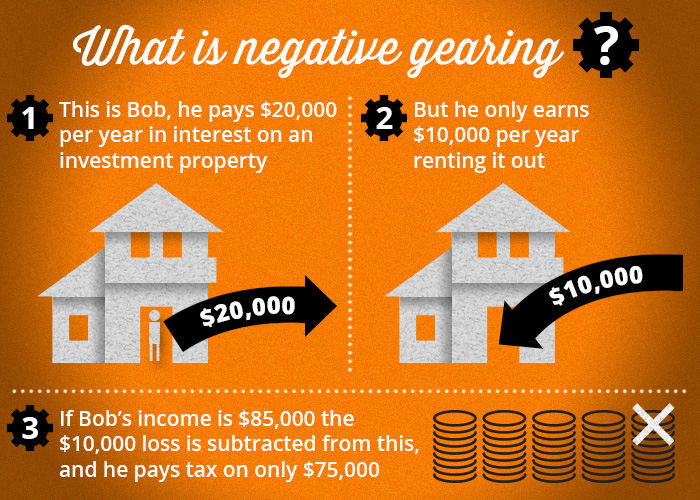

It’s also not possible to negatively gear an investment that does not produce an income. The overall tax result of a negatively geared property is a net rental loss.

It results in a loss for the asset owner.

Tax deductions for negative gearing. There’s no guarantee that every investment venture will go well. The loan interest is often a major expense but it can be claimed as a tax deduction when the property is tenanted or available to let, and this can significantly reduce the cost of the loan. Thanks to the available tax deductions, negative gearing can be a helpful strategy for offsetting the costs of acquiring an investment property.

Negative gearing is a practical and strategic possibility when owning an investment property. However, by negative gearing, you can claim tax deductions for your investment expenses in the same financial year. It results in a loss for the asset owner.

T negative gearing exposed www.iloverealestate.tv 8 it’s called ‘depreciation’. Therefore, you have made a net rental loss of $1,149.04 in your first year as a property investor. If you are paying tax at the rate of 37% + 1.5% medicare levy, you would receive a tax refund of $96.25 per week.

The overall tax result of a negatively geared property is a net rental loss. This reduces your taxable income and how much tax you have to pay. This could reduce the overall tax you pay on your other income, such as your salary.

This means that the investment property has negative gearing. The key benefit of negative gearing is that any net rental loss you incur during the financial year may be offset against other income you earn, such as your salary. This greater loss is claimed as a legitimate tax deduction against personal income, and further decreases the investor�s tax liability, or boosts a tax refund.

You can therefore claim $250 per week against your income tax. Depreciation improves tax position when negatively geared for property that is negatively geared, claiming for depreciation further increases the loss made by the investment property. A negatively geared asset is one that does not provide sufficient income to cover its cost.

Depreciation and negative gearing kim earns $80,000 a year and pays approximately $17,500 in tax. Kim receives $25,000 in rental income. Negative gearing can apply to any type of investment, not just housing.

Case study penny, a property investor, buys a unit for $300,000, putting in $50,000 of her own money and borrowing the remaining $250,000. Federal mp jason falinski has acknowledged that negative gearing pushes the price of housing up by as much as 4 per cent but defended the tax break for property investors, saying the diversity of ownership it creates is good for the country and the economy. As a result, john’s tax payable for the year reduces from $14,616 to $7,826, saving $6,790.

Individuals who are negatively geared can deduct their loss against other income, such as salary and wages. Most investors use some gearing in the form of their mortgage to fund their rental property. This is consistent with the broader operation of australia’s personal income tax system.

Being the building and specifically the fixtures and fittings of that building. Negative gearing at least provides a nice cushion should your rental property make a capital loss. Negative gearing is when you claim more in tax deductions than you earn for an income producing asset that you have purchased using debt.

The benefit to the buyer or investor is that, depending on the. See our section on negative and positive gearing for more details. The interest of 7% each year is $17,500 and the weekly rent is $300 or $15,600 a year.

With a negatively geared investment property you may be eligible for a tax deduction if you have a loss on your investment. In some circumstances, this can improve your capital gain more substantially than a positively geared property. The property initially costs you $100 per week out of pocket.

Under sec 51 of the income tax assessment act 1936, you cannot claim as if you repay the loan early, and in less than five years, you can claim a deduction for the balance of the borrowing expenses, in the year of final repayment. “if you’ve got investors in the market, then you’ve got lower rates of home ownership by definition.” housing values would fall as much as 12 per cent under the former labor policies of abolishing. It is not limited to property, you can for example negatively gear shares, but property is.

It’s also not possible to negatively gear an investment that does not produce an income. The overall tax result of a negatively geared property is a net rental loss. Both policies, first flagged in 2015, exempted assets that were already held and would only have applied.