location.

The tcja suspended moving expense deductions for tax years 2018. Keep in mind though, that under the tax cuts and jobs act, this money will count as taxable income. The last part of deducting moving expenses is how long you work at the new job.

Starting in 2018, congress did away with the federal tax deduction for moving expenses, with few exceptions. Make sure to plan for that if you decide to go this route what’s the first step to saving money now that the moving tax deduction is dead? But can’t you just calculate it both ways and take the better option at tax time?

But there’s serious talk about making the elimination permanent. For example, if the old commute was 10 miles to work, the new job must be at least 60 miles from the old residence. In order to deduct moving expenses, your move must meet three requirements:

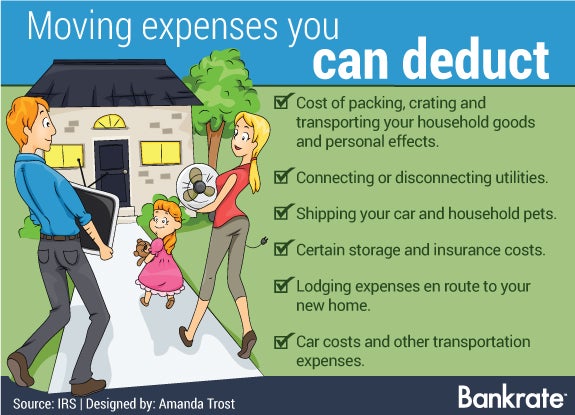

For most taxpayers, moving expenses are no longer deductible, meaning you can no longer claim this deduction on your federal return. What moving expenses can you write off? You may be able to deduct your costs if you move to start a new job or to work at the same job in a new location.

Deduction for moving expenses if you relocated for a new job last year, forget about deducting your moving expenses from your 2021. The 2017 tax cuts and jobs act changed the rules for claiming the moving expense tax deduction. Moving expenses are not tax deductible for most people.

- employment requirements the irs requires that you be employed full time for 39 weeks of the first 12 months of your move in the area of your new job location in order to qualify for moving deductions. If you are moving because of convenience, you will not be able to receive tax deductions for your expenses. The tool is designed for taxpayers who were u.s.

Most people can’t deduct moving expenses, but you might be able to written by stephanie moore updated 07/29/2021 the tax cuts and jobs act of 2017 made it so only military members and their. The irs offers the following tips about moving expenses and your tax return. But if you meet those, you can deduct pretty much any of the costs of the move minus food.

Irs moving deductions are no longer allowed under the new tax law. It can be a new job, a transfer, or even a first job. This includes the cost of renting/driving a moving truck or van, as well as the cost of.

To qualify for the deduction, your new work location must be a sufficient distance from your old home and you must begin working shortly after you arrive. Types and amounts of moving expenses. There are only two categories of expenses you can deduct:

You must continue to work in the new location for at least 39 weeks during the 12 months after the move. According to the irs, the moving expense deduction has been suspended, thanks to the new tax cuts and jobs act. Citizen or resident alien for the entire tax year.

For 2020 tax returns, that rate is $0.575 per mile. Taxact reports your expenses and deduction on form 3903, moving expenses. If you drive or fly, if you have to pay for storage, if you need lodging along the way —.

If you recently moved to another city for a new job or because your old job is now at a new location, you may be able to deduct your job related moving expenses on 2017 and earlier tax returns. For tax years prior to 2018, federal tax laws allow you to deduct your moving expenses if your relocation relates to starting a new job or a transfer to a new location for your present employer. It doesn�t have to be 39 weeks in a row, and it doesn�t have to.

If married, the spouse must also have been a u.s. 2,000 x $0.575 = $1,150 in this case, the standard mileage rate is better, which is a common result. The tax cuts and jobs act of 2017 eliminated the deduction just until january 1, 2026.

Citizens or resident aliens for the entire tax year for which they�re inquiring. However, you can’t move and expect to deduct the expenses just because you like the weather better someplace else.