Deductible moving expenses include the costs of moving the contents of your home, as well as lodging on your route, but not meals. You can deduct your unreimbursed moving expenses for you, your spouse, and your dependents.

Moving expenses you can deduct as an adjustment income on form 1040 and for this you will need form 3903.

Tax deductions for moving out of state. The deduction applies to both independent contractors and employees. See if they update automatically when new irs rules go into effect. To qualify, you must have duplicate living expenses, meaning you must continue to keep a residence in your home city.

Most of the rules for qualifying for this deduction as a military member are the same as those that applied to other taxpayers before 2018. If you qualify, use form 3903 to calculate your moving expense deduction. Your new job would add at least 50 miles to your commute if you were to remain living in your old home.

Moving expenses you can deduct as an adjustment income on form 1040 and for this you will need form 3903. If you move to massachusetts and receive pension payments from your former states� public employee retirement plans, you can deduct those from your massachusetts gross income if the former state doesn�t tax income its residents receive from massachusetts. If you need help determining whether you can deduct your moving expenses, check out the irs moving expenses deduction tool.

This means your client has nothing to deduct so long as the employer administered an accountable reimbursement plan (if not direct payment) for qualified moving expenses and excluded those. California is one of a few states that still allow the moving expense deduction: Virginia (originally decoupled, but reversed course late in 2018) west virginia;

You can only deduct housing or. Citizen or resident alien for the entire tax year. You can�t deduct expenses that are reimbursed or paid for directly by the government.

Moved into or out of new york state during the tax year. The tax cuts and jobs act of 2017 eliminated the deduction just until january 1, 2026. These states will have to pass legislation to conform to the tcja.

The deduction for temporary housing related to a move is the most limited. Out of pocket expenses, however, may be deducted. If your income tax return is due before you’ve met this test, you can still deduct moving expenses if you expect to meet it.

The state�s personal income tax rate is 4.95% for the 2021 tax year. To find out if your moving expenses are deductible on your state taxes, check your state’s tax codes. Sixteen states have conformed to the disallowance of the moving expense deduction/exclusion:

You claim moving expenses on the front of your form 1040, as an adjustment to income. If married, the spouse must also have been a u.s. Only costs specifically related to your move are tax deductible, including packing, shipping, travel, interim lodging, storage unit, rental truck, supplies, and parking costs;

Your expenses also must be reasonable to claim this deduction. For people who have moved since the law went into effect, tax deductions may still apply on state taxes. See publication 521, moving expenses, for more information about these rules.

Meeting the time and distance tests. But there’s serious talk about making the elimination permanent. Deductible moving expenses include the costs of moving the contents of your home, as well as lodging on your route, but not meals.

If you are temporarily reassigned or you travel on business, you might be able to deduct your lodging costs. You must satisfy two additional criteria to qualify for counting these expenses as tax deductions: Five states have passed legislation to make moving expenses deductible or excludable.

But not meals you ate on the way, for example, or the costs of shopping for a new home. Allows exclusion in 2018) kentucky; Also, while the federal government has suspended the deduction for moving expenses, some states still allow taxpayers to claim a deduction on their state income.

When you�re reporting your income on your personal income tax return: Moving expense reimbursements may not be claimed as a deduction. The internal revenue service allows taxpayers to deduct certain relocation related expenses from their gross income if they meet eligibility requirements.

The tool is designed for taxpayers who were u.s. If you receive a temporary job assignment away from your home, you may be able to claim a tax deduction for your expenses. For more information you should check with your tax consultant and with irs.

You can only deduct moving expenses incurred within one year of the day you started your job. To take such a deduction, you must file your taxes with a form 1040 and also submit form 3903 to document your relocation expenses. Types and amounts of moving expenses.

Moving expenses are not tax deductible for most people starting in 2018, congress did away with the federal tax deduction for moving expenses, with few exceptions. You must pay tax to illinois on any income you earn there if you work there and live in any other state except wisconsin, iowa, kentucky, or michigan. You can deduct your unreimbursed moving expenses for you, your spouse, and your dependents.

That means if you don’t move closer to work within the first 12 months of employment, you will lose your opportunity to deduct moving expenses. For example, illinois allows only contributions to an illinois 529 plan of $10,000 (filing single) and $20,000 (married filing jointly) to reduce taxable income. There are changes happening each year so, you need to stay up to date and pay attention to any tax deduction requirements changes.

If you can claim this deduction, here are a few more tips from the irs: That includes any hotels or motels you stop at along the way to your new house, and for the first night in your new tax home. Were not a resident of new york state and received income during the tax year from new york state sources, or.

However, moving your 529 dollars to a different state may cause you to lose the tax benefits associated with the plan. You are only allowed to deduct necessary and reasonable expenses. Citizens or resident aliens for the entire tax year for which they�re inquiring.

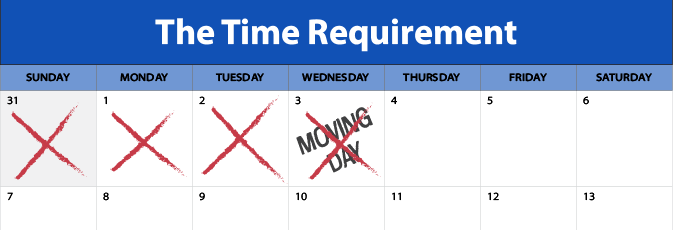

That doesn�t tell the whole story, ca also conforms to irc §312(g) effective as of jan 2015. What is the time test?